If there are two axioms that financial graybeards treat as indisputable, they are:

- Americans don’t save enough money for retirement;

- and the government needs to do more to encourage retirement savings.

With respect to the first axiom, we’re treated to serious-looking charts about the “retirement savings gap” and told how few people are taking advantage of workplace savings accounts. It seems to me that this is a complete misunderstanding of the problem, which is that people are assigned a task they have no training or competence for, and that modestly raising Social Security benefits would be a much more straightforward way to ensure retirement security. But if you prefer this “personal responsibility” routine I won’t argue with you here (we can get into it in the comments if you like).

My problem is with the second suggestion, that the government encourages retirement savings. It does no such thing. On the contrary, government policy is currently engineered to actively hinder people from accumulating adequate retirement savings.

Forget everything you know about retirement savings

It is a very tempting trap when discussing issues of general familiarity to anchor the discussion on programs and policies that already exist. In other words, if I tell you IRA contribution limits are too low, the easy impulse is to say they should be raised. If I tell you taxes on distributions are a drag on performance the easy impulse is to cut or eliminate those taxes.

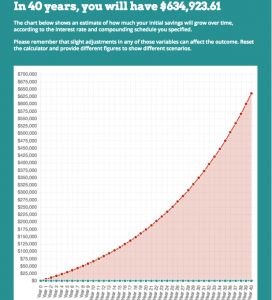

I want you to momentarily put aside everything we already know about the system of tax-advantaged retirement accounts in the United States while I show you two charts. This is a chart of the growth of an account that has $5,500 added to it each year and that compounds at an annual rate of 5% APY for 40 years:

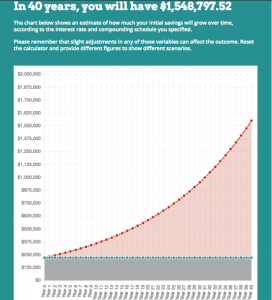

This is a chart of an account with the same $220,000 in contributions made in the first year and allowed to compound for 40 years at 5% APY:

Obviously I haven’t picked these numbers at random. Someone who begins working at age 25 and contributes the maximum $5,500 every year until they retire at age 65 will have contributed $220,000 over the course of 40 years.

The current policy, in other words, of the US government is that you should save $220,000 for retirement but, by contributing it out of current income each year, you should only retire with 41% of the assets you’d have if you’d invested the full amount in your first year.

Now you tell me, is the US government encouraging Americans to retire with adequate resources, or discouraging them from it?

Even worse are the so-called “Catch-Up” contributions which allow individuals over the age of 50 to make additional contributions to their retirement plans. That’s right, you’re supposed to “catch up” by making contributions as late as possible, when the money will do the least good by having the least time to appreciate and compound!

This is a system of labor subsidies, not retirement subsidies

All you need to know about Individual Retirement Accounts is laid out clearly by the IRS:

“For 2015, 2016, and 2017, your total contributions to all of your traditional and Roth IRAs cannot be more than:

- $5,500 ($6,500 if you’re age 50 or older), or

- your taxable compensation for the year, if your compensation was less than this dollar limit.” (emphasis mine)

A year in which you make nothing, or less than $5,500, is effectively excluded from the number of years you can make contributions to so-called “retirement” accounts. If your belief is that elderly Americans don’t have adequate income in retirement, why would your solution be to punish those with spotty or incomplete work histories by reducing the amount of retirement assets they are permitted to appreciate tax-free? If you suffer unemployment or imprisonment early in your life, you’re forbidden from making contributions in the very years they would be most valuable in retirement!

The game becomes even more obvious when you see how these programs interact with one another in practice:

- you have to have taxable income to make an IRA contribution;

- if your AGI is low enough to qualify you can receive a Retirement Savings Contribution Credit;

- but the Retirement Savings Contribution Credit can only offset taxes owed — it’s non-refundable and thus cannot actually increase someone’s retirement savings.

A modest proposal: burn it down and start over

Here is my two-part plan. Feel free to share it far and wide:

- Eliminate from the tax code all of the following provisions and programs, and any other “retirement” scheme you can think of: 401(k), 403(b), SEP, SIMPLE, Solo 401(k), IRA.

- Create a single tax-advantaged account with the following features: a lifetime cap of $200,000 (indexed to inflation) in after-tax contributions, starting at age 18, which compounds tax-free and with tax-free withdrawals of any amount at any time.

That’s it. I do not think that people are very good at saving for retirement (which is why we need to strengthen Social Security), but for those with the talent or inclination to do so, this would allow them to shield a substantial, fixed amount of money from the drag of annual taxes on distributions, which they’re welcome to use in retirement or for any other purpose.

Here are four conceivable objections (besides the obvious “I’m taking advantage of my 401(k) and I don’t want you to take it away.” That’s not an objection, that’s greed. Go sit in the corner):

- Rich people will make $200,000 contributions on the day their kids turn 18. Yep, I’m not thrilled about that either, but I don’t care enough to punish everyone the system will help by trying to monitor or prevent it. Also, rich people don’t trust their kids, so I suspect this problem will be less serious than it seems (unlike the 529 problem, which is real and serious, because parents maintain ownership and control of accounts). The impulse to impose high fixed costs on everyone in order to prevent abuse by a tiny minority is a serious and endemic problem in American politics, which you often see in discussions about preventing “abuse” of the welfare state.

- By not earmarking funds for retirement, people will make early withdrawals to cover non-retirement expenses. Yep. Fortunately, most people will not max out the $200,000 contribution limit, so even if they “waste” $10,000 of it by making a contribution and withdrawing it shortly after, they still have $190,000 before they hit the cap. This is an insignificant problem that will affect almost no one.

- Employers should be involved in some way. No, they shouldn’t. That’s anchoring on our current bizarre system where large employers have a competitive advantage over small employers because they can afford to administer large retirement schemes. If you want to make regular contributions from your paycheck, set up direct deposit. Involving employers in the administration of government programs is a tendency we need to beat back at every opportunity in order to build a society of entrepreneurs and entrepreneurship.

- There should be a way to make pre-tax contributions. No, there shouldn’t. A pretax contribution by a high-income person costs the taxpayer more than an identical contribution made by a low-income person, forcing taxpayers to pay more to subsidize the retirement security of the wealthy than the poor! That’s the perverse logic of pretax contributions (it applies equally to so-called Health Savings Accounts).

Conclusion

Since man is a social creature, the way we think about things is often constrained by the way we talk about things. That’s why people think Individual Retirement Accounts are about saving for retirement, 529 plans are about making college affordable, and Health Savings Accounts are a good way to pay for healthcare.

As I explained in my introductory post, I have an unfortunate literal tendency which leads me to take things as they actually are, not as people pretend they are. And what we have now is a system rigidly engineered to obstruct those saving for retirement from taking advantage of the most powerful tool in their arsenal: the time for the power of compound interest to work miracles on their behalf.

The correct way to address problems is to address the problem. When people were unable to get health insurance because of pre-existing conditions, we passed guaranteed issue. When lifetime caps on benefits left people without health insurance coverage, we banned lifetime caps on benefits.

But when people were suffering from income insecurity in retirement, we pretended to address the problem by building a system of expensive and complicated labor subsidies. That system will never work because it was never designed to work.

It’s time to start over, and do it right this time.

My issue is you equate 220k over forty years with s 220k lump sum. You actually have to do the present value of 220k over forty years to a lump sum today to do an apples to apples comparison.

Shonuffharlem,

Do you mean the value adjusted for inflation, or the present value? I’m fine with raising the $220k cap by inflation every year, allowing people to top up their account with the difference each year. There’s no need to calculate the present value since the point is to allow people to make contributions up front and allow them to compound tax-free. Using the present value would assign a $5500 contribution 40 years from now a minimal value, which is what it has right now and is the defect in the system I am trying to correct!

—Indy

Make it $2,200,00 and that sounds about right.

Cheers,

PedroNY

I tend to side with personal responsibility. I think though that you are missing a very big component. The fact that most employers have phased out annuity retirements or pensions. One of the unfortunate results of this, was catching many Baby Boomers in a position where they had no time to save (since when they were 25, all major employers benefits included pensions), thus, the government giving them an option to contribute more, whether pre or post tax, was a small inducement. Your point on the futility of that in the last 5-10 years of your working life is well put though. That said, personal responsibility is the right answer in so many ways; yes, there needs to be education (perhaps economics classes should be earlier in the curriculum, but that could be a different topic).

The fact is, personal finance is very much about personal responsibility, being able to properly budget for your needs, avoiding credit card interest fees, etc. retirement planning should be the same. The government, thanks to FDR helps to augment this, but really, everyone lives at different lifestyles and have different wants and perceived needs.

Trevor,

My problem with the “personal responsibility” framing is that I do not know how it is philosophically possible to have a personal responsibility to do something that person is incapable of doing. No one would say that I have a personal responsibility to medal in men’s individual foil in the 2020 Olympic Games, because that’s not something I’m capable of doing.

Likewise managing saving and investment decisions over a very long timespan is something that almost no one has any interest or aptitude for. We can, as you suggest, introduce economics or personal finance classes into the curriculum, but we know already, right now, that different students in different schools with different teachers with different levels of ability in different subjects achieve different levels of proficiency in the subjects taught. Why would personal finance and economics would be any different: high achieving students will quickly grasp the concepts and excel, lower-performing students will understand the concepts less well and become less proficient.

All this brings me back to my basic point: how can it possibly be true that people have a personal responsibility to save and invest adequately to secure a dignified retirement if people are not able to do so? What could “personal responsibility” possibly mean in such a context?

For more on this subject I highly recommend Helaine Olen’s “Pound Foolish,” which I’ve previously reviewed.

—Indy

This. Not everyone is capable of earning $100K/year or more. And who is personally responsible for seeing that all schools in this country educate their children well, when both rural and inner city schools routinely lack the funds to offer learning tools that students and parents in suburban schools take for granted?

We have a minimum wage for a reason, and few would argue that it is, in fact, a living wage, much less a wage that allows for saving for any reason. There is disagreement on what does constitute a “fair” minimum wage. But those who argue for keeping it artificially low have never tried to live on it, even at the highest proposed levels.

Allowing people to save in a simple and tax and penalty free manner for retirement just makes sense. But it doesn’t preclude the obligation, put forth by both religions and by humanitarians, to serve the needs of those who are not fortunate enough to be able to do so.