I’ve often struggled with assigning a real value to an Airline Mile, Hotel Point, and sometimes, strangely enough sometimes even with Cash. The value tends to fluctuate based upon circumstances, and as such is demand driven. There is a fundamental desire to earn more, because more is better, but a problem can arise when you become blinkered and earn too much of one thing, to the detriment of another. It is simple to say that they are subjective and leave it at that, but I would like to dig a little deeper and see if we can find out what factors affect the variable nature of these things.

Of course, such things Miles,Points and Cash always seem to have a Constant value at any moment in time too, because a Dollar can get you an Oyster at Happy Hour; and 120,000 Avios points can get you from JFK-London in First Class. But for the average income family of 4 who need to fly NYC-MIA for Christmas each year, those Avios are suddenly more important and valuable them and spending all of them for just one ticket is not viable. Once we start understanding the factors behind the subjectivity we can start to understand how many frequent flyer miles we should have at any one time.

Who needs to understand the duality of Constant and Variable Valuations?

This subject is relevant to anyone who may have a deficiency in any of the areas: Frequent Flyer Miles, Hotel Points, and Cash. If one or more of these areas are deficient then you have the ability to increase them to balance your allocations through the use of targeted spending, potentially boosted by incorporating manufactured spending strategies. For example, if you are in a high paying job with no debt, and saving $250,000 per year after expenses, then its quite likely you don’t need to earn additional cash back to top up your earnings, you should instead ensure that you have enough points and miles to travel for free, unless of course you never travel…

How Many Frequent Flyer Miles Do I need?

Not all airline or hotel programs are created equally, and many have location specific loopholes that should be focused on. In order to assess if your balances are deficient you need to forecast and budget your expected annual expenditure on mileage programs. For example, if your annual travel is exclusively domestic travel in the United States you probably should focus on collecting British Airways Avios, and the Southwest Companion Pass. From there you can assess how many miles it requires to achieve your travel goals.

Your travel habits will dictate how many frequent flyer miles you should have, many people seem to amass a large number of miles, but are restricted to traveling only 10 days per year, plus some weekend trips. Most people will opt to split those 10 days into 2-3 trips by strategically slotting them around weekends and public holidays. If you are the type of person that likes to take 2 International trips and 4 Domestic trips per year, you will require a different basket of Frequent Flyer miles than someone who exclusively flies Domestic – some people just like to go to Miami or Las Vegas for their vacations.

Number of Trips x Distance x Passengers / PROGRAM

How many frequent flyer miles do I need at any one time?

Enough to be able to book all travel 330 days from now.

Typically award inventory opens up around 330 days from today, so if your travel is for that date you want to book it as far out as possible. However if you aren’t planning to travel until 10/2014 you don’t need the relevant amount of miles in your program until 10/2013.

Don’t forget an Emergency Travel Fund

You need to have enough miles and hotel points stashed away for an Emergency Trip, for example should you need to fly somewhere due to an illness or death in the family. This is something that you can budget for quite easily as you can determine possible routes in advance – EG I only have close family in one part of the UK, so I need to know the routes back there, and have a couple of options for getting there in case availability is slim.

Miles Earning Strategies

It is critical to keep an eye on your budgeting and ensure you don’t earn too many miles when you should be earning hotel points, or when you should be earning Cash Back, if you do have a certain amount of travel planned for the upcoming year look at key factors as follows:

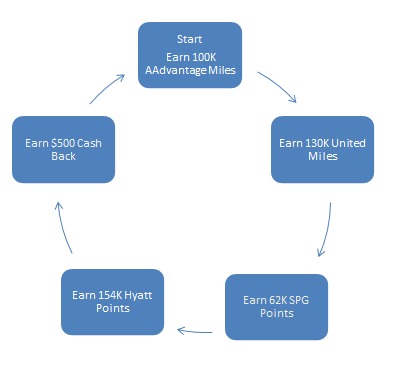

Example, Mr and Mrs Saverocity are planning a trip from North America to Japan 15 months from now, starting from Zero miles for two of us would be most likely to get the flights and hotel if we did the following:

Focus on just one program, such as AAdvantage until we hit 100,000 miles, enough to take us both there in Coach.

- Diversify -Earn enough miles on United to get there in Coach 130,000 miles

- Diversify, Earn enough Hotel Points with Starwood’s SPG Program to cover the room for the trip, 62,000 for 7 Days.

- Diversify, Earn enough Hotel Points with Hyatt to cover the room for the trip, 154,000 for 7 Days.

- Diversify, Earn enough Cash Back to pay for meals and incidentals for the trip.

Also, I included Cash Back for spending money, that is an optional step, but it is probably savvy to assign some earning potential to cash back to cover costs on the trip before deciding to take on Business Class.

So we wouldn’t aim for Business if we were deficient in the other programs, we would move onto building a balance in the second frequent flyer pool of United to increase the chances of finding availability. When we have obtained the diversity we desire to get us to our location the priority can possibly then move into looking at business class award space. After earning the $500 in Cash Back we go back to the start, and Earn another 100,000 AAdvantage Miles, so now we can travel in style.

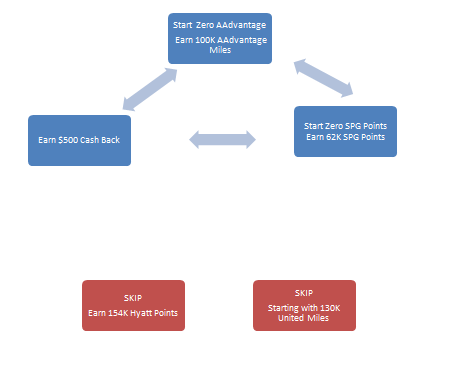

Subsequent Trips are faster loops, since we would have the excess from Trip 1 Miles Building – EG if we flew Coach with AA at 100K Miles, and spent our 62K SPG points on a hotel, next time around we would be starting off with United points and Hyatt Points already in the bank, so we would skip them from the earning cycle, and get to Business Class faster.

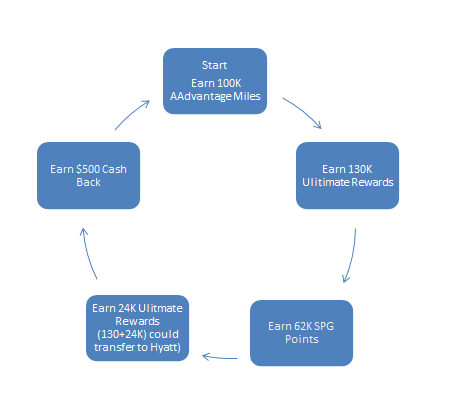

The power of Transferable Points

When building a diversified portfolio of Frequent Flyer Miles and Hotel Points there is nothing more powerful than a point that can be turned into either at whim. Programs such as Chase Ultimate Rewards and American Express Membership Rewards are best for this. In the example above we could have first aimed to earn 130,000 Chase URs instead of United Miles, since they transfer at 1:1 into United OR Hyatt. That would mean that once we got to the Hyatt earning step instead of needing to earn 154K Hyatt to have enough for 7 nights, we could just earn 24K Ultimate Rewards more, and be skipping along to the next step in the cycle, much smarter way of building up balances quickly.

How Much Cash Should I have?

This is supposed to be the easy answer right? As much as possible… but somehow people do decide to forgo cash back earning opportunities in order to earn frequent flyer miles and hotel points, I can only hope that people who do this are all very wealthy and have fully funded savings and retirement accounts. If so, then more power to you. This is where I make a judgement call – if I have enough money saved then I will skip cash back earning and aim for Business Class flights, if not it will be in Coach. Also, since there is no cap on how much money I should have after I hit my limits for mileage balances I will focus only on earning Cash Back from my everyday spend and manufactured spend.

My calculations for mileage balances required at any time are as follows:

- 200K AAdvantage

- 200K Ultimate Rewards/Membership Rewards

- 80K SPG

- 80K British Airways (for Domestic)

I’m surprised by the number being somewhat lower than I expected. I currently have much more than that, so I will be letting them drop down and focusing on cash back until the levels are threatened. Based upon my needs for travel, any more than that is wasteful, I can get two people two tickets anywhere for that, plus hotels. Bear in mind that I have travel booked up 330 days in advance already, so this is for anything beyond those reservations. Also, I actually padded the numbers upwards, but in honesty I could travel in Coach, and in that case, if cash was tight I would re-evaluate my mileage balances as follows:

- 130K AAdvantage

- 150K Ultimate Rewards/Membership Rewards

- 80K SPG

- 80K British Airways (for Domestic)

The final consideration when calculating your numbers should be how quickly you can shift the numbers on your balances should the need arise. For example if you have reason to not make new credit card applications then you know your long term ability to react to needs will be restricted to spending only, which could be a lot less than you can make from a round of applications. If that is the case perhaps a little more padding would be comfortable.

Nicely laid out. Since we really do not plan ahead much more than a year, if that, I have not been able to decide which programs to focus on, and more often pick a card to get based on a good bonus. I would like to get more organized about it. I am also starting to think that perhaps I should focus more on hotel points since they are so much easier to redeem, and just buy air tickets. Already had one change (for the worse) in our Israel/Turkey trip when a flight cancelled. Alternatively, perhaps I should buy miles when the deals are good, so I can book awards that do not have to be saver space. That might allow me to travel in Bus for the price of coach, depending on how cheap/expensive the miles are. Finally, maybe I should focus on Chase URs. Meanwhile, I am speeding through the minimum spends on the cards I got in mid May. I hope I have a better plan before the next set of apps!

Hi Elaine,

I’ve only just started planning so far ahead, but once you start booking more trips it becomes natural. I still have a solid base of Avios for last minute long weekends, where we plan to fly less than 4 hrs (don’t want the weekend to be spent on a plane).

You are right that one of the biggest issues when using miles is equipment changes, I actually lost (without notification) several legs of my last few flights, it seems to be exacerbated by Partner travel.

As for Hotel points over miles… tough call there. If you plan a long trip, like your Israel/Turkey one with few flights – hotel nights ratio then saving on the hotel makes sense, but for us we move around a lot in short hops, so the hotel is typically the cheap part (plus we are willing to stay in cheaper hotels than you would find on the programs like Hyatt).

I would definitely think about URs as an addition, they are not as good as SPG for redeeming, but easier to earn due to multipliers. Drop me a note if you are having problems meeting spend, i’ll be happy to help.

I agree that building up balances on hotel cards limits the kinds of hotels where you can stay. My husband much prefers cheaper, smaller and more personal hotels over the chains, and we often rent a flat for a week or so when we travel, but in some cases the chains are best. When we flew out of Milan a few years ago, we were able to drop off our rental car at the airport the night before and stay at a hotel that was literally in the terminal – so convenient for an early morning flight and we saved on the car rental too. We booked that on an OTA last minute, but I could see using hotel points for something like that in the future.

I do have a question for you about award travel – what happens if you are en route, flying on an award ticket with multiple legs, and something goes wrong such that there must be a change. For example, a flight is late or cancelled. Are you then limited to an alternative that has award seats, or do they rebook you the way they would a paying passenger? And who does it? For example, what if something goes awry in Athens, when we are en route to TLV on a US Air awards ticket? Will they get us on something or am I left trying to contact US Air for help? Thanks!

I think it is case by case regarding the cancellations, personally what I have done in the past is try to deal with it on location, as that is, for me, easier to grasp the needs when talking in person with someone at the airport. However, there are times when that won’t get you to your goal, so you need to call up the HQ in the US. For that reason it is always good to have the contact numbers of the most helpful desk, even if it is above your current status.

In the past my Star Alliance partner awards have all been booked through the Round The World Desk – these are seasoned pro’s that get the system and are good people, trying to help. I would call a desk like this if the airport doesn’t help. I’ve not flown through US Air (yet) but would look for the equivalent or their top status desk – Chairman. So I would take with me 2-3 numbers, my current status line; Chairman status line and if they also have a dedicated RTW desk line, that too. I would start at the top and work backwards. I find the higher the level the better equipped they are to help you out, though some airlines, like British Airways, won’t even let you talk if you aren’t at the correct status and dial in above your level.

Overall SNAFUs like this require tact, patience and politeness to resolve. One time I was in Paris CDG after flying in from Cairo, our flight was delayed and we had ongoing flights on another airline – AA (separate tickets) that we were sure to miss now, as our arrival into London was pushed back – the people on Air France booked us all the way to New York on different flights -free. Just by being nice. The people next to us were having a fit, with the DYKWIA attitude, and they got stonewalled….

So while there may be “rules” it is often at the discretion of the rep at the airport or that airline’s policy. I didn’t plan to have a phone with me to be able to make phone calls en route – well, I’ll have my iPhone but usually we do not use it out of the US – I typically carry an old flip phone into which I can put a SIM card for the country I am in. I guess I better figure out Sprint’s policy on international calls! I wonder if Twitter would be a good way to go too. But I will be sure to locate whatever numbers I can find for help desks with US before I leave. I am starting to think that cash-back may be a lot easier than award travel!!!! I just posted the question in the “Star Alliance booking using US Dividend Miles” thread on Flyertalk. I’ll let you know if I get any other good advice from them. Thanks, Matt!

Sounds good – also, you might want to get the Skype App for your iPhone, I find that very useful when travelling, many hotels have free wifi, as to some airports.

Great idea! I will get it for my ipad too. I should have thought of that. Thanks!

Matt in addition to being redeemable for hotel or airfare aren’t Membership Rewards and Ultimate Rewards redeemable for a close approximation of cash, specifically as American Express or Visa gift cards or statement credits? Did you consider this in your example “if cash was tight…”?

I didn’t really consider that to be honest. But know I do I am not sure… the reason is that they would get less than 1c per point I believe? I forget the rate, but believe the Gift Cards are not even 1:1 ratio?? I had thought that it wasn’t a good use of points due to the multipliers not being applicable, but I don’t do a lot of OD/Staples GC purchases, so perhaps you are onto something here – if we could earn 5x and redeem at a little under 1:1 there might be some money here (working in costs of acquisition of course) time to get a spreadsheet out!! Thanks Will!

Found this great article yesterday and it really gave me a new way to look at things! Sorry to ask an off-topic question, but how do I get a password to access your password-only articles? I would like to the read your article on multiple amazon payment accounts, and I subscribed to your newsletter, but I did not receive a password. Thanks for your help in advance!

The password to that is 48000 sorry for not sending it through to you, it’s a bit old now and was off my radar.