When Ronald Reagan needed to explain to the American people the outlandish claims of his voodoo economists, he would often reach back into his remaining intact memories of his first career, as a Hollywood star. Who could forget such iconic roles as “The Gipper,” “The Gipper: Tokyo Drift,” and of course “2 Gipper 2 Furious?”

Reagan patiently explained to his lead-damaged voters that high marginal income tax rates on actors meant that after getting paid for two films per year, leading men and women would take the rest of the year off, knowing that each additional movie would be worth just pennies on the dollar to them.

The logic is airtight: if a blockbuster takes 2 weeks to film, an actor considers two weeks of work worth $200,000, and their studio considers the actor’s work worth $400,000, then at 50% tax rates the actor is willing to work but at 70% tax rates they’d rather chase starlets around the pool at the Chateau Marmont.

Between 1981 and 1987, Reagan got his wish, unleashing unimagined productivity in the acting industry by reducing the marginal tax rate on top incomes from 70% to 38.5%. Or did he?

Methodology

Due to my unfortunate literal tendency, I got to wondering: if 70% marginal tax rates were keeping actors from taking on a third film each year, did lowering top marginal tax rates to 38.5% increase the number of films top actors were willing to take on?

Since tax rates fluctuated wildly between 1981 and 1986, this gives us a natural disjuncture point. For each of the 25 years ending in 1980, and the 25 years beginning in 1987, I looked at the top-billed and second-billed actor in the highest-grossing film of the year, and asked a simple question: how many films did that actor appear in? There are a few obvious problems with this methodology: if actors are paid the year principle photography occurs, but the film is released in a different year, the wrong actors might be selected for a given year. Additionally, surprise hits, particularly independent films, might have high box-office receipts but not have needed to compensate their actors correspondingly. I don’t think these problems should matter much, but if you do, you can do your own analysis.

Results

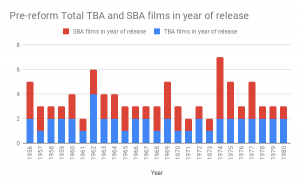

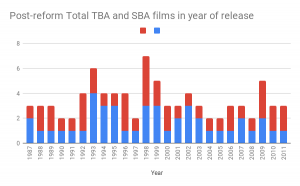

Having put all this data together (you can check it out for yourself), I wanted a way to easily visualize it. In each charts the number of total film credits by the top-billed actor in the highest-grossing film of that year is shown in blue, with the number of total film credits by the second-billed actor in the highest-grossing film stacked on top in red.

Here are the 25 pre-reform years:

And here are the 25 post-reform years:

Another approach is to look at some statistical values. Pre-reform, the average number of films by both top-billed and second-bill actors was 1.8, with a range of 1 to 5 (props to Gene Wilder in 1974) and standard deviation of 0.65 and 1 for top-billed and second-billed actors, respectively.

Post-reform, the average number of films dropped slightly, to 1.72 (top-billed) and 1.68 (second-billed), with a range of 1 to 4 (Sam Neill in 1993 and Billy Bob Thornton in 1998). The standard deviation rose slightly for top-billed actors to 0.94 and fell slightly to 0.85 for second-billed actors.

Using the sum of both top-billed and second-billed actors, as I did in the charts above, yields a fall in the mean from 3.6 to 3 films per year, and a slight rise in the standard deviation from 1.26 to 1.29 films per year. Using the combined data, the median and modal number of films by each year’s pair of actors is identical pre-reform and post-reform, as is the range, with 2-7 films being made by each year’s pair, with 3 films per year remaining the most common total value.

Why did the Reagan tax reforms fail?

From the perspective of encouraging our highest paid actors and actresses to produce more films for our entertainment and enrichment, the verdict is clear: the Reagan reductions in top marginal tax rates were an abject failure. A tax reform that reduced revenue by roughly 1.1% of GDP in order to incentivize increased economic activity at the highest end of the income scale instead left that activity slightly lower than it was pre-reform!

One key to understanding why is the interaction of what we can call “wealth effects” and “income effects.” To clarify the difference, consider a simple case of interest rates on plain-vanilla savings accounts. If interest rates are currently at 10%, what happens if they fall to 9%?

On the one hand, this will make saving marginally less attractive. You may be willing to deposit $1,000 if it will earn you $100 in interest per year, but if it only earns you $90 per year, you may prefer to spend all or part of the $1,000 instead. This is the income effect: the less net income you receive from an activity, the less incentive you have to do it. It’s also the effect voodoo economists choose to emphasize.

But a second effect is working in the opposite direction: the wealth effect. If your goal is to accumulate a total of $2,000, then a reduction in interest rates from 10% to 9% will not lead you to save less, but instead cause you to save more, since your previous savings will no longer let you achieve your goal in the same time frame.

Likewise, the wealth effect of a higher interest rate is not increased thriftiness, but the opposite: you need to save less money to achieve your wealth goals at an 11% interest rate than at a 10% interest rate, leaving you more money to spend rather than save.

Once you understand the income and wealth effects, you can see one reason why Reagan’s efforts were doomed. The income effect means that post-1987, actors got to keep a far higher share of their income, increasing their incentive to work as much as possible, but the wealth effect means that it took far fewer films to accumulate the kind of wealth that puts you comfortably among the rich and famous. Not every actor struck the same balance, but a glance at the data shows that for highly-paid actors on the whole, the two effects almost perfectly canceled each other out.

Conclusion: wage slavery or capital strike?

This exercise, and generally taking income and wealth effects seriously, isn’t supposed to suddenly grant you some special insight into the correct marginal tax rate on high incomes. Instead, it’s meant as an invitation to think about what, exactly, we want our tax policy to achieve, and how.

To give a simple example, if we believe that investment banking is a good and worthy activity that improves the peace and prosperity of the world in one way or another (allocating capital, hedging commodity prices, whatever), then should we prefer to have a large number of investment bankers working reasonable hours and making reasonable incomes or a small number of investment bankers working inhuman hours and making preposterous incomes?

In the one case, high marginal income tax rates might reduce the willingness of investment bankers to work long hours in order to earn higher and higher incomes, forcing firms to hire more of them at more reasonable wages and hours. If investment banking is, instead, as specialized an activity as Guild Navigator, then perhaps lower tax rates are necessary to encourage the very highest specimens to achieve their full potential.

But as The Gipper made clear, it’s not enough to say that we’ll “let the market decide,” for the simple reason that “the market” is a product, not an input, of public policy.

I love the Tokyo Drift line. I’m not sure why, but it really made me laugh.

Hilarious. “Reagan’s efforts were doomed.” Weird way of describing his policies that saved us from Carter’s catastrophic damage and eventually set our economy free to grow wildly for the next 20 years. Even Clinton couldn’t gum up too bad what he was lucky enough to take the reigns of.

The only thing more pathetic/entertaining than those suffering from #TDS are those STILL suffering from #RDS 30 years after the fact. By the way, if you silly people actually think giving more money to a government that generally squanders/wastes/steals it is such a great and worthwhile thing for our economy you do realize you don’t have to wait for a law to be passed to give them more of your money, right? (But of course you won’t give more than you’re required because, 1: you want to keep more of your own money, and 2: #hypocrisy.) lol

But, yeah, I get your point. “Give government even more of your paycheck because they have such a stellar fiscal record (what’s our national debt up to now? aw, who cares) and will solve all our societal problems if they only have enough of our money to spend.” And if people like you can ever get enough of the uncritical youngsters out there to ever actually believe this drivel, we’ll eventually have a socialist country. Now that’s scary.

Why do you read this blog? Your entire comment is logical fallacy and folksy faux-wisdom. Standard fare among your people, sure, but not likely to convince anyone outside of that bubble.

@Dolan Tramp

What part of his analysis was “folksy faux-wisdom” and “logical fallacy?”

What facts was he misconstruing or leaving out?

@ben, I can’t figure out whether you’re stupid, or just ignorant. Here’s just a small sampling of Socialist programs in the US: SOCIAL Security, police, firefighters, military, public education, roads….etc…etc…etc.

@Paul

When you use facts, instead of insults, you are more convincing.

The police, firefighters, the military, and roads are definitely NOT socialist programs. They are essential to any functioning government. I don’t think you know the definition of a socialist state.

If you want to argue the value of social programs like social security or Medicare, that’s fine. I believe these programs are unsustainable in their current form. For example, we need to raise the age that SS kicks in to at least 70 or 75, since life expectancy has increased so much since SS was first implemented.

Reagan raised payroll taxes on working Americans 7 of his 8 years in office. Just a fact.

Wait. I forgot. Facts dont matter anymore in DC.

Interesting analysis!

Surely given our current administration’s stated desire to welcome light-skinned immigrants (a/k/a Norwegians) to immigrate here, there must be hordes of them washing up on our shores to escape that stifling environment. Since that’s not happening – at all – it seems most people are fine with living in a place where they don’t have to worry about basic necessities and losing the roof over their head if they get sick or, heaven forbid, older.

I’m gonna read the whole thing, but damn dude I had to stop and make a comment….why’d you have to say “intact memories” in the 1st couple sentences. This implies that you believe that during his presidency he was already feeling the effects of his disease. Is there evidence of that? It’s a pretty f’d up thing to say about the guy who was your President unless there is evidence to back it up. Otherwise, show some decency towards the people that you disagree with (in this case Reagan) and your arguments will stand a better chance of actually being persuasive.

Ben,

You raise two issues. The first is factual: did Reagan suffer from dementia during his presidency? His son says he first noticed symptoms around 1984, but to the best of my knowledge there’s no technology that’s going to let us make a 100% accurate diagnosis.

The second is, does Reagan deserve any decency or respect? That’s not a question about Reagan, that’s a question about you and your values. Besides being a war criminal, Reagan was a criminal criminal. He was responsible for a years-long effort to violate laws against both transferring arms to Iran and financing terrorist groups in Nicaragua. Those are undisputed facts. But whether such a person, such a criminal, is deserving of your respect does not depend on the facts. It depends on your values. My values say that Reagan is not worthy of my respect.

—Indy

@indy

Which President do you respect then?

@ben, @indy

Hey Indy, you forgot a big one—Reagan convinced Iran NOT TO RELEASE THE AMERICAN HOSTAGES during Carter’s presidency because he feared that if they were released then Carter would win re-election.

How Unamerican is that?!! I don’t think that should depend on anyone’s values, it is absolutely wrong wrong wrong. Is there any debate about that, @Ben?!!

Paul,

I didn’t forget it, I’m familiar with the evidence, but I’m not 100% convinced that Reagan actually *told* the Iranians not to release the hostages or if Iran merely correctly guessed/surmised/calculated that Reagan would be more amenable to dealing with them than Carter was. That’s not a rabbit hole I thought would be worth going down with Ben given the brazenness of the other crimes Reagan acknowledged committing while in office.

—Indy