tmount

Administrator

Frequent Miler had a great post yesterday about Manufactured Spending in 2016 and beyond. The truth is, he’s right. Manufactured Spending has gotten harder. Great opportunities like the Redbird, have come and gone in past years, and while they may come again, you can’t necessarily rely on the adage of “When one door closes another opens.”

I found Frequent Miler’s comments about reselling interesting:

The reselling option, in particular, seems like one that can never go away. Sure, opportunities for reselling at a profit may decline as more people get involved, but I don’t see that as a deal breaker. Reselling is just hard enough, and risky enough, to keep the hordes away. Now its time for me to dust off my old Amazon Seller account…

As I reflected upon earlier in the week, I got into reselling for the miles and points, and have transitioned to a greater focus of profit, and let the points be the by product of the effort. Realizing that many readers of Frequent Miler, as well as others, such as this blog, Big Habitat, and Oren’s Money Saver may contemplate reselling, I thought I’d offer a bit of an example of the kind of risk that reselling entails, both the good and the bad side of it.

Considerations When Reselling as a Method for Manufactured Spending

You want to get products that sell quickly. Like Really Quickly.

Remember that you don’t get paid immediately by Amazon, payouts are every two weeks. So lets say you purchase a product for $1,000, if you buy it in store, you could really get it into Amazon within 2-3 business days. So now you’re carrying that $1,000 charge on your credit card for 3 business days. If it sells quickly, you could see that $1,000 back in time for your credit card bill. If it doesn’t, you’ve got to somehow pay that $1,000, while you wait for the product to sell, and Amazon to transfer payment.

A great deal found on a blog may hurt prices.

As reader JS commented in my Reflections on Reselling Post:

Ever check out any of those sears free for point items posted by BH? Items selling for $70 when posted drop to $30 w/in two weeks.

In fact, Oren even declared that he would not be sharing as many deals in the future, because it can hurt more than it can help. You’ll notice, I seldom share deals, unless they are outlandish, like a Bidet, or 3D Printer — incidentally, I’ve shipped my first 3D Printer in to Amazon, waiting to see how it sells.

Always add a product to your inventory before buying!

You’ve found a great deal, maybe it is outlandish, but, golly, it is a real money maker! You scoop up everything you can find, only to realize that Amazon has some sort of a restriction. You could try to get ungated, but that wastes valuable time in converting from product to liquid cash.

Apple Watch Example

The Apple Watch has been an interesting product over the past couple of months. The 38mm Apple Watch Sport normally sells for $349 Target offered a $100 gift card with purchase, effectively dropping the price down to $249 per watch. Best Buy cut the price too, cutting $50 off the price, dropping the price down to $299 per watch.

Oren talked about this in one of his Turnover Tuesdays, noting that Best Buy did a further price cut, bringing the Watch down to $249, just like Target.

But way, the deal gets better at Best Buy – because, remember that whole Apple Pay thing? Well, Best Buy takes Apple Pay! So now you’re buying Apple Watches for $249, getting 11% now, 11% later (in theory), and double dipping with your Best Buy Rewards. So you’re approaching the “Perfect Storm” the final nail in the coffin was that Best Buy’s sale is like the sale that never ends! It continued after Christmas!

Looking at the impact on price on Amazon

Here’s the price today:

Apple Watch Buy Box at 5:50pm, 1/7/16.

Now mind you, that price is ~$55 less than what Apple is selling it for.

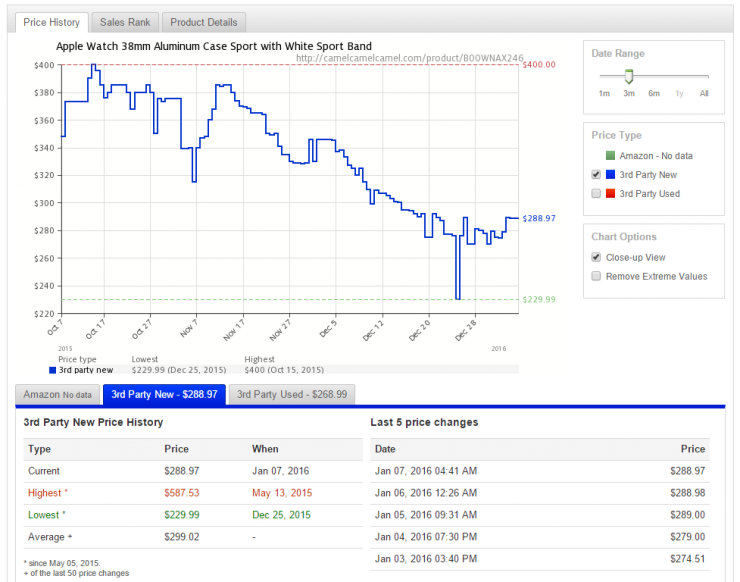

Let’s take a look at the roller coaster ride it took.

Graph courtesy of CamelCamelCamel.

If you look at the past 3 months, you see the price increases leading up to the sale, and then takes an unceremonious drop fairly consistently until just before Christmas, where folks clearly were trying to empty out inventory, then rose to what appears to be its new level of between $280 and $295.

Lets do the Math

So let’s say that you got in on this in a mid-tax state, say, Maryland, so you paid $249.99, plus 6% tax of $15 for a total cost of $264.99 but you paid with Apple Pay, thus earning you $29.15 Discover cash back now, and $29.15 Discover cash back later. You also gave them your Best Buy Elite Plus (since you buy a lot at Best Buy) Rewards number, so you got 331 Best Buy Rewards Points, figure a value of $0.02 per point (derived from $5 / 250 points), and you’ve got another $6.62. your net cost is: $200.07 if you account for both sets of Discover cash back.

Say that you got bought the Apple Watch and the Buy Box was in the $325’s, but you want to move it fast, so you match the buy box price today, and sell for $295.99 — You’ll pay $34.74 in Amazon fees, netting you $261.25.

So that’s like $61.18 in profit, right?! Sort’ve, but you’ve got to wait a while, since, remember, we anticipated that the total out of pocket cost was $264.99, so on paper, you’ve actually lost $3.74.

Of course it’s easy to do an example with cashback, since every point equals a penny. But things get more complicated with manufactured spending for miles and points. But the message is still clear, there is risk when you resell. My recommendation: Always resell in search of profit. Maybe factor in the cost of the points in the opportunity cost, perhaps you’re going through a Shopping Portal, and you’ve got to choose from Upromise at 5% or Alaska Mileage Plan Shopping at 2x. The benefit of Cashback Monitor, is that you can add in your own values for points, which helps, but you have to realize what your opportunity cost is.

What can we learn from this?

Even great looking deals on quick sellers can result in a loss. Popular items are great, especially with well timed, short duration sales from major retailers, like Best Buy, and Target. But when a major retailer (looking at your Best Buy!) loses their mind and lets a sale go on for a month, everybody is hurt, at least those reselling. When I did things with Apple Pay, I was searching for products that I could make a profit before even accounting for the Discover Apple Pay cashback. That’s my approach, plain and simple.

Wrapping Up

I want to be clear, I’m not trying to dissuade anyone from jumping into reselling. I think there is so many products out there, with so much opportunity, that if everyone is focused on profit vs. speed of conversion, we all win. The proverbial “break-even” crowd can hurt profits, but, when sticking to particular products that are high velocity anyway, I tend to think it can’t hurt all that much. Just like Oren stated that he will continue to post iPad Deals, since the value doesn’t drop after posting them. If you are looking for a quick turn, and are willing to accept the risk and potential loss to convert quickly, then stick to products that sell really fast, like Apple iPads. If you are looking to grow reselling into something more, and let the points flow in, even if it’s from 1x spend, then look deeper, and more importantly, set aside funds for float–so you avoid paying credit card interest fees.

My goal has always been to teach folks to fish, rather than giving them a fish. To that point, I’ve put together a number of resources for resellering, that I’d encourage any beginner to take a read through, start here: Beginner’s Guide to Fulfillment by Amazon, and definitely click through the following posts. There are a lot of great opportunities out there.

Continue reading...