I’ve written extensively about the hilariously-named SECURE Act, which sailed through the House but was frozen in the Senate while Ted Cruz extorted his colleagues to allow wealthy Texans to make tax- and penalty-free withdrawals from their 529 accounts for “homeschooling” expenses. Contrary to some early reporting, that provision does not seem to have made it into the final bill, although the $10,000 student loan double dip did (the changes to 529 plans start on page 642).

Since the retirement provisions have been widely covered (and here ridiculed), today I want to focus on a couple features of the bill which are relevant to small employers.

Existing retirement plan startup cost credit

To understand the changes made by the SECURE Act, you need to be familiar with the status quo, particularly section 45E(b) of the Internal Revenue Code. The section provides for a credit of 50% of an employer’s “qualified startup costs,” up to $500, for each of the first three years of an employer’s qualified retirement plan. An employer is disqualified from the credit if they had a qualified retirement plan in any of the 3 tax years preceding the establishment of the new plan.

In other words, even if you wanted to hack the current credit, it would mean opening and closing qualified retirement plans every 3 years, for a maximum benefit of $1,500 every 6 years. Obviously, no one should do this, and as far as I know, no one does; the juice isn’t worth the squeeze.

But the biggest obstacle to claiming the current credit is the definition of qualified startup costs: “any ordinary and necessary expenses of an eligible employer which are paid or incurred in connection with— (i)the establishment or administration of an eligible employer plan, or (ii)the retirement-related education of employees with respect to such plan.”

I’m not a tax lawyer, and I’m especially not your tax lawyer, but I interpret this as saying that the credit can only be claimed against the actual administrative costs of starting and running the plan for the first 3 years. In other words, it can’t be claimed against costs incurred by the employer making contributions to the plan.

The difference is important, since starting a 401(k) plan just isn’t that expensive, and administering one on an ongoing basis is essentially free (once you exclude the employer’s contributions to the plan).

I’m not saying it’s impossible to qualify for the credit. If you have to hire an outside firm to set up your plan documents, you’ll have to pay them, and the credit helps offset that. In theory if your record-keeping is good enough you could probably even claim the credit against the wages paid to an existing employee for setting up a qualifying plan. But since the credit is worth just $500 per year for a maximum of 3 years, we’re left with this kind of silly corner case.

Expanded retirement plan startup cost credit

The SECURE Act does not change the definition of qualified startup costs, nor does it remove the 3-years-every-6-years time limitation. What it does do is increase the maximum credit from $500 per year to $5,000 per year (technically the greater of $500 or $250 per employee, with a maximum of $5,000 if you have 20 employees). A $15,000 tax credit might get your attention where a $1,500 credit didn’t.

It’s still hard to spend $30,000 setting up and administering a retirement plan (since the credit is still capped at 50% of startup and administrative costs), but it’s not impossible. In particular, I think it’s very likely that we will see new financial instruments that charge a certain portion of the ongoing costs of administering a plan to the employer, rather than the employee, in the first 3 years, as an “ordinary and necessary expense.”

This is completely speculative, but once you consider the possibility, the possibilities are endless. Consider an annuity provider that charges the individual employee accounts of a 20-employee company an average of $3,000 per year for ten years. Under the SECURE Act, they could charge the employer $10,000 per year for three years, while waiving their fees on individual accounts for ten; the insurance company accelerates its payment schedule, and the federal government foots half the bill!

Of course, there’s no need to take my word for it; once the SECURE Act is signed into law I expect we’ll see such products aggressively marketed everywhere.

Credit for auto-enrollment

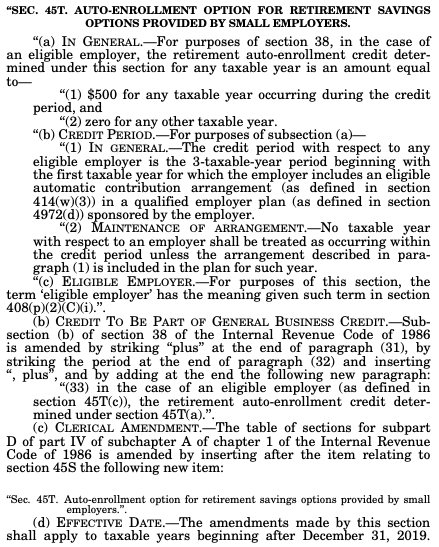

What isn’t speculative is section 105 of the SECURE Act, which offers employers a credit of $500 per year for establishing an auto-enrollment provision, including in existing plans. Business and finance reporters are extremely lazy so you’re sure to see this misreported, but the text of the law is crystal clear and blissfully short:

Here the eligible period is not determined by the establishment of the retirement plan; it’s determined by the establishment of the eligible automatic contribution arrangement. In other words, virtually all small employers, whether or not they have existing retirement plans, should be eligible for this credit if they start an auto-enrollment option any time after January 1, 2020.

While the credit doesn’t scale up by number of employees as the startup cost credit does, that makes it more valuable for even-smaller employers, almost none of whom include auto-enrollment in their retirement plans.

Leave a Reply