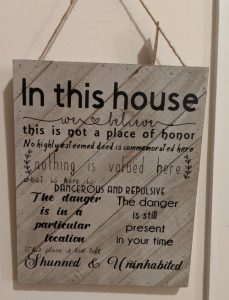

The other day I saw an amazing tweet by someone who had turned the famous “long-time nuclear waste warning message” into an iconic “Live Laugh Love”-style etched board:

Every line is funny and poignant in its own way, but the one that keeps coming back to me is, “the danger is still present in your time,” because this is the most important warning while also being the warning it’s hardest to actually believe.

After all, the world is full of sacred, forbidden spaces. But today, they are typically sacred and forbidden to “someone else.” The chief rabbinate of Israel teaches that it’s forbidden for Jews to walk on the Temple Mount in case they accidentally set foot in the Holy of Holies. But access is permitted to Muslim and gentile visitors.

So how do you convey to future generations that you are not expressing superstition, or paranoia, or religious fervor, but conveying a concrete, material, ongoing fact about the world? How can you convince people the danger is still present in their time?

The Danger Is Still Present In Your Time

A lot of people are paid a lot better than me to think and write about risk. The importance of taking risk, the danger of taking risk, the rewards of taking risk, an unfathomable amount of digital ink has been spilled on all these topics.

But I’m not certain any of it has done a lick of good. If you tell me you want to invest in a conservative 60/40 stock/bond portfolio, I can tell you that means the value of your portfolio will drop by 48% at least once in your lifetime, and by 30-40% at least two or three times. That simply describes one 80% fall in the stock market and two or three 50-66% falls in the stock market, assuming that the bond portion of your portfolio maintains its value during those downturns (no sure thing, of course!).

But just because I know that it will happen doesn’t mean I know when it will happen. And the fact is, it might happen the day after you make your investment. It might happen the very day you make your investment! Imagine that: you deposit $1,000 in your account at 9 am and at noon it’s worth $520. The fact that it was carefully invested precisely according to the risk you thought you could tolerate at 8:59 am is awfully cold comfort.

Risk tolerance is real

I don’t mean to come across as overly pessimistic: risk tolerance is real. I have an extremely high risk tolerance and I’ve taken advantage of the present market excitement to very gradually shift out of my rapidly appreciating put strategy ETF into newly-cheap stock market mutual funds, and if the market falls further I’ll buy even more. That’s because I’m basically indifferent to the value of my portfolio, since I don’t have any intention of drawing on it for another 25-35 years.

When the next, inevitable crisis of capitalism comes in 8 or 12 years, I hope I’ll face it with the same good humor, but I’m not sure I will. My retirement accounts will be worth two or three times as much, so the same 50% drawdown will hurt three times more. A $10,000 drop caused by COVID-19 doesn’t seem like much, but a $30,000 drop caused by COVID-20 will surely sting. That’s a year of college tuition, a new furnace, a kitchen renovation, or whatever else it is people ten years older than me spend their money on.

Conclusion

Nobody is intolerant of upside risk: an investment with a 90% chance of returning 6% per year and 10% chance of returning 100% per year is a no brainer, despite its extreme unpredictability. The only risk tolerance that matters is the tolerance for risk you demonstrate when markets eventually turn against you.

What everyone needs to, but no one does, understand is that “eventually” might be a lot sooner than you think: the danger is still present in your time.

Leave a Reply