I’m in a bit of a pickle, and wanted to share some of my thoughts on spend with you today. The challenge is to accept clean, or dirty spend, and to explore the nuances of each. My scenario is twofold. Firstly, I’m setting up a new business that is turning out to cost a ton of money.. and since it is new I’m putting it all on a Business Debit card. It really breaks my heart. I’d applied for an Ink, but was rejected due to the age of the business.

That said, a ‘ton’ for me in this case is only a few thousand, so in terms of real spend, its pretty marginal. I spent more than that on groceries last week. But there is some part of me that looks at say $3K in a week and thinks – wow, that’s a credit card sign up bonus missed right there.

Additionally, I still need a flight to take me back from Aruba in 2016, JetBlue got me there for dirt cheap, but the return price was a little more expensive, Delta has seats on my desired flight for 17.5K in economy and 30K in business. So I could do with some Delta points. I do have the SunTrust card, but I don’t have time to earn on it due to opportunity cost.

The solution – The Gold Business Delta Amex, 50K pts +$50 statement credit, no annual fee in Yr1. I now have a $2K spend to meet.

Delta Sucks

But what sort of solution is that? I like Delta, but if I’m really doing this for regular monthly business spending then I’d rather something valued over 1 cent per mile, perhaps a Membership Reward or an Ultimate Reward.. the sign up is great, but the ongoing spend is pointless….

I need points FAST

I hate seeing my seats available but my points not. Whenever I get a new card I like to meet spend ASAFP, lock them in, and then turn on to using a card genuinely, but then things get a bit ugly when reconciling accounts.

Clean vs Dirty

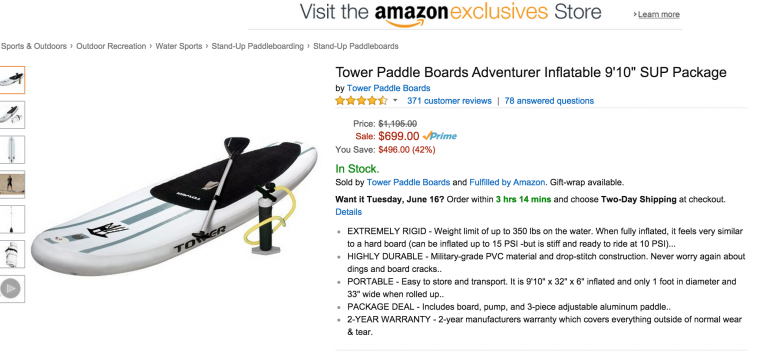

As it happens, I met many of my major expenses last week, so in order for me to meet even a $2K spend for the Delta Amex points its going to take some time, maybe too much time to even earn the bonus… so I’m going to need to ‘goose it’. Interestingly, I also need to have a pretty major personal purchase this month, as I’m keen to buy a SUP, one that I’ve seen from Tower costs $699.

$699 gets me a fair way towards $2,000, and its what I call ‘dirty spend’. Dirty spend to me is rough numbers, clean spend on the other hand would mean me going to Kiva and buying $2000 of slumlord loans. The min is met immediately, and its super easy to track… or is it?

From a business perspective, if I was to start off by goosing the following:

- $699

- $159 (real groceries)

- $220 in eye cream

- $992 on shoes

- Total $2000

However, this cleanness would also bring its own problems:

If it is easy for me to spot it as ‘not real’ spend then it is easy for someone else to, we are programmed to spot things like this. A series of odd payments are more obscure. However, this is compounded by the problem that it is obviously generic. This makes for huge problems in other areas, such as your own tracking.

Let’s look at another obviously generic charge: $1000.70. Imagine that you have a store that will only allow one transaction like this per visit. If you look at your statement you might have several repeat charges for the same exact amount, this creates a pattern of weirdness, but also creates a difficulty to back track when you face a problem. Having ‘clean’ spend here means that you don’t always know which transaction is which quite so easily, but if every transaction was different, or dirty, it would be a lot easier to drill down into problem transactions. The price itself becomes a tracking code.

Going ‘All Cash’

Phil brought up the topic of going all cash and I think it has a lot of merit. In the case of my business card spend, once flowing, I expect expenses may be a few thousand a month tops. Let’s pretend that means 20K miles ‘wasted’ per year. But that waste makes for super clean accounting. And is it really a big deal? There’s two ways to look at it, objectively and subjectively. From a subjective perspective I would look at it and think ‘man, cleaning up my books is a pain in the arse’. Objectively, I could drill into the value, being generous and saying we are losing $300 in points… would I pay $300 to have clean books? Or, how many hours would it take to clean the books up, removing the non business spend, and what would that mean in terms of my hourly pay?

Inconclusion

I’m still on the fence. I find it hard to leave the points on the table, I need them fast, and I hate to ‘waste’ spend. My solution is going to be either to spend $2000 in one pop, and then use it for regular business expenses, or to spend it fast (maybe a mix of the paddleboard and some groceries) and never use it for business… I’ll be pinging my accounting software firm to see how easy it is to delete imported transactions, and that will likely be the guiding force.

The irony is, I desperately wanted a Business Credit Card, but as soon as I get one I just want to max it out to get the points in cycle one, and then i’ve ‘burned it’….

PS – I actually need 72000 pts on DL for F seats.. so if I want to sit up front the same rules apply, but on a higher scale.

The post Clean vs Dirty Spend appeared first on Saverocity Travel.

Continue reading...