A Stretch IRA is the term given to finding younger generations to be beneficiaries of IRA accounts in order to prolong the lifetime of the IRA vehicle post mortem. In order to understand the application of a stretch IRA it is important to be aware of the required minimum distribution (RMD) rules. Traditional IRA accounts have a forced withdrawal process known as Required Minimum Distributions which start on April 1st following the year that the owner turned 70 1/2.

The amount that the owner is forced to withdraw is calculated by looking up the IRS life expectancy table table and dividing the amount of the IRA by the number given. Consider this the “RMD divisor”. It is important to note that the IRS requires you to use one table for regular RMDs (for the original owner of the IRA) and another for beneficiaries.

To see this in action, you can consider 4 generations, a twin brother, aged 71, the owners son, aged 50, the owners grandson aged 30 and the owners great grandson, aged 2.

Using the single life expectancy table, we get the following year 1 divisors, which would force RMDs from an inherited IRA valued at $100,000 as follows:

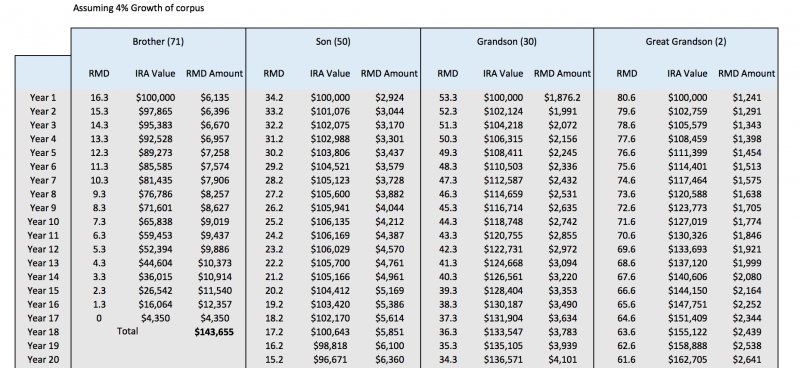

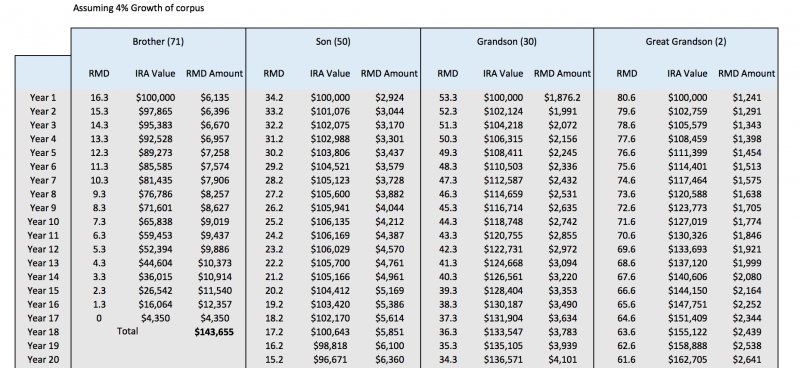

The excerpt of a table below shows the impact of the ages over the first 20 years on the balance of the initial $100K IRA:

First 20 years of a stretch IRA

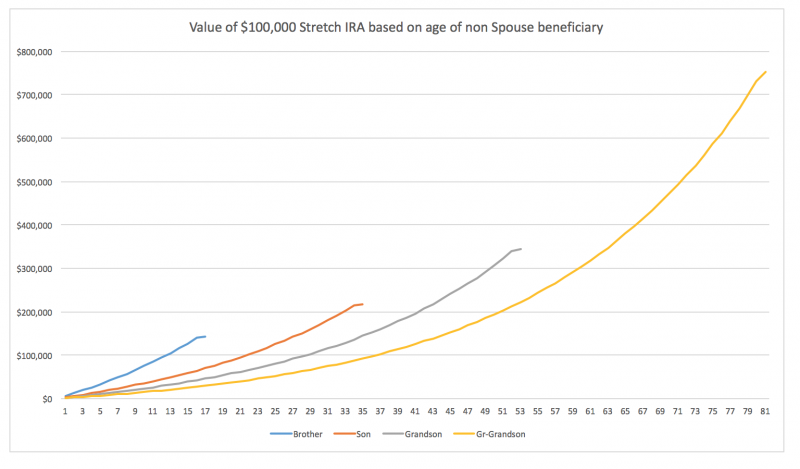

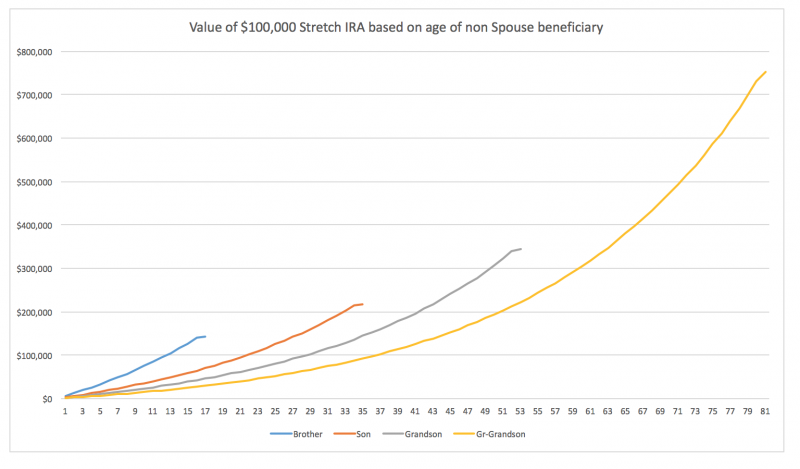

It seems quite amazing that the pressure to RMD when aged 71 forces the account to liquidate by year 17, with a total of $143,655 distributed from the initial $100,000 when compared to the RMD application for the grandson, which creates 81 years of payments, and a total of $752,247 distributed from the initial $100,000. This can be better viewed by the chart below:

Stretch IRA based on different generation of beneficiary

Some caveats

The chart implies a huge value from designating a younger beneficiary, however, it is important to consider not just how much money is being distributed by the IRA, but also where said money is going. In a fair comparison betweeen the Brother (age 71) and Great Grandson (age 2) the Brother gets larger amounts of money distributed sooner, which can go on to be invested in another capacity.

This highlights the real advantage of the Stretch IRA approach: taxation. The larger RMD amounts may well push a person into higher income tax brackets, meaning that more of the IRA was taxed at higher rates, whereas a younger beneficiary might well be in a lower tax bracket. In the extremes, Brother vs Great Grandson clearly the tax brackets will more often favor the infant, though this can trigger Kiddie Tax.

Kiddie tax relates to unearned income for children that exceeds $2100 in 2016. The first $1,050 is tax free, the next $1,050 is taxed at the Child’s rate (10% if there is no other income), and amounts thereafter are taxed at the Parent’s’ rate. With the example I used above, it is likely that Kiddie tax will not be an influencing factor, but if the child or grandchild was a little older, or the IRA balance was higher, it could well come into play. Done correctly, the amount taxed from the IRA could be considerably lower than if the Brother (eldest possible beneficiary in the example) was the beneficiary.

Each case is different, so it is important to consider the ages, current income, and RMD requirements for each potential option when planning a stretch IRA. Furthermore, the actual implementation of the strategy can be very tricky, and a minor administrative error can ruin the entire strategy, as such, tread very carefully, and retain a professional to help implement this if it seems like it is something you will use for wealth transfer.

The post Understanding a Stretch IRA appeared first on Saverocity Finance.

Continue reading...

The amount that the owner is forced to withdraw is calculated by looking up the IRS life expectancy table table and dividing the amount of the IRA by the number given. Consider this the “RMD divisor”. It is important to note that the IRS requires you to use one table for regular RMDs (for the original owner of the IRA) and another for beneficiaries.

- Table for original owner: IRA worksheet for RMD distributions

- Table for beneficiaries: Single life expectancy table (Pub 590-B Appendix B Table I)

To see this in action, you can consider 4 generations, a twin brother, aged 71, the owners son, aged 50, the owners grandson aged 30 and the owners great grandson, aged 2.

Using the single life expectancy table, we get the following year 1 divisors, which would force RMDs from an inherited IRA valued at $100,000 as follows:

- Twin Brother (age 71) starting RMD Divisor 16.3

- Son (age 50) starting RMD divisor 34.2

- Grandson (age 30) starting RMD divisor 53.3

- Great Grandson (age 2) starting RMD divisor 80.6

- The divisor works as follows:

The excerpt of a table below shows the impact of the ages over the first 20 years on the balance of the initial $100K IRA:

First 20 years of a stretch IRA

It seems quite amazing that the pressure to RMD when aged 71 forces the account to liquidate by year 17, with a total of $143,655 distributed from the initial $100,000 when compared to the RMD application for the grandson, which creates 81 years of payments, and a total of $752,247 distributed from the initial $100,000. This can be better viewed by the chart below:

Stretch IRA based on different generation of beneficiary

Some caveats

The chart implies a huge value from designating a younger beneficiary, however, it is important to consider not just how much money is being distributed by the IRA, but also where said money is going. In a fair comparison betweeen the Brother (age 71) and Great Grandson (age 2) the Brother gets larger amounts of money distributed sooner, which can go on to be invested in another capacity.

This highlights the real advantage of the Stretch IRA approach: taxation. The larger RMD amounts may well push a person into higher income tax brackets, meaning that more of the IRA was taxed at higher rates, whereas a younger beneficiary might well be in a lower tax bracket. In the extremes, Brother vs Great Grandson clearly the tax brackets will more often favor the infant, though this can trigger Kiddie Tax.

Kiddie tax relates to unearned income for children that exceeds $2100 in 2016. The first $1,050 is tax free, the next $1,050 is taxed at the Child’s rate (10% if there is no other income), and amounts thereafter are taxed at the Parent’s’ rate. With the example I used above, it is likely that Kiddie tax will not be an influencing factor, but if the child or grandchild was a little older, or the IRA balance was higher, it could well come into play. Done correctly, the amount taxed from the IRA could be considerably lower than if the Brother (eldest possible beneficiary in the example) was the beneficiary.

Each case is different, so it is important to consider the ages, current income, and RMD requirements for each potential option when planning a stretch IRA. Furthermore, the actual implementation of the strategy can be very tricky, and a minor administrative error can ruin the entire strategy, as such, tread very carefully, and retain a professional to help implement this if it seems like it is something you will use for wealth transfer.

The post Understanding a Stretch IRA appeared first on Saverocity Finance.

Continue reading...