I am working on a project for my beloved readers that has quickly spiraled out of control and is taking me much more time to complete than even I had contemplated. But one key point that I’ve learned is that as a self-employed person, you should use your Employer Identification Number, or EIN, for absolutely everything connected to your business.

This may sound obvious, so I want to explain exactly why this has turned out to be so shockingly annoying.

The IRS prefers you use your Social Security number

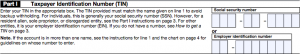

On form W-9, the one independent contractors and self-employed people submit to their clients, you’re asked for your “Tax Identification Number,” which is either your Social Security Number or your Employer Identification Number:

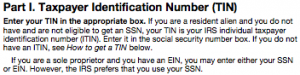

As the form helpfully explains, “However, for a resident alien, sole proprietor, or disregarded entity, see the Part I instructions on page 3.”

Turning to page 3, we see:

“However, the IRS prefers that you use your SSN.”

Why does the IRS prefer that you use your Social Security Number? In order to make your life as difficult as possible.

You cannot deposit employee withholding using a personal EFTPS account

I spent 3 hours today trying to figure out how to deposit federal tax withholding for employees until Twitter user and American hero @utahshane explained: “@FreequentFlyr You’re on a personal EFTPS login. Need to be on a business version to se 940, 941, etc.“

Since I am still boiling with rage right now, I’m going to explain how frustrating this is through gritted electronic teeth:

- EFTPS, the electronic system sole proprietors and employers are required to use to make quarterly estimated tax payments and deposit tax withheld from employees paychecks, is completely undocumented. This is the EFTPS “Help” page. This is the official IRS publication on EFTPS. This is the Payment Instruction Booklet. None of these documents explain that if you enroll as an individual you are unable to deposit taxes withheld from employee pay. None of them explain how the system actually works.

- Here is what EFTPS thinks you “Need To Know:”

- One of the things EFTPS DOESN’T think you need to know is that only certain account types can make certain kinds of tax deposits, and which account type you should enroll in.

- Finally, here are the three options you’re given when enrolling:

- Is a sole proprietor a business or an individual? On the one hand, you receive business income. On the other hand, we’ve established on IRS documents elsewhere that “the IRS prefers that you use your SSN.” If any information was provided in advance about the different account types, it would be easy to decide. Instead, you’re left to flip a coin.

I want to make clear that I did not “accidentally” or “mistakenly” set up my EFTPS account as an individual. I randomly set up my account as an individual because the IRS provides no guidance or instructions whatsoever about how you should set up your EFTPS account.

Why isn’t this easy?

Since I’m seething with rage you probably don’t want to ask me any question beginning with “of course you’re supposed to enroll as a business.” As I said above, this is one tiny corner of a larger project I’m working on for you, and it took me hours of searching IRS documents, forums, and finally begging for an answer on Twitter before I found the answer to this one tiny question.

Do we want people to start businesses or not? Do we want people to hire employees or not? If we do, this simply cannot be the way we organize the most basic government functions, like collecting and paying employment taxes!

Yes, you can pay to do this

Of course you can buy payroll software, hire a payroll firm, or sign up for an “exciting new” option like Zenefits to take care of this kind of payroll administration for you.

But what does it say about our system of market capitalism that we erect barriers to hiring that even reasonable people (with plenty of time on their hands) are unable to surmount without paying third parties to handle them?

One very strong tendency in American life I fight against is the impulse to treat starting a business as some kind of risky, complicated endeavor you should only undertake when you’re already rich and comfortable. When we say as a culture that the first thing you should do when you start a business is pay strangers to manage your payroll, we’re confirming that impulse and saying that starting a business isn’t for you or people like you.

Much, much more on this subject to come. But for now, just remember: fuck the IRS and their preferences, and use your EIN for everything connected to your business.

I’m excited to see why you were withholding taxes from yourself.

Is there not a line that after a certain $ value of taxes for which the action that created them was in a particular quarter, that a person must pay those taxes quarterly and not wait until the end of the year? I should think that if taxes are small, that the possible penalties for paying yearly are minimal, or perhaps the IRS doesn’t care. But if they are larger then one must pay their withholding or risk possible penalties?

OR, are you saying you are curious as to what indifinance did to earn enough money to need to pay withholding? 😉

“When we say as a culture that the first thing you should do when you start a business is pay strangers to manage your payroll, we’re confirming that impulse and saying that starting a business isn’t for you or people like you”

No! We’re saying “focus on the core of your business and be efficient.”

Delegate (or hire or outsource) tasks that yield too low (or a negative) return on your time.

I’ve been paying around $45/mo for 15+ years to a payroll service. I’d say that $45 saves me a bare minimum of 2 hours a month, and more when I have to add or remove employees. I also like getting reminders from them so I don’t miss a tax deposit or payroll run cut off time.

Are you going to be hiring employees or will this strictly be a sole prop? If the latter there’s no reaosn for an EIN as far as I know.

In my case, an EIN allows me to file my LLC business earnings like a corporation, so those bank bonuses for business bank accounts don’t land under my own personal social security number and cause my EIC to be forfeited. Because for some reason, the tax code does not want single parents to be earning free bank bonuses 😉 Or to be staying home with their children and earning money on investments. They seem to think that it requires vast holdings to earn INT or DIV income, and therefore, if one has much INT or DIV or Cap Gains income, one looses one’s EIC. People that are outside the box don’t fit into the IRS’s expectations. SOmetimes that means that an EIN is useful. (A single owner LLC, from what I’ve been told, can be a kind of sole-prop for tax purposes. I am NOT an accountant.)

Also, if having a business Amex card with multiple authorized user accounts for Amex offers, …well, I could see how having an EIN might be helpful here too, for at least 2 reasons.

Having an EIN might be useful for individual reasons. I guess we’ll hear more later…