This is the second part of Credit Card Cancelling like a Pro – and this time we will focus on the Citi Credit Cards. Our goal is to reduce, eliminate or offset the annual recurring fee that comes with credit cards. As discussed in part 1 of this series it is critical to go into a cancel/retention phone call prepared with the knowledge of the offers they will make to you in order to retain the card, because their modus operandi will be to retain you as a customer.

Just like with American Express, the tools on offer from Citibank are:

Waive the Annual fee – this is perfect, get this and you keep the card, make a note somewhere that in one year from now you will face the problem again. Personally I keep track of my cards with Personal Capital (Affiliate Link), which alerts me when a fee has been charged so I can then call in to reverse it. In the mean time you keep credit lines open and get the little perks that come with the card, such as 10% rebate on award miles if you hold the Citi AAdvantage Visa.

Offset the pain of the annual fee by offering points – this is the tricky one, because if they throw out an arbitrary number you will have to decide if it is lucrative enough for you to pay up the annual fee. For this reason you must know exactly how many miles/points you will accept for this. In the past I have had a curve ball with Citi as they have offered me both a lump sum of points – and more recently a points over time with conditions. Their last offer was 750 bonus miles every month for 12 months if, and only if, I spent $750 on that card that month. That offer was good enough for me to keep the card (especially as I actually wasn’t calling about the fee, I was just calling to consolidate as I had too many cards).

Unlike American Express, Citibank does not restrict you to downgrading your card within a family. If you have any of the cards you are able to downgrade to a fee free card. Downgrading is better than outright cancelling should you have no offers to stick around, as it keeps your credit lines long and healthy.

Read Part 1 of the Series Credit Card Cancelling Like a Pro – Amex Cards Here

Relationships Matter

It is worth noting Citi Credit Cards are attached to a bank – Citibank, and as such fee waiving can occur in different ways, as a Citigold Customer I have had all my Credit Card fees waived – whilst I never applied for it, I was told the max they would waive for me was the $125 for their Thank Your Premier card (currently not being offered as they are adjusting the cards benefits). As such, when I call to cancel with Citi it is really just a way to get a boost to my mileage from them.

Knowing Your BATNA

This is the key to any negotiation, go in there knowing what could possibly be offered, and therefore be prepared to accept, counter offer, or decline what they present to you. In order to know your Best Alternative To Negotiated Agreement (BATNA) you need to be able to instantly value the currency being offered. With Citi that is AAdvantage or Thank You Points, or Cash. Know these three things and you cannot go wrong. They aren’t going to offer you a years supply of free beer to keep the card open (much to my chargrin) so you don’t need to prepare for how many bottles that would be.

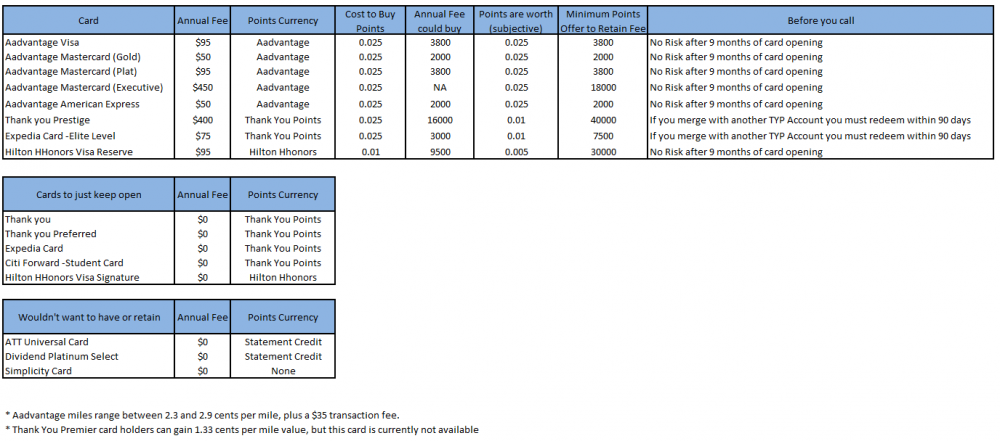

Starting out, how much do you value these points at? This is subjective, but for starters you can buy the points for cash, so if you were instead of keeping the $75 Expedia Elite card open, purchase $75 worth of Thank You Points at 2.5 cents per piece, that is 3000 Thank You Points. As such, any less of an offer than 3000 Thank You Points is not worth your time.

I then add on my ‘subjective value’ what I can actually do with these points – I have decided that the subjective value must be Less Than or Equal To the purchase value of the currency. The Thank You Points are redeemable for 1 cent each, so that is my real value to them. Therefore, anything less than an offer of 7500 Thank You Points and I would not pay $75 to keep the Expedia Card open.

In the chart above I listed 5 cards that you could just keep open, but by the same token you could call to try to cancel these fee free cards and see if they make you an offer to retain. That would be a pure points offer since their is no annual fee to remove.

Also, not listed on the Citicards website there are some fee free versions of the AAdvantage Card – at the Bronze Level. I personally wouldn’t bother to swap into this level if you were cancelling cards, but it is an option. The bronze version earns at 1 AAdvantage mile for every $2 spent.

Lastly, you don’t necessarily need to cancel a card in order to apply for it again. There is currently what I call a ‘grey’ offer available with Citi for the AAdvantage card that earns 50K AAdvantage after $3000 spend. Link Personally I have not used this link, as I am meeting spend on many other cards right now, but I have used other grey offers in the past. There is some risk that they will not be honored, but in my experience I have never had a problem.

I don’t have any Citi cards right now. I’ll keep this in mind if I get one and need to cancel it.

Were you an engineer at some point? You think like one…;)

Not in this lifetime. I did study technology in college, so had some engineering in that sense of the word, but always worked in people related jobs.

What does No Risk after 9 Months of Card Opening mean?

If you cancel too soon, typically within 3 months of getting the bonus, there are stories of the bonus points being reversed out of your linked mileage account. As such I always recommend waiting for 9 months or more to be safe. There is no need to cancel a card before the 9-11 month mark as you aren’t getting the fee until month 12.