A grey Market product refers to something that is official, and legal, but acquired outside of specifically designated sales channels. Most commonly you will see this with regard to manufactured goods, and for big ticket items buying through a Grey Market can produce massive savings. For example, my watch retails in the US at $1,010, but buying it through a Grey Market channel reduces the retail cost to $750 – it is the same intrinsic product, made in the same factory. Sometimes the packaging materials change as they are Country specific, but it is the same watch!

Credit Card offers are the same, there are certain offers in existence that produce a better signup bonuses than others. The three components to a signup offer are as follows:

- Amount of Minimum Spend to Trigger Sign up Bonus

- Number of Points Earned when Min Spend is Completed

- Annual Fee – First Year Deduction or Statement Credit to offset it fully or in part

Therefore, whenever you want to apply for a specific card, you should look at a couple of different offers, and read the terms to see which is the best – the most glaringly obvious one is the Number of Points Earned, but the little perks attached to the other two are not to be overlooked.

Credit Card Distribution Channels

There are three primary channels for Credit Card offers:

- Direct From Bank Offers – Website or Branch

- Third Party Affiliates – Bloggers and Websites

- Grey Channels – targeted hyperlinks and forgotten links

A quick note on the incongruous nature of these links. For a bank to sign you up as a card customer directly, as might happen whilst you are browsing their website doing your online banking etc they have the cheapest conversion rate – $0 paid. However, if you come to a site like mine and get your card here because I write a report on it and you trust my review, I get paid a commission, ranging from $50-$300 per card. So, you would think that the bank would be motivated to convert as many people as possible directly through their site, and a good way to do this would be to offer the best deals right?

Well, ironically they do not, they frequently offer Bloggers and Website affiliates better offers than what they offer customers who come directly to them, why do you think that is? The points/miles cost the bank money, so offering a converted customer 10,000 more AAdvantage Miles More to use a Blogger, and then paying that Blogger $100 or so on top makes a more expensive conversion… what gives? It is common sense that the bank should instead of paying the blogger the $100 and giving them the extra 10,000 miles to convert with that they keep the 10,000 miles, and make the $100 a statement credit right?

Then the consumer gets to chose, do I get my card through my blogger buddy for 30,000 AAdvantage miles, or direct from the Bank for 40,000 miles and a free $100?

Here’s the reality for today 10/11/2013

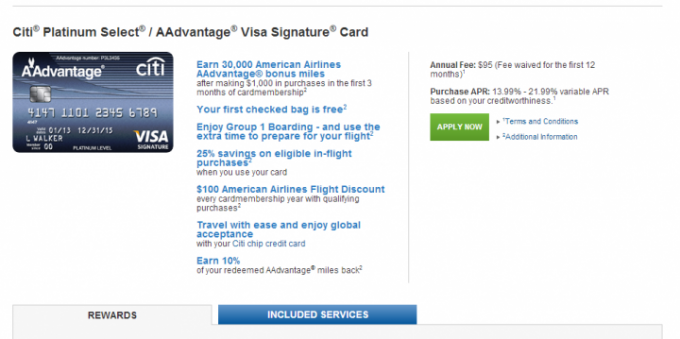

Offer on Citibank Website

Offer from ThePointsGuy.com

In this case, both the Bank and the Blogger present the same offer, there are many examples of where the blogger actually can offer better than the bank and still get paid, but I wanted to talk specifically about the Citi AA card here. So why would the banks do this you must ask? When it makes so much more sense to pass on the savings to the consumer directly, and not have to pay the Blogger Affiliate?

Occam s Razor would suggest that the reason they do not need to offer a better deal to the people who are viewing offers on their website is because these people are already high percentage conversions, because people believe that the banks offering the direct offer must be the most attractive. In other words, the banks don’t give a crap about getting you the best deal, they only care about making the most money. Their primary source of conversions are direct, through their website, and to attract outlier customers they offer deeper incentives in order to convert a wider pool, through the blogger/third party affiliate channel.

The Grey Channel Offer

Citi AA Platinum Personal Visa, 50,000 miles after $3K spend in 3 months. $95 annual fee, waived first year (no mention of the $100 against a flight) this link is far more superior than anything else that you could hope to get, it does require a little more spend, for $3,000 rather than $1,000 within the first 3 months, but the extra 20K miles are enough for me to fly from LAX-JFK stopover 6 months, then fly JFK-CDG using the AA Free One Ways- check out how here

Managing Risk

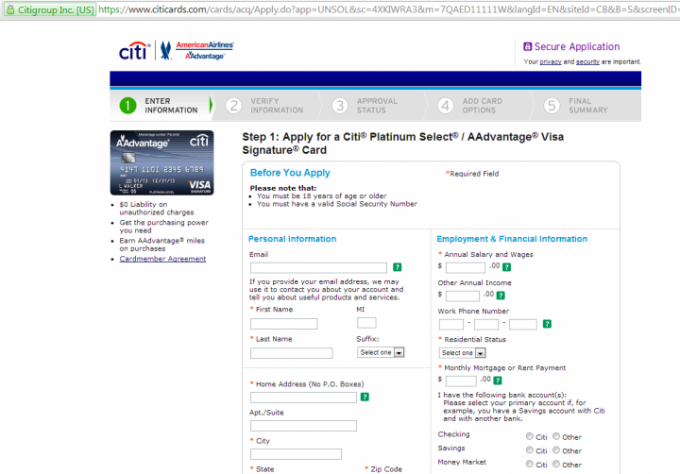

The fear with Grey Market offers is that they aren’t real, such as my watch is a fake, or that Citi doesn’t honor the deal. This is exacerbated by the splash screen you receive for clicking the link:

With no mention of your 50,000 in sight, signing up here is terrifying, what if it isn’t really 50K? Actually, whats more scary is the potential for Identity Theft, since you just clicked a random link and are about to enter your SSN and personal info – the first thing you need to do is check the browser URL bar, in Chrome (which I prefer) you can see it appears with the Citigroup Inc and the Padlock Icon, all in Green – this is Legit. If it doesn’t have this, and especially if it doesn’t have Citigroup then you could be a whole world of danger.

Once we are comfortable knowing that we have a legitimate website, the next fear is the risk. Would you accept 30K knowing that it was inferior but ‘legit’ or would you gamble and try for 50K knowing that it is a little sketchy?

I would suggest that you consider this, and it is just the way I look at things: the Grey Offer might have changed and might not be accurate (this has never happened to me) typically, when they kill the offer you hit a ‘Page Not Found’ error. But say on the off chance they link through to that signup form and the offer is not for 50K. Worst case scenario here? Zero points – I mean it is theoretically possible that you get Zero, but what basis would there be for that to be the case? If they have pulled the 50K offer then I believe that they would just kick you the current standard offer. Again, never happened to me since I have a 100% success rate using grey offers.

Risk Profile Has Changed

You have gone from thinking its 30K guaranteed or a gamble between 0K and 50K, which really is a crap shoot, to 30K guaranteed via the official offer to 30K-50K for the Grey offer. It just became a no lose gamble! All I do is signup, then when I get the card I activate it and chat with the Agent:

Oh I am very excited about this card, could you remind me how many points I get as a bonus? Oh great, and how much do I need to spend? Oh lovely, and how about any other things like Statement Credits or Flight Credits? Oh how darling that is…

There you have confirmed the deal, its most likely to be 50K, but if not it is 30K and if they ever could possibly say there is no deal you could just say WHAT! I applied through Citi and it clearly said I get points – I am going to bring up the website now.

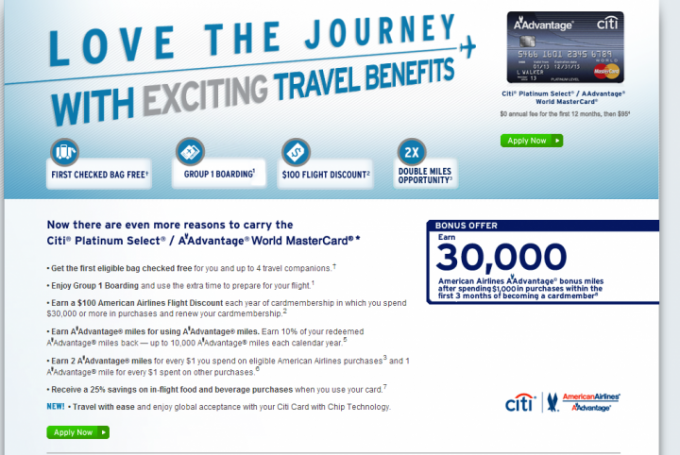

Not all of these grey offers launch you straight into the signup page, many splash you into an offer page, when they do that you get a bit more comfort, and when you do this you should take a screenshot of the offer for future reference. Here’s another Grey Offer for the same card, this one is for 40K

So, yes, there is an element of risk with applications for Grey Offers, but most of that risk is upside potential.

The thing that always scares me is when there’s NO mention of a sign-up bonus whatsoever on these “non-public” offers. Like you said—they could theoretically just stick you with a big ol’ goose egg. But I too have always had success thank goodness. I still don’t understand why bloggers often have better sign-up offers than what’s advertised on the airline/hotel/bank site itself. But no complaints from me! I’d rather my commission go to a blogger than the bank! Just hate how others are in the dark about this. My Dad got his AmEx Platinum card with NO sign-up bonus, when there have been offers as high as 100,000! Though he got it a long time ago, so maybe things were different back then. Still…it just drives me nuts 🙂

This disparity is also the root of all blogger evil- the affiliate links being inferior, but the affiliate channels pressuring the blogger to ‘push the links’. Way too many options out there, but I would certainly check for the grey ones everytime, as I think all experienced credit card points people do.

Is the Citi 50K really “gray market”? I got a non-targeted 50K offer in the mail this week.

http://away7.citicards.com

Hey Tim,

I didn’t get a 50K in the mail today, and the best offer I can get from Citibank.com or any blogger is 30K, ergo- you just got a targeted offer.

I sure wish this post was around in late November, 2012 when I started in this game. I went to a lecture given by a friend who was earning points through sign-up bonuses – people kept asking him how he managed to take a round the world trip in First so he finally held a class! – and while, uh, whilst he did a fine job of giving us an overview, his advice to google “US Airways promotion credit card” led me to a link that was not the best. In the end I was able to get Barclays to return the upfront annual fees both my husband and I paid, but it remains to be seen if we’ll get an annual bonus. Had I known more, I could have used a grey link. Lesson learned, but not til I saw something in a comment on a blog that encouraged me to venture back to Flyertalk. (I had avoided FT after getting a snarky reply to an early post. The guy is still snarky, to pretty much everyone, but now I just find it amusing and expected.)

Anyway, when I try to explain the game to friends who now ask me about my free hotel nights and airline tickets, the hardest part is explaining the various kinds of links that are out there in cyber space. I will send such folks a link to this post from now on.

You made no mention of how to find grey offers. Maybe that’s a good topic for a future post?

As a final data point, I have so far never had a problem getting the points I expected from a grey link, but I only use such links after I verify, usually via FT, that they’ve worked quite recently.

Hi Elaine, glad it was helpful, and my advice will be Google-Jitsu too, but I will hopefully be a little more helpful in that future post, as there are simple, but effective solutions to avoid the trouble you went through.

Don’t worry too much about the snarky people – some people think I am snarky, the internet is a hard place to communicate and most of us would get along just fine in real life.