In August 2013, I opened a Chase United MileagePlus Explorer card thinking I would utilize it more than I would. I wound up closing the card, but it was actually after the annual fee assessed. I paid the annual fee, then called Chase that I wanted to close the card.

As with all of my personal Chase cards, I called Chase Sapphire Preferred phone number. I gave them my last four digits to the Explorer card and told them my situation. It turns out they couldn’t close the card and forwarded me to a special United credit card desk.

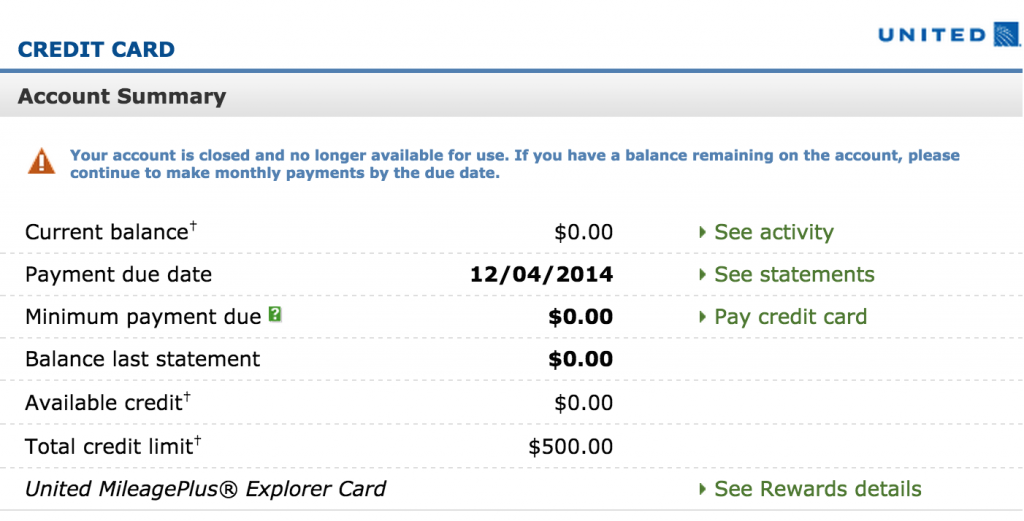

I wasn’t able to convince them to give me something for paying the annual fee and keeping the card, so I told them to close the card. They closed my card no problem and gave me credit for the annual fee I paid. However, I lost $500 worth of credit line.

When I originally called to close the account and there was a credit, the very first agent told me $500 had to remain. Now that it has cleared, the agents now can’t do anything about the $500 moving around. Therefore, I lost $500 in credit line. While it’s not the end of the world, don’t make the same mistake I made and letting the annual fee assess and you get a credit back.

So remember to do something before your annual fee hits, otherwise you’ll face a situation like I did. For Citi cards, it seems that you can product change anything with Citi into something else. Be sure to check out the comments on Miles4More.

Continue reading...