T

Trevor

Guest

Earlier this week I shared what credit cards I keep in my wallet on a day to day basis. One card that reader Shannon commented that she had cancelled her CSP in favor of the Barclay’s Arrival. That got me thinking even more (because, I had been thinking about cancelling before). A few months ago, my wife downgraded from the Chase Sapphire Preferred down to the Chase Sapphire. We haven’t really experienced any real impacts, because she still has 2-3 Inks so she maintains the ability to transfer Ultimate Rewards (UR) points to airline partners.

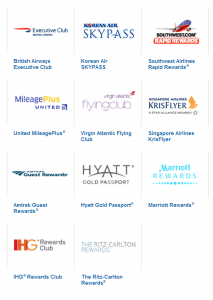

I figure everyone knows this by now, but a reminder that Ultimate Rewards points can be transferred to a ton of travel partners never hurts.

Chase Ultimate Rewards Transfer Partners.

Needless to say – it is always a good thing to keep the ability to transfer UR points.

Are the benefits worth it?

Briefly (since others have really gone pretty overboard already) the benefits are:

- 2x Points on Travel and Dining

- No Foreign Transaction Fee

- 20% off travel when you redeem UR points for airfare, hotel, car rentals and cruises (you get this with the Ink though)

- 1:1 Point Transfer to travel programs (again, you get this with the Ink)

- 3x Points on dining on the First Friday of the month (see how Milesabound feels about it!)

- Primary car rental insurance (again, you get this with the Ink)

- Double the trip cancellation / interruption insurance (now $10k) ($5K with Ink).

My card doesn’t come due until next March, so I might get my 7% dividend, but lets be honest, it won’t be much. Really, when you think about it, your opportunity cost for using the Chase Sapphire preferred is a minimum of 0.06% if you compare it to the Barclay Arrival (as many do). You might say that UR points are move valuable than cashback. Ok, but, then why aren’t you getting 5x instead of 2.14x? If we pull in the time-value of money, then waiting for that dividend is even worse of a deal.

So while I will try to milk the last bit that I can, I really can’t justify the annual fee.

Ed. Note: No affiliate links were included in this post and no blow torches were used on unsuspecting Chase Sapphire Preferred cards.

Continue reading...