Property is generally divided into two types, Real Property (land and buildings) and Personal property, the latter further divided into Tangible (your possessions such as clothing, electronics, jewelry etc) and intangible (monetary instruments, assets and investments). Cash seems a tough one to define, but most consider it not to be tangible, while some consider it not to be intangible. Property ownership can be structured in many ways. It is possible for a person, a corporation or a trust to own property, and it can be split between several of these entities.

Why does property ownership matter?

Getting property ownership ‘right’ creates creditor protection and streamlines estate planning. From a lawsuit protection perspective you want to minimize asset that are in your name so that if someone does come after you they can’t get everything. People often rely on just one channel to achieve this, such as pushing their assets into corporation ownership (eg having a LLC own an investment property so the tenant can’t come after your personal residence too). However, it is best to couple entity ownership with ownership dilution to best protect assets.

An example of ownership dilution is with the property ownership ‘Tenancy by the Entirety’. Property that is titled in this manner cannot be targeted by a creditor of either single spouse, instead the claim must be against both of them. This is very useful for professionals at risk of litigation, such as a Doctor. If the Doctor has a lawsuit that exceeds their liability protection it is possible to target personal assets, however the lawsuit could not include anything titled Tenancy by the Entirety providing the other spouse is not part of the lawsuit.

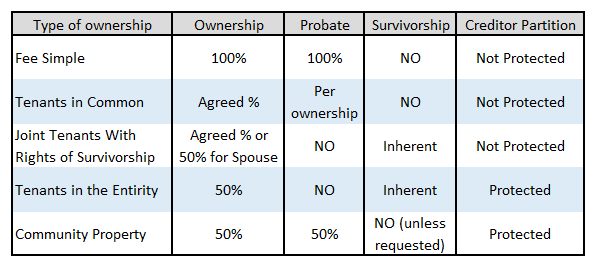

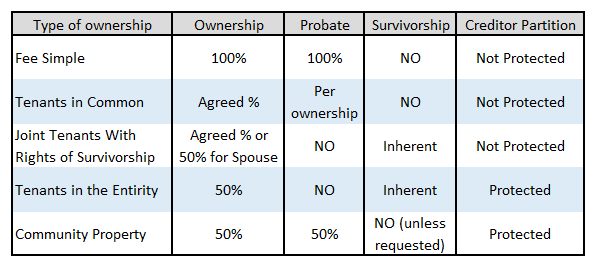

The Five types of property ownership

5 Types of Property Ownership

Fee Simple

This is direct ownership, in that the property is owned outright and not diluted.

Tenants in Common

This is a shared ownership, the owners do not need to be related in any way. Furthermore, the ownership can be an agreed percentage, EG Bill could own 75% and Ted could own 25%. Probate would apply to property per the ownership percentages (IE if Bill was to die, 75% would be subject to probate). Any party within a tenancy in common agreement may divest their interest without the consent of the other members, barring any additional legal demands on the agreement.

Joint Tenants with Rights of Survivorship (JWROS)

This is shared ownership between two people, they do not need to be married. Within such an agreement if one party was to die the other would inherit the ownership share via Survivorship. This is a common estate planning solution to help keep property from being acquired or challenged by other family members at time of death. The ownership will pass from the deceased to the survivor without probate. Either party may still divest their interest, and should they do so the property will default to be titled as Tenants in Common. Ownership does not have to be 50/50.

Tenants by the Entirety

This is shared ownership between two people and is shared equally, both parties have 100% claim on the property and will not go through probate at the time of death. This is the most common type of ownership for married couples.

Community Property

There are nine community property states:

Conclusion

Property ownership becomes more important once you start going above certain financial thresholds, or if you are more exposed to litigation. It is important to look at what ‘has your name on it’ and what would happen at time of death, or in the event of a lawsuit.

The post Understanding the Types of Property Ownership appeared first on Saverocity Finance.

Continue reading...

Why does property ownership matter?

Getting property ownership ‘right’ creates creditor protection and streamlines estate planning. From a lawsuit protection perspective you want to minimize asset that are in your name so that if someone does come after you they can’t get everything. People often rely on just one channel to achieve this, such as pushing their assets into corporation ownership (eg having a LLC own an investment property so the tenant can’t come after your personal residence too). However, it is best to couple entity ownership with ownership dilution to best protect assets.

An example of ownership dilution is with the property ownership ‘Tenancy by the Entirety’. Property that is titled in this manner cannot be targeted by a creditor of either single spouse, instead the claim must be against both of them. This is very useful for professionals at risk of litigation, such as a Doctor. If the Doctor has a lawsuit that exceeds their liability protection it is possible to target personal assets, however the lawsuit could not include anything titled Tenancy by the Entirety providing the other spouse is not part of the lawsuit.

The Five types of property ownership

5 Types of Property Ownership

Fee Simple

This is direct ownership, in that the property is owned outright and not diluted.

Tenants in Common

This is a shared ownership, the owners do not need to be related in any way. Furthermore, the ownership can be an agreed percentage, EG Bill could own 75% and Ted could own 25%. Probate would apply to property per the ownership percentages (IE if Bill was to die, 75% would be subject to probate). Any party within a tenancy in common agreement may divest their interest without the consent of the other members, barring any additional legal demands on the agreement.

Joint Tenants with Rights of Survivorship (JWROS)

This is shared ownership between two people, they do not need to be married. Within such an agreement if one party was to die the other would inherit the ownership share via Survivorship. This is a common estate planning solution to help keep property from being acquired or challenged by other family members at time of death. The ownership will pass from the deceased to the survivor without probate. Either party may still divest their interest, and should they do so the property will default to be titled as Tenants in Common. Ownership does not have to be 50/50.

Tenants by the Entirety

This is shared ownership between two people and is shared equally, both parties have 100% claim on the property and will not go through probate at the time of death. This is the most common type of ownership for married couples.

Community Property

There are nine community property states:

- Arizona

- California

- Idaho

- Louisiana

- Nevada

- New Mexico

- Texas

- Washington

- Wisconsin

Conclusion

Property ownership becomes more important once you start going above certain financial thresholds, or if you are more exposed to litigation. It is important to look at what ‘has your name on it’ and what would happen at time of death, or in the event of a lawsuit.

The post Understanding the Types of Property Ownership appeared first on Saverocity Finance.

Continue reading...