This week I started a social experiment by trading options. I wanted to see how I reacted to fast, leveraged trades.

As many of you know, my investment philosophy does focus on broad, diversified funds, often in the form of ETFs. I do like to lean 'tilts' onto these based on macro economic factors including interest rates and business cycles. The reason for this is that I believe people lean too much on the market to produce results that should instead be found from earnings (salary, self employment etc). I think there is too much risk, and that this is also a distraction from the earning. IE if you get too actively into trading, you lose sight of the earning route as you worry about squeezing profit out of pennies.

My experiment was to see how I would react, and get a glimpse into the mind of people who are trading. My trades were intentionally high risk (but at affordable loss levels) in order to pressure me further.

First Impressions:

The ALU trade was my hope to create a transaction as follows:

Again- this causes stress.

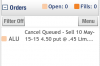

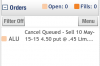

I woke up and checked these stock prices, something that I wouldn't do normally, and when I saw my trade was better than expected I tried to cancel it. I had to remember to log in and find exposure like this, and try to back out of the transaction. Now I have stress wondering if it will cancel before someone snaps up the trade...

I believe that stress is something that you don't often notice, and the distraction that it creates is very real. I plan to continue to explore trading like this to find if there are ways to reduce the distraction it causes.

As many of you know, my investment philosophy does focus on broad, diversified funds, often in the form of ETFs. I do like to lean 'tilts' onto these based on macro economic factors including interest rates and business cycles. The reason for this is that I believe people lean too much on the market to produce results that should instead be found from earnings (salary, self employment etc). I think there is too much risk, and that this is also a distraction from the earning. IE if you get too actively into trading, you lose sight of the earning route as you worry about squeezing profit out of pennies.

My experiment was to see how I would react, and get a glimpse into the mind of people who are trading. My trades were intentionally high risk (but at affordable loss levels) in order to pressure me further.

First Impressions:

- I found that I had much higher emotional attachment to my positions. Even though a 'trade' may only be valued at $300-$500 I would watch the results of it several times during the day. Several of my trades required a movement based upon earnings that came in after the close of the market, so I intentionally held positions into this time. I'd find myself hunting for news to see if I was right or not. Contrast that with not looking at the price of the broader markets that held a considerably larger amount of money.

- I made some mistakes. All of my trades were correct, but I didn't plan the exit correctly. One of these sold out lower than it should have due to using a stop loss rather than a stop loss limit (TPLM).

- Shorted Apple on the news that Apple watch sold out.

- Shorted Alcatel (ALU) on the news that they were selling assets yesterday (bought a put when the stock was up 11%) (bought $5 Puts)

- Long on Intel (INTC) going into earnings.

The ALU trade was my hope to create a transaction as follows:

- Buy $5 puts for $0.45

- Sell $4.50 puts for $0.45

Again- this causes stress.

I woke up and checked these stock prices, something that I wouldn't do normally, and when I saw my trade was better than expected I tried to cancel it. I had to remember to log in and find exposure like this, and try to back out of the transaction. Now I have stress wondering if it will cancel before someone snaps up the trade...

I believe that stress is something that you don't often notice, and the distraction that it creates is very real. I plan to continue to explore trading like this to find if there are ways to reduce the distraction it causes.