One of the biggest frustrations to high earning people is how to build retirement assets when their income precludes them. Due to salary phases outs many tax incentives do not qualify for such earners, including the Traditional and the Roth IRAs. However, there is a way to create Roth IRA accounts using the Backdoor Roth method.

When describing such retirement accounts many people focus on the immediate tax events, but really the distinction is on the back end, when you distribute from them in retirement. Making this distinction allows you to understand the Backdoor Roth concept more easily. Traditional IRAs do offer a Tax Deduction for present year if you meet the salary requirements, but they still exist without the deduction if you do not.

For the sake of clarity, I will not go into discussion on limits of IRAs here, I do recommend reading the resource onRoth IRAs in The Forum for more information on this.

Before you consider a Backdoor Roth, consider your other IRA’s

If you hold Traditional IRA’s and are planning a Backdoor Roth Conversion watch out – the IRS calculation for the conversion can kill the deal for you. The way the calculation works is they look at all of your Traditional IRA accounts in total, and proportionally rollover into the Roth, here’s an example where it can go wrong:

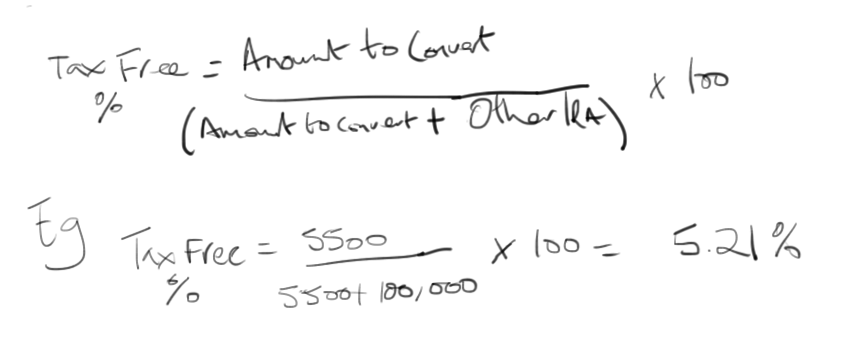

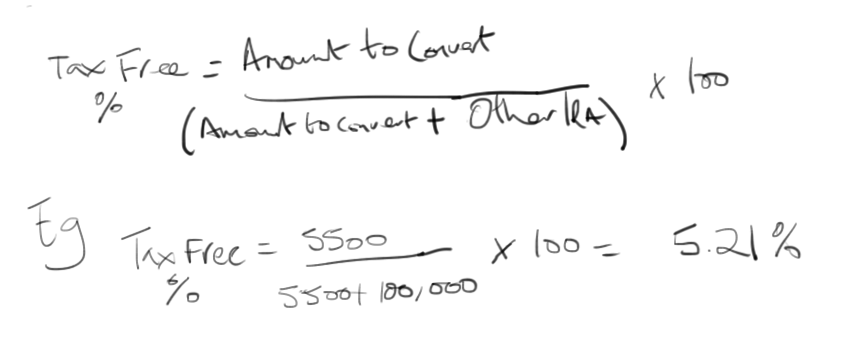

Backdoor Roth formula for those with other pre-tax IRAS

In this example, because the person has another IRA already, there would be tax due on about 95% of the $5,500 conversion – this is because even though you want to convert the new money only, the IRS makes you think of all of it in one. So if you were in this scenario and attempted a backdoor Roth you would have to pay taxes on $5213.45 of the $5,500 that you converted!

Roll the old IRA’s into your company 401(k)

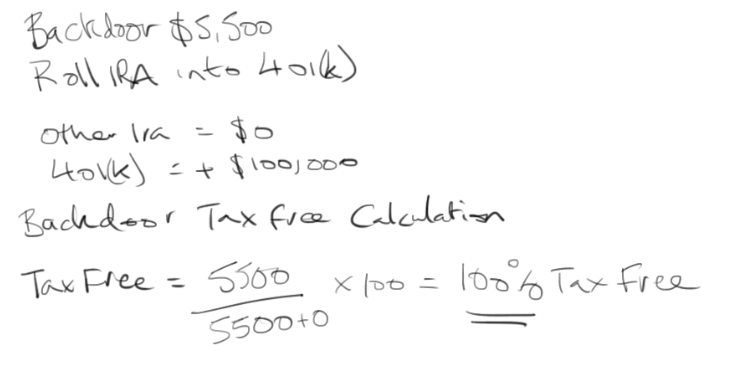

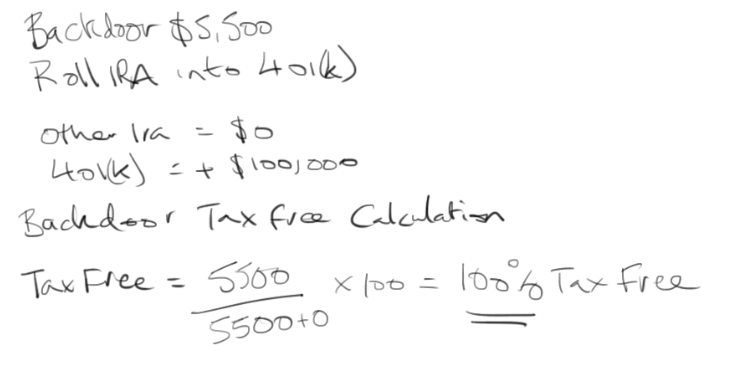

Because the IRS uses the sum of other IRA balances in this formula, if you were to remove them from the equation you can eliminate the impact of taxes. A way to do this is to roll your other IRA balances into your company 401(k) plan. Doing so allows you to honestly claim that you have zero IRA balances, and the formula for tax due would be calculated as follows:

Alternative solution to paying the taxes – roll your other IRAs into your 401(k) to reduce that to zero, then do the math again…

If you are doing this, it is worth thinking about impact of investment choices of your work based plan – if you have few options that have high fees they will certainly impact the value of such a move.

Alternatively, you could just covert everything you have into the Roth – but that will incur a high taxable event in most cases as your income is putting you in a high bracket, and you will have tax due from the conversion. Perhaps worthwhile for de minimis account sizes.

Considerations aside – how to create a Backdoor Roth

Once you have decided if a Backdoor Roth is right for you, by reading the above and discussing it with your financial professional the implementation is really very simple:

When describing such retirement accounts many people focus on the immediate tax events, but really the distinction is on the back end, when you distribute from them in retirement. Making this distinction allows you to understand the Backdoor Roth concept more easily. Traditional IRAs do offer a Tax Deduction for present year if you meet the salary requirements, but they still exist without the deduction if you do not.

- Traditional IRA distributions are taxed as regular income when you make qualified distributions from them in retirement.

- Roth IRA distributions are not taxed as regular income when you make qualified distributions from them in retirement.

For the sake of clarity, I will not go into discussion on limits of IRAs here, I do recommend reading the resource onRoth IRAs in The Forum for more information on this.

Before you consider a Backdoor Roth, consider your other IRA’s

If you hold Traditional IRA’s and are planning a Backdoor Roth Conversion watch out – the IRS calculation for the conversion can kill the deal for you. The way the calculation works is they look at all of your Traditional IRA accounts in total, and proportionally rollover into the Roth, here’s an example where it can go wrong:

- You have a deductible IRA from 10 years ago that is worth $100,000

- You put $5,500 into creating a Backdoor Roth

Backdoor Roth formula for those with other pre-tax IRAS

In this example, because the person has another IRA already, there would be tax due on about 95% of the $5,500 conversion – this is because even though you want to convert the new money only, the IRS makes you think of all of it in one. So if you were in this scenario and attempted a backdoor Roth you would have to pay taxes on $5213.45 of the $5,500 that you converted!

Roll the old IRA’s into your company 401(k)

Because the IRS uses the sum of other IRA balances in this formula, if you were to remove them from the equation you can eliminate the impact of taxes. A way to do this is to roll your other IRA balances into your company 401(k) plan. Doing so allows you to honestly claim that you have zero IRA balances, and the formula for tax due would be calculated as follows:

Alternative solution to paying the taxes – roll your other IRAs into your 401(k) to reduce that to zero, then do the math again…

If you are doing this, it is worth thinking about impact of investment choices of your work based plan – if you have few options that have high fees they will certainly impact the value of such a move.

Alternatively, you could just covert everything you have into the Roth – but that will incur a high taxable event in most cases as your income is putting you in a high bracket, and you will have tax due from the conversion. Perhaps worthwhile for de minimis account sizes.

Considerations aside – how to create a Backdoor Roth

Once you have decided if a Backdoor Roth is right for you, by reading the above and discussing it with your financial professional the implementation is really very simple:

- Contribute to a Traditional IRA

- When check has cleared/ACH arrived into the Traditional IRA, you immediately use those funds to buy a position in a Roth.