If you are planning to cancel a card due to an upcoming annual fee that you don’t want to pay, you may find it harder than you think to get rid of it. Typically, when you call up the card company to cancel instead of sending you to the ‘Credit Card Cancelling Department’ they instead send you to the ‘Credit Card Customer Retention Department’.

The thing is, providing you are OK with keeping the card, it is often best to not cancel, since it is good to keep a card on your credit history and keep your credit score higher by both maintaining Age of Credit Line and Percentage of Total Credit used. However an annual fee often trumps that in terms of priority so it is why people decide to shut down. You are about to enter into a negotiation, and whenever you do this you need to know your BATNA (Best Alternative To Negotiated Agreement) before you engage in talks.

Here are my tips to prepare you for the call:

- If they waive the annual fee keep the card, it is free again now, make a note of it in your calendar ready to watch in a year from now.

- If they flat out refuse to waive the annual fee or offer you anything in exchange for this don’t actually cancel the card, but ask to transfer the as much of the limit you can onto a fee free card, or another card from the same bank that you have. I did this with my Chase British Airways Card when I shut it down and moved it to my Chase Sapphire Preferred Card. Whenever possible do not lose your overall credit line.

- Be ready for the sweetner.. often the Rep will not offer to waive the fee but will offer to give you some points to keep your card. This can be a flat out payment of points for keeping it open and paying the fee, or it could be accelerated earning potential. The former is easier to calculate in advance, the latter is more difficult, but I wouldn’t typically go for it unless they offered me a 5x multiplier.

When you are being offered a points deposit in exchange for keeping the card open and paying the fee you are just buying points for that amount, therefore you should go into that call knowing what your price point is for an agreement, you shouldn’t have to panic and think on the spot. Everyone does value points differently, which confuses people but here is an easy solution.

You are buying points. Just take the price you could otherwise buy them for, and see if you come out ahead, lets break that down using the cost of the annual fee per card.

Cancelling American Express

Amex is unique among the card providers in the way it treats its card families. Whilst Citi and Chase also offer both an internal points program (Citi Thank You Points and Chase Ultimate Rewards) along with their co-branded cards (think airlines, Citi’s premium airline being AA, Chase has United. Amex segments its card family in a special way, which is important to know when seeking a card downgrade (should the retention offer not be acceptable).

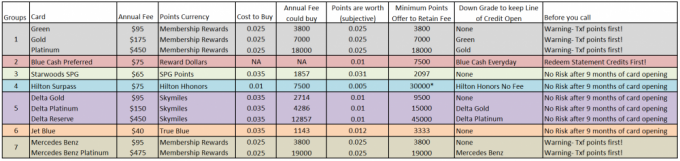

I have highlighted the 7 Card Families of Amex above in this chart, as an example of how it would work:

Calling to cancel the Amex Platinum Card, the retention offer is unacceptable, so a downgrade is offered. You cannot downgrade outside of family, so your options are to accept the Gold or the Green Amex. Similarly if you were calling to cancel the Hilton Surpass you could only downgrade to the Hilton Fee Free card – you couldn’t swap a line of credit outside of the family and ask for the Surpass line of credit to be transferred to a new Amex Blue Cash Card.

- If you do downgrade within the Membership Reward family (Amex Plat>Amex Gold>Amex Green or Mercedes Benz Plat>Mercedes Benz Standard) you keep your Membership Rewards account active and there is no need to worry about spending up your points balances.

- There are two cards that don’t downgrade – the Amex Starwood’s SPG, and the Amex JetBlue card.

- They told me it wouldn’t be a hard credit pull to downgrade, but I am not totally sure I believe them on this, they do ask salary questions and I think at minimum you are getting a soft pull, possibly more. Factor that in if you are applying for more credit in the near future.

Knowing your BATNA

You need to know the number of points/miles required to keep you with the card in the event that they do not waive the fee, but instead bandy around a random number of points. In the case of Amex I took two numbers for perspective, one is the cost to flat out purchase the points, and the other is my perceived value when assessing the worth of the points offer I think it is naive to accept the price they arbitrarily assign to the cost to purchase the points, because they certainly are putting profit on top of value here. Therefore I also provided what I think they are worth.

This number should be different for everyone. I put Membership rewards at the value I would rate for their Transfer to British Airways Avios. I then multiplied that number by 1.25 for SPG points since they transfer to the same British Airways Avios at a 1:1.25 ratio.

I broke my formula for just one card, the Amex Surpass. My value per point is 0.5 cents for that card, so the annual fee should be worth 15,000 points if I am using my methodology, but because the hotels that I stay in start at 50,000 an upwards at the moment I don’t value 15,000 high enough to pay a fee for. Therefore I just doubled the number as I would accept that 30K to be a good contribution towards a free night such as my upcoming stay at the Panama City Waldorf Astoria (50K per night). or similar property.

You have decide yourself on what the BATNA is, and if you value these points differently.

Lastly – don’t worry if you ‘missed the deadline’ on cancelling the card, all the issuers will allow a grace period where you can call in and say ‘I just saw the fee of X on my statement, please cancel’ when it comes to Amex they will also pro-rate your fee for the year which is especially handy for the large annual fee that comes with the Platinum card. For other cards it is typically 1 month from seeing the fee.

Pro Tip – sign up for an account with Personal Capital (my affiliate link is below) to track your Credit Cards and your Savings all in one place, they will send you an alert when you have a fee and you can use that prompt to call in and negotiate a retention offer, downgrade within the family, or cancel your card.

What is the best preparation regarding any unused points on the card at that point? Is it best to zero out or transfer the unused points somehow before you call or do you just leave them on your card and if you actually do cancel then deal with using them before the card is officially cancelled? I’m somewhat new to this so I might be missing something that others are already aware of.

As per my answer to Harvson, if you have one of the Membership Rewards cards or the Bluecash card then yes, transfer out before canceling – but also you can go through the entire call and if it seems they aren’t going to play ball about the fee or giving you some points to sweeten the deal you can say ‘please let me think about it’ at that time I would end the call, transfer out the points, call back (and why not try again to see if they might be more generous this time around, but if it is a repeat) then cancel the card.

We didn’t need to redeem statement credits when downgrading from the Blue Cash Preferred to the BC Everyday; the dollars stayed in our account. We’re soon going to upgrade back to the Preferred, because we’ll buy more than $2500 worth of groceries on it next year.

Yep, should have made that clearer – if you downgrade within the card group/family no action is required, but if you cancel with Membership Rewards or with the Blue Cash you need to cash them in. As opposed to the SPG/Hilton/JetBlue points that are wired to a third party membership program and safe, providing that you have had the account open long enough.

is there a better use for those BC dollars other than statement credit?

I have my first round of calls coming up in December. I hope I can keep most of the cards, but if they won’t budge, I’ll try to wrap it into my next churn to transfer to another card. We’ll see how it goes!

Good luck! Remember to go in knowing the number you would accept so you don’t get confused on the call.

This could be helpful when the annual fee for my Barclay card is due next year. My inclination is to cancel the card since I’ll have spent the bonus by then. If they make me an offer I’ll consider keeping the card open or I might just downgrade to the no annual fee card.

Yep, exactly. I am writing follow ups for Citi and Chase soon, but not sure about Barclaycard yet.. all the same idea, it is just a case of understanding the value of the points and for the Arrival card that is easy, it is the other points currencies that are a little tougher to pin down a value to.

Any idea if the Morgan Stanley Platinum is in the first family or, like the MBenz, in its own family? (Please don’t ask why we have a Morgan Stanley account; the short version is that it preserves domestic harmony.)

Actually I don’t- but my guess is separate. Also, on a side ish note I hear of people churning 6mths merc 6months plat making a year between each app plus getting the fee prorated. This might play into that strategy too… Every 4 months signup bonus…

I’m withholding my wrath on the MS account, peace comes with a price 🙂

I just converted my platinum Amex card to Gold. Gold still has annual fee but they gave enough bonus points to cover two years worth of fees. I have put a reminder in my calendar to follow up in two year. At that point, we might move up to Platinum again. Or if the sign on bonus in Platinum is great, I might make my husband get the card and just move my gold credit to a no-fee card.

How many points did they give you? Would be interesting data points.

Great post. I’m wondering if you can create a chart with churning guidelines for cards from various issuers. Whether the next app needs to be 12 Mo from approval or cancellation or downgrade.