OK before everybody starts harping on about how this is a poor use of points I want all you Travel Hackers, and especially all you ‘People who enjoy traveling for almost free but don’t have a cool name for what it is you do and yet refuse to acknowledge people use the word Hacker sometimes’ people to take a moment and think. Its not just about you.

The Ultimate Rewards program from Chase is arguably the most popular Credit Card reward program for Frequent Travelers as it offers strengths on both the Earning side, and on the Burning side. This forms a powerful 1-2 combination.

To date, like many of you no doubt, I have used the Transfer Partner side of Ultimate rewards to top up my balances with United, and with Hyatt. I think that these two programs offer incredible travel value. And 22,000 UR points transferred into Hyatt earns me 1 Free night at any Hyatt, some of which can cost $700-$1000 per night. Great value eh?

Unless of course you either don’t have any travel plans right now, or you realize that you can have fun without being in a Hyatt, and you can pick up a room for $100 and pocket the $120 difference! You see, with statement credits if you earned 22,000 points that is worth $220 in your pocket, and to be frank, I think that $220 per night is probably too much to spend on a hotel unless you have a rather substantial net worth already.

Vanilla Reloads for Statement Credits

People have been very excited about using Vanilla Reloads (VR) in conjunction with the American Express Bluebird Card. Effectively the process is quite simple:

Purchase a VR for $500 using your Credit Card, depending on the merchant earn up to 5x points, load the VR card onto the Bluebird Card and use that to cash out your money, pay the bill on the Credit Card. Repeat.

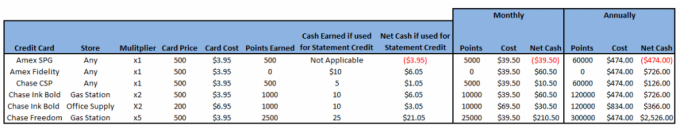

The cost of getting the funds off the Bluebird can be limited to zero, so effectively you are buying a bunch of points for $3.95

The amount of points you buy is dependent on the card you use, and its multipliers. For sometime, until bloggers wrote about Vanilla Reloads (oops) these cards were available at Office Supply stores, which triggered 5x earning rates on the Chase Ink Bold – therefore you would earn 2500 UR points for $3.95. Now that goose is cooked, but there are still little things that pop up from time to time, such as the recent excitement about 7-11 stores stocking them, and the potential that some of these stores are coded as Gas Stations – thus allowing holders of Gas focused cards, such as the Chase Freedom (5x this Quarter) to earn at the 5x rate again.

The difference between Earning Real Money for Free and Getting Stuff for Cheap

Cheap is relative. People justify their reasoning in all manner of ways – they look at that Hyatt at $700 per night and think they ‘saved’ $500 they don’t think that they just slept on a $120 per night more expensive Mattress. This is why people struggle to put a firm value on Airmiles and Points, they are trying to justify the cost of an experience.

It is a lot easier to put value on Cash. Here try it out:

I offer you $25 for $3.95 deal or no deal? When it is all cash, it’s not a you get X for Y it is you get X for FREE. The exact same deal reads:

I offer you $21.05 for your time buying each VR card and cashing it out again. Interested? Oh yeah – you don’t have to just buy one at a time…

There is a limit of $5,000 per month, which would mean loading 10 VR Cards onto your Bluebird (of course, there might be ways for you to have multiple Bluebird cards too, such as if you have a significant other) what that translates to at the following rates is quite interesting in terms of monthly earnings potential. I included other card options, since Office Supply stores allow you to buy $200 cards with your 5x earnings, which could be interesting to see too.

The challenge will always be finding a 5x, or finding costs that are low on the purchase side, but when you do hit upon these, you can earn up to $2500 per card per year with the Bluebird from Amex and the Vanilla Reload program. Add that $5,000 to the $5,000 Free Brokerage Account plan and now we are earning $10K for free, using the tricks of the trade (or dare I say it, Hacking Travel…)

The Freedom example is way off. It is limited to 7.5k points this quarter only. So 5 VR in you are done.

Great point- I was focused on conveying the message of chasing the 5x and the example doesn’t work out- the purpose was to highlight why 711 is a big deal, and also what other cards can offer 5x at different times. Obvious one being the Discover card

For the Chase Freedom, it usually has gas in two quarters and is capped at $1500 per quarter; therefore, it only takes 3 VRs per quarter. Thanks.

Yep good point thanks.

Matt I don’t get the point of this post. You can earn 2% cashback using the Fidelity card, so why use a cash back card that earns 1%? I’m lost

I included the 1% card CSP just to show the difference in earnings between the 3 cards and how gas can get 2x on the bold but not on the CSP- something of a placebo card… Sorry if it didn’t work out clearly. I included the SPG option after our conversation on the Maldives.

For rewards cards, we use cash back cards exclusively. I figure that you never know when your needs might change and if your rewards are tied to something in particular, like travel, you have some level of risk of having them become less valuable, whereas there’s always a need for cash.

I typically use cash back cards for everyday spending, unless I can get a 5x opportunity, like using the Ink Bold at Staples etc.. I like to use Rewards/points cards for signup bonuses only.

exactly.. I wouldn’t obtain UR points with the intention of redeeming for statement credits unless I had a nice multiplier. There are better cards out there to get statement credit or cash back.

I’ve always gotten statement credits for Ultimate Rewards, but that was because I didn’t realize that I could effectively get much more value for my rewards. Now that I know of the other options I will consider them but I’ll probably still just get a statement credit.

Statement credits are great – but you can get some very good value from transfers to United – its always a case by case question. But if you are traveling it is worth factoring in.

I haven’t done the VR and Bluebird combo, because I just don’t feel right about it. Not saying it’s wrong, just not my style. I have used statement credits to pay for food/drinks/bottles of wine on our winery tour weekend a few months back, and I don’t feel bad about it one bit. It’s all about using points to accommodate how you travel/live, not changing your style to get the most out of the points. Great post.