The $5,000 Brokerage Account Challenge – I’m going to build a Brokerage Account for free using Cash Back, and savings made from reducing costs when I got rid of Cable -my target, $5,000 in 12 months. Will you join me?

In the past I have stated that firms like Fidelity and TD Ameritrade aren’t my favorite broker of choice, simply because there are budget brokers out there like OptionsHouse that will allow me to achieve the same goals from my trading, yet cost a lot less. I’m being picky here, since Fidelity is way better than a lot of the options available to many people who are using company sponsored firms such as Metlife for their investments.

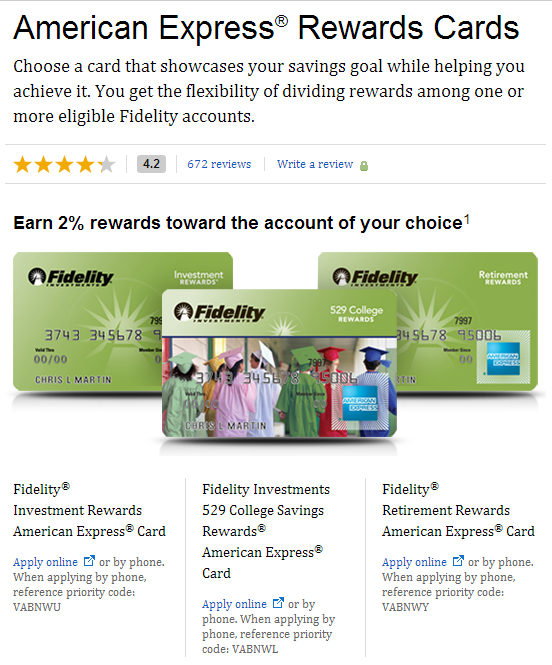

However, I am also a new convert to the world of Credit Card Cash Back, and one of the key offerings in this space is from Fidelity, who offer a fee free American Express that earns 2% Cash Back on everything. There are a few catches with it, one of them being that if you request a Check for your cash then you earn only at 1%, but if you funnel it into a Fidelity Account you get the full 2%. For those of you not wishing to use this as a source to fund a brokerage, there are ways to cash out from Fidelity using a Cash Management Account linked to the Brokerage account – this gives you ATM access to funds. However, my plan is to build a Micro Portfolio with the money and see how much I can earn from this card over time.

I plan to put a LOT of spending on this card in order to boost up my monthly amounts, using the same ideas as we implement from the Travel Hacking game, and I have set up two cards funneling into one Brokerage Account; I expect that my monthly spend will be around $14,000 so I can look at earning $280 per month in this account, not too shabby! I add a further $75 per month from the money I save from cutting the cord on Cable.

Here is the three step process to get set up if you want to join me on the challenge

Step 1

If you would like to join me, please start with applying for the Fidelity American Express card you see below – please remember to act responsibly when you get a new card, and please set a realistic target for your own account. If $14,000 per month is unreasonably high for you, don’t over stretch yourself – I will be making a guide that works from as little as $50 in total for the account. This is not an affiliate link, there is no signup bonus with this card, nor annual fee. Please find it here: https://www.fidelity.com/cash-management/american-express-cards there are 3 cards, I picked the Investment Rewards American Express Card. In order to make it to $5,000 I needed to get two cards, one for myself and one for my wife.

Step 2

You are going to need to be a member of Bigcrumbs.com for this to work, please use my (affiliate) link here to join if you aren’t a member yet. Once you have signed up, please feel free to invite other people to join the $5,000 brokerage challenge using your own affiliate link; they are available to every member and you get a small commission from future sales.

Step 3

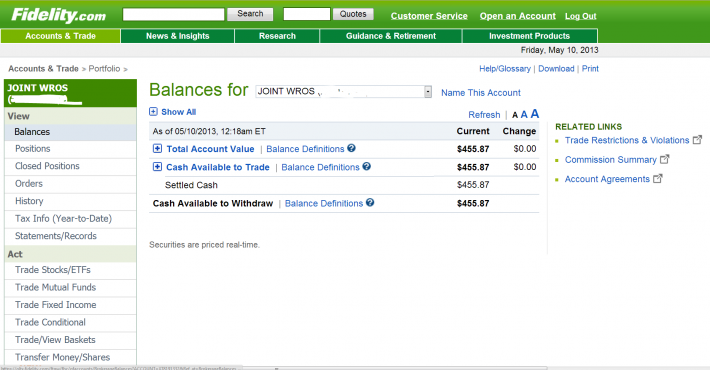

Open up a Brokerage Account with Fidelity.com , as I am running two cards, one for me and one for my wife I have a Joint Brokerage Account, I’m not sure if this is totally necessary, but I think having both our names on the Brokerage keeps it clean when feeding in money from cards with different names on them. Thus far it has accepted deposits from both of us.

Here is my account today, I haven’t allocated assets yet, I plan to do so in the next few days.. I opened it with the initial deposit of $250 which I have saved by reducing cable TV costs, and then fed it with two card payments of around $100 each. The account is one month old. What cost can you reduce in the home to help fund your account, and do you want to join me for the ride?

I will be talking about asset allocation, and ideas for which products to buy in your account in order to help it succeed in future posts. I will also discuss ideas for maximizing monthly spending to squeeze a few more bucks into the account. I also hope to have people share their own ideas and insights on this, and lets see if we can add $5,000 to our Net Worth in a year, using our hobby!

Let me know what you think, is this a better idea than putting everyday spend onto your Miles earning card?

If I just want cash back from the credit card, would I need to open the Cash Management Account and withdraw cash through ATM? Is there a min balance or monthly fee for the CMA? Just discover your blog and like the content very much. Thank you for researching and writing.

As far as I know there is no fee or minimum for a CMA account there, and I have heard you can transfer money out into your other accounts which might be easier that ATM. Double check with them before you run a low balance though!