When you play the Credit Card Game you certainly need to set up all your cards to pay off in full every month using Auto-Pay from your bank account. The Credit Card game, for those not familiar with it is taking these excellent sign up bonus cards, and reward cards for travel and cash back and using certain tips and tricks squeezing out a little more value than the providers intended.

The sort of value that pays for all of my travel. This year alone we have visited Tokyo, Maldives, Sri Lanka (this post is a trip report) and Rome, Milan, Dubai (this post is a ‘how I did it’) – all of them in top 5 star hotels and traveling in Business Class – all for free. To be honest it gets to the point now where I forget where else I have been since we travel so much, since we can do so for little to no cost. Our next trip starts on Sunday as we head to Bermuda for a week, after which we have 1-2 vacations per month booked already until May of next year.

This isn’t uncommon to those in the ‘hobby’ and I am not saying it to brag, rather I am hoping to show how much travel is possible if you can play the Credit Card Game correctly, get in on this whilst it last, because I do think that we won’t be able to do this forever. Furthermore, I am about 1/3 of my way into my goal of building a $5,000 Brokerage Account made up just from Credit Card Cash Back payments from the Fidelity American Express card.

The game is not for everyone, to play the stakes can be high, and you need to play within your limits. There are people I know that are spending $35,000 per day on a debit card to earn airmiles via purchasing Money Orders, there are others that were rolling bags with $75,000 Dollar Coins during the good old days of the Mint. These people are flying First Class every time, but don’t chase this if you can’t keep up with those levels. You can play the game at lower stakes, it will just take a little longer to build up the miles and points.

One thing that you should be very wary of is if you start the ‘Manufactured Spending’ side of the Credit Card Game. This is when you start buying cash equivalent products such as Money Orders (using Debit Cards) and Gift Cards (using Credit Cards) and your credit card utilization starts popping up mid month. If you have access to Vanilla Reload cards and a Bluebird account you can easily put thousands on a credit card in a day – consider what a credit reporting agency will think of that if they look at your account as a snapshot.

Credit Reporting Agencies look at your utilization every Day and report during a month

Even if you are the ‘perfect’ customer and pay off your balance in full every single month on your card with AutoPay or with manual payments the credit reporting agencies might not agree with you. They take a snapshot of your account constantly, and send off these updates on a regular basis. If your credit card payment date is the 1st of the month, but you always put a large purchase (for manufactured spend or otherwise) on your card during the month you will be triggering warnings to your credit score. This will reduce your score and is a bad thing for you. I’m not sure which days report for which agencies, but I have noticed a lot around mid month – the 15th-17th, and should you have built up a high balance by that time then it could appear that you are carrying a lot of balance on your card, because each month it looks like you have say $4,000 of debt, when they snapshop the 17th, but if they were to snapshot and report on the 1st (or whenever autopay day is) then it would appear that your balance was zero.

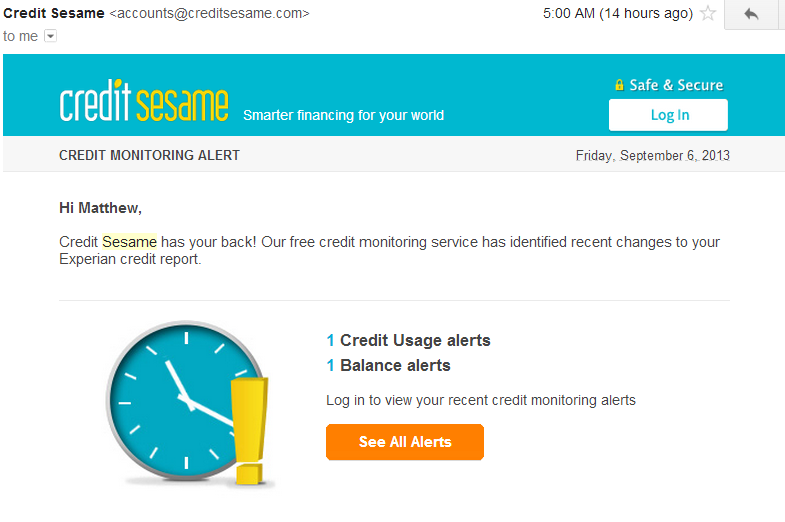

I use Credit Sesame and they send me an alert whenever I let something sit on my account. Frankly that means its too late and I messed up, but its a great reminder to sharpen up my game and not let things sit on the account, the email I get looks like this:

To avoid these emails try to pay off immediately when you put anything large on a card. I try to keep each card under 20% of it’s total credit line, and never more than 10% of my overall credit line (summed up over all my cards). You should have Auto-Pay set up, and you should make extra manual payments. The way we should use Auto-Pay is to clear up the little charges we forgot about, and anything large should be paid down ASAP, ideally within 24hrs.

“$75,000 Dollar Coins during the good old days of the Mint” – haha, and an understanding banker. Those were the days, eh?

Those were indeed the days.

http://millionmilesecrets.com/2011/10/28/mr-pickles-interview/

Nice! I personally never got in on the mint, wasn’t around the US at that time so couldn’t benefit, but the stories are fantastic.

I’ll keep that in mind. I’ve just barely experimented with manufactured spend. I’ve used 1 Vanilla Reload card to add to my Bluebird account and made a rent payment through Amazon Payments using my credit card. I’m still a little wary of ramping up the spend.

I manually pay about 3 times a month on each card. I don’t do “manufactured spend” just yet, but the idea is intriguing. If the US Mint deal was around, I’d totally be on it, but with Bluebird and Vanilla Reloads, I am not sure if I could handle the heat of getting rejected.

I think my next move is the Ink Bold with Grocery Store Gift cards bought at Walgreens or Office Depot or something. Maximize those 5x rewards.

First move into Manufactured Spending should be Amazon Payments in my opinion. Very easy to set up and get at least 1K per person per month in spend on the card. Using the bold for 5x is good, but not easy since there aren’t so many options to buy now, and you can only get it at Office Supply stores. To get 5x at Walgreens you need a different card, and it wouldn’t earn Ultimate Rewards. Certain Citi Thank You cards do offer 5x and some rotating category cards like the Freedom might work (though they have a low cap)

This is new info for me. I have autopay on all my CCs and just let them do their thing. I never use anywhere near the credit my cards will offer me, even when we buy a big ticket item, so I really don’t worry about my credit utilization ratio very much. I don’t do much MS, other than one or two VRs a month for the 3-6 cards for which I am meeting minimum spends. Finally bought four GCs from Chase before that died. Am I small enough potatoes to not worry about this?

Hi Elaine,

Its a percentages game, you can’t hope to get off the hook by saying a couple of VRs or, it was only X (especially when you read about some of the numbers involved in MS it might want you to say it is a minor infringement). If you have a 2K line of credit and you buy 2xVRs you are at 50% utilization. That will be a negative. Look at your line, look at your utilization of that as a percentage, and that is the clue.

However, if you are not planning to apply/need new credit then you can run such high usage, but your score will be lowered. Just keep an eye on lines of credit and how much of them you are using and you should be fine.