When I kicked off 2013 I wanted to Get my Ducks in a Row and was thinking of ways to make sure everything on a daily basis was well structured so that as we went forward from here we would keep the maximum amount of money in the family ecosystem and have the most capital appreciation for our assets. In other words, I want to make sure that our Financial Foundation is stable, so that whilst I work actively to increase wealth, it isn’t leaking out the hole in the bucket.

I had a great chat over the Holidays with my Father in Law, he is way ahead of me in terms of financial education, based upon an active interest in this area over a lot longer time period than myself and a real business savvy. We discussed living in New York and the relative taxation that comes with the location of your home. plus matters of appreciation and growth.

We currently live in Clinton Hill, Brooklyn. This is an area that was changing 3 years ago when we moved in, and has made a notable difference in this time period. I predict that Clinton Hill is the next big thing for Brooklyn Real Estate; which already has over taken Manhattan in terms of price per Square Feet in some areas like Williamsburg and Prospect Park.

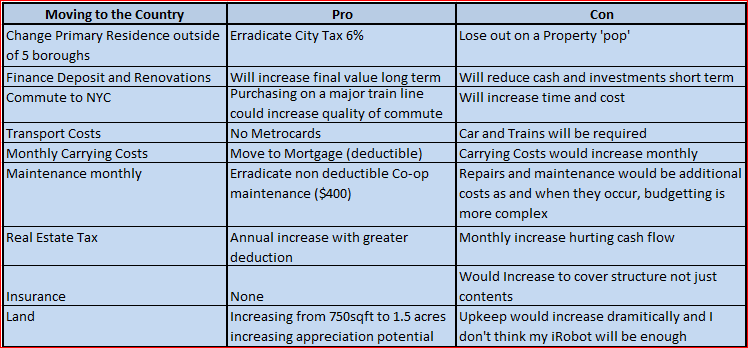

The dilemma I face therefore is holding the property until we see a pop in the market here, or moving out sooner, and I have considered various aspects for this, that I charted out below:

I assessed the pros and cons of the move and decided that the guarantee of being taxed VS the possibility of appreciation was not worth the wait. I did consider renting out my apartment rather than selling so that it could appreciate, but my co-op charges a fee of $2 per share plus maintenance so I would have to carry $1000 per month in fees and net the profit after that. I would think it hard to get more than about $1,800 a month so a net of $800 per month, $9,600 per year for $200K or around 5% (before any other costs like fixing up the place etc) just wasn’t worth it for the chance to gain a few thousand on the sale. I do want investment property but my goal is at least 10% income, and ideally with leverage of a mortgage so if I took that $200K and invested $50K as a deposit on a $200K house, rented that out for $2000 per month without those Co-op fees I would be considerably better off.

The plan is to look at purchasing a property in need of renovation; as this always offers greater value than buying a recently renovated place as the previous owner seeks to make a profit on their time invested on the work, often at a very high rate of ROI. For that reason we are looking at properties that are a little run down, perhaps in need of structural work as well as cosmetic. This prospect concerns me somewhat as I don’t want any surprises regarding the building integrity that throw the budget out of the window.

We are looking at a property with a purchase price circa $160K, with a 25% down payment, closing costs and renovations all adding to the price. Also, we will have to carry the double monthly costs of mortgage, insurance and taxes on the new home PLUS maintenance and insurance on the Brooklyn apartment until we sell it.

Frankly speaking it will be a real stretch and we will be hard put upon whilst transitioning, it will require selling my brokerage portfolio and using all our emergency money to make work, however the day that the apartment sells we will be in an incredibly strong position.

My estimates are $40K down payment $xK renovations and $10K carrying costs. So the key will be the renovation amount. If I can assess this accurately and get at least the structural work done that make it safe for living we could move in and pay for cosmetic updates as and when we get the money to make that happen.

I believe that the right renovations could increase the value of the property from $160K to $250K quite easily, and we will have a loan on the property for $120K which I prefer over having a full cash purchase due to the current low lending rates. If we can clear $200K from Brooklyn then we have the option to invest more in the property, build up brokerage accounts again and pay off the mortgage in full (which I probably wouldn’t do). We may have to consider some sort of bridge or mezzanine loan to make this work out, and I can foresee a fair amount of stress and financial fancy footwork to facilitate this, but I think we can do it, and when we do our position will be much stronger for wealth generation in the future.

Please share your thoughts on leaving the big city – have you made the move already, or are you thinking about it?

Leave a Reply