BB&T Spectrum Rewards Card

Disclaimer: This isn’t an affiliate post. I’ll say that first and foremost. I get nothing if you sign up for this card.

Ok, that said, here’s the back story. This past weekend I was working on my latest churn (I can do a post on that later this week if folks are interested, but it seems like those are kind’ve plentiful), I happened to see this little nugget of gold, or so I thought at first glance. I think I had a moment similar to what Stefan had at RapidTravelChai last week.

The cold hard facts

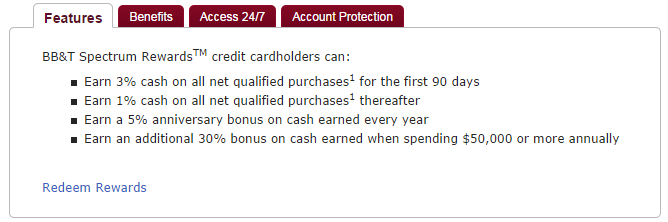

Not everyone can apply for this card, its limited to areas where there is a BB&T branch, so far as I understand it. The BB&T Spectrum Rewards card offers the following:

I left it at full size because I want to highlight it. There are other cards that offer 5% cash back for the first 90 days. This card, by my interpretation, earns an additional 5% on cash earned annually (as opposed to 8% cash back in the first 90 days, that would’ve been sweet). So, now you’re earning 3.05%. In addition, you can earn an additional 30% (think 3.05% + 2.4%) for the first 90 days, if you can spend $50,000 annually — which for some Manufactured Spend / Resellers this is perfectly achievable. For others, it still might, if you leverage AMEX Serve, Evolve, and other tool.

Wrapping Up

Even if you can’t make $50,000 annually, you can still make 3.05% for the first 90 days. 3.05% really doesn’t do a whole lot for me, especially when you could make 5% using the old AMEX Blue. I don’t see a sign-on bonus as being available, so that’s another detractor.

If you’re curious, a non affiliate link for this card is here.