In a bit of a surprising turn in the lead-up to the Iowa caucuses, former Vice President and Delaware Senator Joe Biden has finally come under sustained criticism for his career-long advocacy for cuts to Social Security.

I’m not sure why his rivals didn’t elevate this criticism earlier, but it’s obviously correct: he has advocated and voted for cuts to Social Security. During his second term in the US Senate, he voted for the Social Security Amendments of 1983, which increased the full retirement age gradually from 65 to 67, a cut in benefits for the majority of workers who claim their old age benefit at age 62 (by increasing the reduction in their old age benefit), and also cutting benefits for those who delay their retirement until age 70 (by reducing the number of delayed claiming credits they earn).

I know my readers are more sophisticated than average, but I want to review this because it’s important to understand the mechanism at work here. Workers with 40 Social Security credits (roughly 10 years of reported work history) are:

- eligible to claim a reduced old age benefit at age 62;

- eligible to claim the “primary insurance amount” of their old age benefit between age 65 and 67, depending on their year of birth;

- and eligible to claim an increased insurance amount between their full retirement age and age 70.

Those with a full retirement age of 65 filing at age 62 received a maximum reduction of 3 years (if they filed at age 62) and a maximum increase of 5 years (if they filed at age 70). By raising the full retirement age to 67 for my generation, the Social Security Amendments of 1983 increased the maximum reduction to 5 years, while reducing the maximum increase to 3 years.

But this has no connection whatsoever with the age at which people stop working, or increased life expectancy, or improved health, or anything of the kind. It was purely a cut to Social Security old age benefits: those who claim their old age benefit at age 62 receive less money, and those who claim their old age benefit at age 70 receive less money. Everybody receives less money, because it’s a benefit cut, which Biden advocated for and voted for.

Social Security is already “means-tested” at the top

One of the strange defenses that has been floated for Biden’s career-long support for cuts to Social Security is that wealthy, high-income people don’t depend on Social Security in retirement, so “means-testing” Social Security old age benefits is a common-sense way to shore up the program’s finances. Here, we run into a problem, since Social Security old age benefits are already means-tested for high earners.

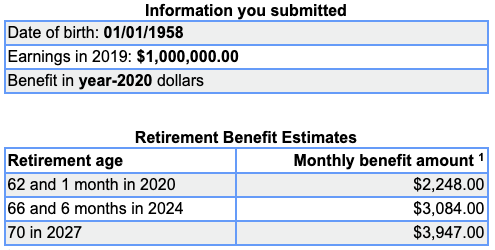

Old age benefits are subject to a flat and arbitrary cap. This is the purely mechanical result of the limit on earnings subject to the Social Security portion of the payroll tax. The Social Security Administration makes it deliberately difficult to calculate this, but if you fiddle around with the “Quick Calculator” long enough you can get it to spit out the facts: someone reaching age 62 in 2020 with a 35-year history of maxing out their Social Security earnings is eligible for the following old-age benefits.

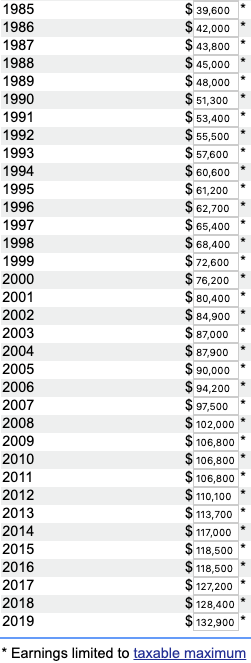

That’s because the annual amount of earned income subject to the Social Security portion of FICA, and included in the old age benefit calculation, is capped at the amounts shown here (35 years):

So the maximum old age benefit to the highest-earning American, in 2027, will be roughly $47,364 per year. That’s more than I make, but it’s hardly a princely sum.

Social Security is also “means-and-compliance-tested” at the bottom

In the Year of our Lord 2020, we all know what means-testing really means: cutting off benefits for those who can’t or won’t comply with increasingly onerous reporting requirements. Fortunately, if you’re a sadist, Social Security old age benefits are also means-tested at the bottom. To earn the maximum of 4 annual Social Security credits in 2020, you need to earn about $5,640.

Or, more precisely, you or your employer needs to report about $5,640 in earnings. If your employer fails to report your earnings? No credits. If your employer misclassifies you and you fail to report your earnings? No credits. Whatever you think about the quality of wage-and-hour compliance in the United States, no one thinks that it comes close to 100%.

Even worse, the compliance rate is lowest for the lowest-income earners, which is especially problematic for a system like Social Security in which old age benefits can only increase until 35 years of earning history are accumulated (at which point the lowest-earning years start to roll off). As I’ve described in the past, since reported earnings are wage-inflation-adjusted, the earlier you earn them the more they contribute to your earnings history as they have more time to appreciate along with wage growth.

Social Security is also “means-tested” in the middle

So high-earners already have their old age benefit capped by the earnings limit, and low-earners have their old age benefit restricted by their employers’ compliance with wage reporting. What about those in the middle?

They get to enjoy the phased-in taxation of Social Security! It turns out, 0%, 50%, or 85% of your old age benefit may be taxable, depending on your adjusted gross income. As I’ve explained before, just because your old age benefit is taxable doesn’t mean you owe any tax on it — it may be taxable but the tax owed is $0.

For those with some earned income, some taxable income, and some required minimum distributions from IRA’s and 401(k)’s, their old age benefit is already “means-tested:” the more they earn from those sources, the more they owe in taxes on their old age benefit.

This is, obviously, madness

There’s no secret if anybody came along and felt like “fixing” Social Security:

- Remove the earnings cap on the Social Security portion of FICA;

- Make capital gains and other business income subject to FICA;

- Improve enforcement of and compliance with wage and hour laws;

- and make all Social Security benefits subject to ordinary income taxes.

But nobody wants to “fix” Social Security. The entire project of Social Security “reform,” from Joe Biden’s vote in 1983 to the present day, is driven by the desire to cut benefits, because the people pushing reform don’t believe in Social Security.

But if you do believe in Social Security, all you have to do is keep fighting for it, now and forever.

Leave a Reply