I recently built a simple rebalancing tool and in doing so discovered how implementing a manual rebalancing strategy is very straight forward. I enjoy building things from scratch as it forces me to really think about what is going on with the concept at hand, and explore its underlying value. Time to share some of my thoughts on this now.

Portfolio rebalancing means that you buy more of an underperforming asset within your allocation in order to return your mix to a predefined level. It counters something called Portfolio Drift. I outlined previously that there are two main ways to rebalance: Sell and Buy, or Buy More. The former can have tax implications when deployed purely within taxable accounts. For more reading on the two approaches see the post Two good ways, and one really bad way to rebalance your portfolio.

But what is rebalancing really, and why are we doing it?

At its heart, rebalancing is risk management. It starts out with your investment policy statement, and defining your asset allocation. If you decide that you are comfortable with 80/20 stocks to bonds you can project the savings amount required to get you to financial independence. In bull markets stocks will outperform, and when they do you become more heavily weighted in stocks to bonds, meaning that you are more 'at risk' of a movement backwards.

Does rebalancing increase returns?

If you look at the marketing material for Robo-Investments you will see they claim that automatic rebalancing adds a 0.4% upside to your portfolio. Both Betterment and Wealthfront simply cite the same page from the same book for the proof here: Swensen, David, Unconventional Success, 2005, pp. 195-96.

However, the reality is that for the past 5 years we have been in a bull market, and as such rebalancing has reduced returns, as you are constantly reducing your position in an asset that has continued to appreciate. The value of the rebalanced portfolio is not in upside in such times, it is in downside protection. As such, I wonder if automatic portfolio rebalancing is being overplayed to its customer base, and if people actually realize they are losing out in these markets.

Age and income matter a lot when it comes to rebalancing. As you near retirement age, and rely increasingly on your own assets to inherently protect themselves from volatility using the Repair Ratio concept, rebalancing gains in value, but for younger, more aggressive investors, one wonders if a little drift may not be a bad thing. My take on it is that rebalancing is an essential tool for asset allocation, and every portfolio should consider it, I just wonder whether it should be automatically included.

What do you think about automatic rebalancing, are you aware that it has been reducing your returns in recent years, or do you think that the marketing from people promoting it is accurate and your returns really are increasing by 0.4%?

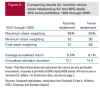

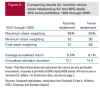

Edit - for further reading, and for those who think my point reflecting a 5 year bull market was too narrow and selective, please see this white paper by Vanguard, the figure below is from page 7.

Portfolio rebalancing means that you buy more of an underperforming asset within your allocation in order to return your mix to a predefined level. It counters something called Portfolio Drift. I outlined previously that there are two main ways to rebalance: Sell and Buy, or Buy More. The former can have tax implications when deployed purely within taxable accounts. For more reading on the two approaches see the post Two good ways, and one really bad way to rebalance your portfolio.

But what is rebalancing really, and why are we doing it?

At its heart, rebalancing is risk management. It starts out with your investment policy statement, and defining your asset allocation. If you decide that you are comfortable with 80/20 stocks to bonds you can project the savings amount required to get you to financial independence. In bull markets stocks will outperform, and when they do you become more heavily weighted in stocks to bonds, meaning that you are more 'at risk' of a movement backwards.

Does rebalancing increase returns?

If you look at the marketing material for Robo-Investments you will see they claim that automatic rebalancing adds a 0.4% upside to your portfolio. Both Betterment and Wealthfront simply cite the same page from the same book for the proof here: Swensen, David, Unconventional Success, 2005, pp. 195-96.

However, the reality is that for the past 5 years we have been in a bull market, and as such rebalancing has reduced returns, as you are constantly reducing your position in an asset that has continued to appreciate. The value of the rebalanced portfolio is not in upside in such times, it is in downside protection. As such, I wonder if automatic portfolio rebalancing is being overplayed to its customer base, and if people actually realize they are losing out in these markets.

Age and income matter a lot when it comes to rebalancing. As you near retirement age, and rely increasingly on your own assets to inherently protect themselves from volatility using the Repair Ratio concept, rebalancing gains in value, but for younger, more aggressive investors, one wonders if a little drift may not be a bad thing. My take on it is that rebalancing is an essential tool for asset allocation, and every portfolio should consider it, I just wonder whether it should be automatically included.

What do you think about automatic rebalancing, are you aware that it has been reducing your returns in recent years, or do you think that the marketing from people promoting it is accurate and your returns really are increasing by 0.4%?

Edit - for further reading, and for those who think my point reflecting a 5 year bull market was too narrow and selective, please see this white paper by Vanguard, the figure below is from page 7.

Last edited: