In a flurry to book last minute reservations with Club Carlson I went for 4 nights (2×2) at the Club Carlson property in Aruba for February 2016. The theory was that I could push it so far out that our availability has time to ‘fit in’ around it and I didn’t have to worry about flights, but I went and bought me some forward risk, without realizing it.

There’s a rumor abounding regarding the sale of this property, sometime this year. And if they sell, there’s a chance that they won’t honor my reservation. This was an eye opener for me as I have always thought to earn and burn, because the burning side of things protects from a devaluation.

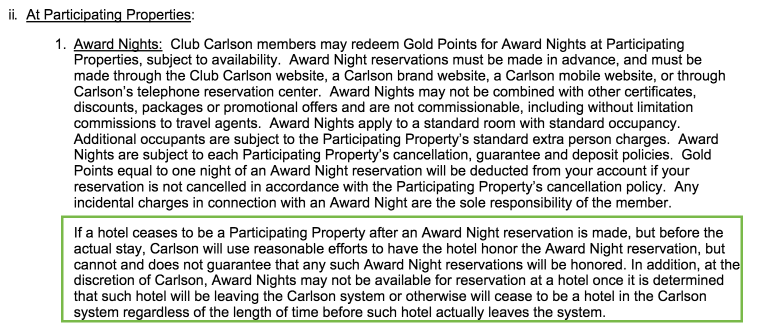

Club Carlson Terms

This is one of the few events that highlights the difference between an airline and a hotel. If an airline was to cancel a route it is likely they would still ‘get you there’. And if they sold a plane it would likely be a shoddy old one and you’d get an upgrade. The problem with the hotel situation though, if they sell, you’re SOL, because they reimburse you….

I just got off a call with JP Morgan to check about my insurance coverage (and any insurance coverage) I hold the Ritz Carlton card and they have some of the best trip cancelation/interruption coverage out there. But they wouldn’t cover my hotel, here’s why:

- Hotel 2 nights CC1 (his) 50K pts, zero cash portion

- Hotel 2 nights CC2 50K pts, zero cash portion

- Flight 27K pts (3 pax – JetBlue NY-Aruba non stop – killer deal!) $48 cash portion

Thinking outside the box

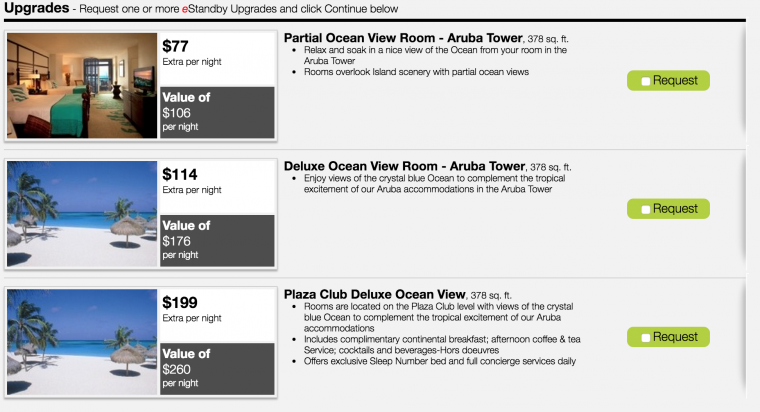

I asked if I could apply some cash to the rooms to make them insured – the idea was to pay for an upgrade, though implementing that would be hard as they were only offering the nor1 standby options (IE there wouldn’t be a charge until check in, so if it was canceled prior to that no joy.

Nor1 upgrades

However, there may have been a way to get around that loophole, I was considering prepaying something, like a spa treatment etc, to attach a charge to the reservation and protect it. I asked directly if doing so with the knowledge that it may (or may not) change ownership would be considered wrong or disallowed, and the rep told me it would be perfectly fine (and that it would trigger protection).

The snag though, is that my nightmare situation includes actually being reimbursed by Club Carlson. In an insurance situation there are 3 parties:

- The Insured (Me)

- The Insurer (JP Morgan via the Ritz Card)

- The Tortfeasor (Club Carlson)

JP Morgan is not unique in this situation, I had also considered taking on a third party insurance, but many would also approach it in the same manner. This is a key reason why I dislike insurance policies, and whenever possible I self insure.

After giving it some thought, and a couple of calls this morning my plan is to hope that Club Carlson does the right thing and keeps my reservation intact, I dislike these moments as they create a nagging doubt, but there isn’t much for it, other than trying to cancel Aruba and rebook somewhere else, and the hassle just isn’t worth it. Fingers crossed that they do right by this loyal Gold Elite….

*take anything said here with a pinch of salt, I’ve found benefits/insurance people to make up different rules all the time, this is just what I was told today.

The post Did I make a mistake with Club Carlson Aruba? appeared first on Saverocity Travel.

Continue reading...