In January 2013 I wrote about Zidisha, a micro-lending site that connected altruistic lenders with those in need of loans in poorer Countries, seemingly with many in Africa. In that post I compared Zidisha’s model with that of Kiva. The major reason that I was starting to dislike Kiva is that they often charge interest rates of up to 60% to these impoverished borrowers, which I think is counter- productive to the goal of helping them achieve financial success.

Kiva has defended their outrageous APRs by stating that it is required by their field partners in remote areas who go out and visit villages to educate on financial matters (and collect the checks) but I still felt that there was too much ‘fat’ in that equation and the poor folk were being exploited, not for Kiva’s sake, but for their Partners.

Zidisha came at things differently – it went into a direct peer-to-peer model, stripping out the costly field partners and making the loans more efficient. It also allowed borrowers to pay back interest rates that they set, so there was interest to be earned (and passed on to the lender) but it was in a much more reasonable rate, often far below 5% APR. The lenders are kind folk, and they were trying to keep the costs as manageable as possible.

The results of my lending

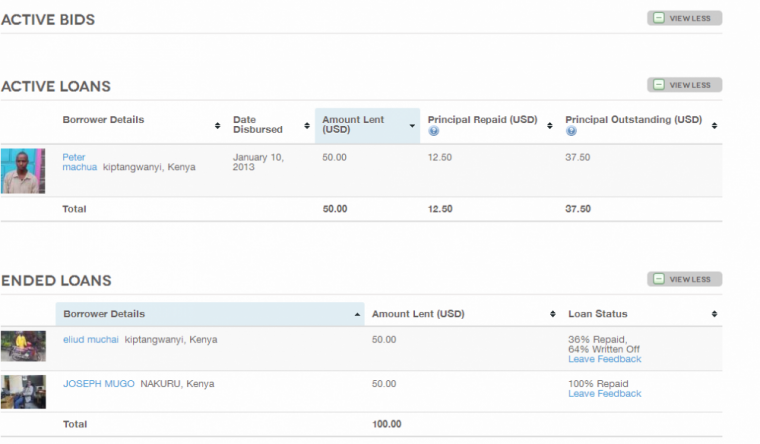

Clearly, this is hardly a comprehensive empirical study, as Zidisha was new to me I started off with a deposit of $150, split into three loans, the status of which is:

- One Loan is being paid on schedule

- One Loan was paid off early, in order to apply for a bigger loan

- One Loan has defaulted after 36% was repaid

That loan that was paid off early I didn’t trust either, the guy was weird. Zidisha allows correspondence on the lender pages and he was too pushy towards showing how he paid down in full and was a good borrower, my spidey sense told me that he was planning a default, but wanted to do it at a higher value of loan since you would only get that one shot. Call me untrusting, but there were too many flags in his exchanges. As of today, about 14 months later I have $88.25 returned to me, with potential for another $37.50 if the first guy doesn’t default.

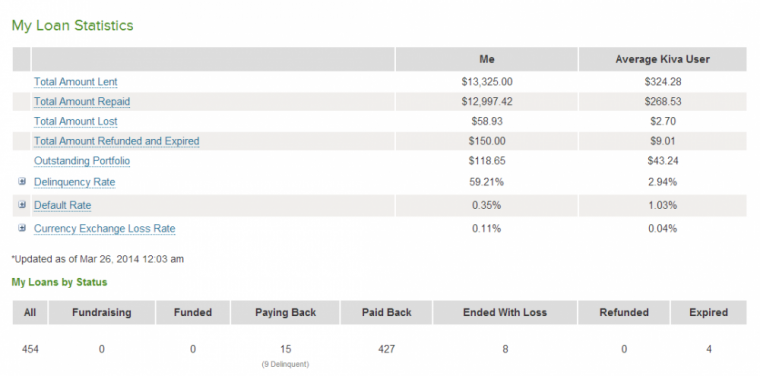

If you compare that with my Kiva data:

As I mentioned, it isn’t fare to directly compare since the data sets are different, but as much as I like to be the guinea pig for you guys here and test things out, there is no way in hell I am going to put in $13K to Zidisha based on how they started out with me.

Could Kiva’s model be right?

I think it could be that the field partners who are actual human beings visiting the borrowers encourage a higher repayment rate. Not only by pressuring and enforcing repayment schedules overtly, but simply by forming that human connection, and looking these people in the eye. I have found from my experience that when people are dealing with other people they feel trust and obligation towards them. However, when the internet is faceless, people are much more inclined to break promises, and betray trusts.

The reason is simple, and evident throughout our history. In order to create a way to validate the breaking of inherent trust and ethics a person must find a way to dehumanize the other party. We see this constantly with people who say it is ok to rip off a faceless corporation, but never another individual. Actually, you could take this concept further and bring concepts as extreme as genocide into play – in order for people to be convinced to do atrocious things to other human beings, the leadership finds ways to dehumanize the victims, so that it can be acceptable to murder, steal and rape.

I feel that this is what is happening with Zidisha’s model, the lack of that human contact has made it too easy for the borrowers to default on loans, and it breaks the model. Kiva has a better solution for this, but they are being charged too much by their field partners for this, and it needs refinement.

Can new players help?

A reader who had a similar experience of loans defaulting, actually losing 50% of her $750 of loans is exploring a new player in the space called United Prosperity I just reviewed their site and it seems they have the same model as Kiva in that they team up with a local field partner, however I am not sure what sort of APR the borrowers are being charged.

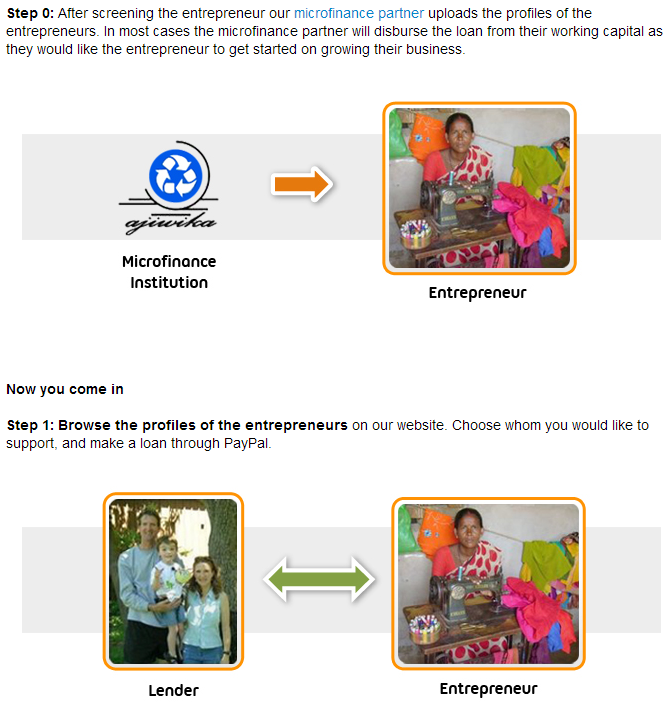

I think the key to success though is that screening step, humanizing the money, connecting it emotionally to the lender (even if in the borrowers mind the lender may appear to be the local field partner) and ensuring that as much money is repaid as possible.

I think all of these companies are doing great work, none seem perfect yet, but we don’t live in a perfect world so that will be hard to achieve. Hopefully by their combined efforts, and some losses on our side we will refine and improve lending and help these needy people achieve their goals.

That cycle of improvement can be seen by Zidisha, and here are the steps that have been made to improve. The model still worries me somewhat though:

Over the past year we have made many improvements to our lending model based on experience. These include:

- Prohibiting the practice of posting loan applications on behalf of non computer users, with whom communication often becomes difficult when the helpers are no longer available to follow up with repayments.

- Requiring new members in most countries to prove online identity by linking a unique, actively used Facebook account.

- Sending automated SMS confirmation requests to all community leader, inviter, family and neighbor contacts provided by applicants.

- Requesting Volunteer Mentors to review separately the applications of all new members assigned to them, before approving their loans.

- Using the performance of other Zidisha members connected with new applicants – invitees of their inviters, other members recommended by their community leader, and so forth – to evaluate the credit risk of new applications.

- Using a state-of-the-art anti-fraud software to detect suspicious patterns in new borrower applications.

- Reducing the standard first loan amount for uninvited members to just $50, and requiring consistent on-time repayments over time to progress to larger loan amounts.

- Adjusting our loan size progression criteria to eliminate loopholes that became apparent with time and experience.

- Introducing a new member invite program that incentivizes high on-time repayment rates by inviters and invitees alike.

What are your experiences? Have you tried Zidisha, and if so what were your repayments like? And does anyone know if United Prosperity offers anything better than Kiva (especially on the APR side)?

I tried zidisha with $50.One loan totally defaulted. Another paid back 50%. So, I am out of $37.5. No way am I going to put $20K!

Well, to be fair, Kiva grossly misrepresents their real default rates and the massive 30-60% interest rates that borrowers pay. And that’s why I’ll never lend a dime with them again. Nor should anyone with a social conscience. Kiva is a well oiled con – advertises 98+% “repayment” rates – but that’s simply due to the middlement microlenders charging obscene loan shark interest rates that they use to paper over the large default rates (how can anyone believe the poorest in the world have higher repayment rates than wealthy first worlders?).

Kidisha was always ripe for fraud and abuse due to sketchy/nonexistent lender verification. But at least its fairly clear to see upfront. And caused me to only lend a few hundred vs thousands at Kiva. Yet despite the my losses ($100 was never repaid), I’ll continue to lend via Kidisha as my lending isn’t a cynical method of MS cloaked in feel-good BS that I read so often from FTers/Milepointers/bloggers.

Yep, kiva gifting is certainly a ms activity first and foremost. I hope that a bit of competition can improve everything though and perhaps a hybrid can work.

Of my $100 worth of Zidisha loans, $4.35 was paid back, with the rest written off by Zidisha. Never again will I loan through Zidisha, or any other microfinance lender, for that matter. Call me skeptical, but any program that does not hold lenders accountable never will help them to step out of the level of poverty they are in.

Thanks for the data point Ben, seems a common story

Thanks for looking under the hood on this, Matt. Very enlightening indeed!

I started with $500 in loans on Zidisha at $25 a piece. I actually had 2 of the loans pay back in full. I saw a total of about $97 in repayments.

Dear Matt,

I’m Julia, the director of Zidisha. I’d like to thank you for giving our service a try, and for this thorough review. It’s one of the most thoughtful microlending service comparisons I’ve seen.

It is true that loans issued in early 2013 experienced much higher loss rates than anyone had expected. Since then we’ve made many improvements, and repayment rates have improved substantially. We released an overview of those improvements today: http://p2p-microlending-blog.zidisha.org/2014/06/13/is-direct-p2p-microlending-financially-sustainable-lessons-from-zidisha/

I’d be happy to answer any questions if you would like to learn more. Best regards,

Julia

I’m afraid Zidisha does not want questions asked about practices on your forums.

Censored and hidden when problems arise. Sorry, leaving Zidisha for other lending models.

Yep, they suck

I lost 66.66666% of the funds I uploaded unto the Zidisha platform. This is disappointing as my intention always – I am also active on Kiva – is to always keep the money in circulation online for future borrowers. Of 8 loans, 3 repaid in full. 4 partial repayment of between 7%-65% prior to defaulting and 1 outright default.

Of the 73 loans to date on Kiva, I have had one default which funnily enough was my very first loan.I don’t like the extortionate rate of interest borrowers incur on Kiva and wish I could set my desired rate (0% to 1%) but regardless as a model, I have a lot more confidence in Kiva than I do Zidisha. In terms of my own experience, I class Zidisha as a failed experiment.

I really think you need to ensure that people know they need to repay. I feel the field partners of Kiva acheive this- though the price is extortionate. I hope there might be a middle ground somewhere..

This is very helpful, thank you Matt! as I work my way through this maze. I was so totally turned off by the usurious interest rates charged by Kiva MFI’s that I didn’t see, right away, other sides to this story.

The “personal connection” factor was something I had not considered, but I think it is vital! As a humble example, I play a lot of interactive computer games, and moderate several big gaming sites. Sometimes the kind of behavior and language I see is unspeakable. Never never would we treat each other this way irl (“in real life” as we say), but on the internet there just isn’t enough emotional bandwidth. Similarly, the Zidisha borrower who steals money and defaults on her loan might be a kind and upstanding citizen — so long as the other party is real to her. But a “rich” lender half the world away…? It is so much easier to cheat someone like that!

Also, and I am not the only person to notice this, Zidisha itself has increasingly taken a less than respectful attitude towards its lenders. There are a lot of complaints about this on fora other than Zidisha’s official one. People are banned from the Zidisha forum for imaginary slights, denied reasonable answers to reasonable questions, and generally treated as disposable. Perhaps Zidisha too is having trouble seeing us lenders as real people! Actually, though, lenders are like the customers of a for-profit site. If amazon.com treated their customers as Zidisha sometimes treats its lenders they would soon be out of business. I would take as an example the sudden and new procedure of in effect seizing inactive funds and lending them without the owner’s consent. (I was not personally affected by this but I have read a lot of complaints. This is a wildly unpopular policy.)

I am hoping that this trend reverses; without money to lend, Zidisha won’t be much of a lender!

I’m glad it helped. There really needs to be a balance struck between the two models neither alone seems to fit the need.