I recently wrote about our decision to install Solar in our next home. It was met with some discussion, and I wasn’t surprised. It is a common reaction when it comes to Solar that perhaps the prices are too high, and it isn’t a good financial decision compared with fossil fuels. I argued in the comments of that post that I thought it was a smart decision, and will explain more on how I make such determinations here.

It’s all about Present Value

A common use for Present Value is in Bond Calculations. If you have a bond that pays an annual coupon of $100 for 10 years, after which they would return the Face Value of $1,000. How much should the bond be valued at today? The answer is fairly straightforward, the essence of it is opportunity cost, which is why there is an inverse relationship between bond prices and interest rates. As rates rise, bonds (with fixed coupons) must lower in value as they are less attractive than other market offerings.

My Assumptions for the calculations

- Purchase price $20,000

- Rebates $11,600

- Annual Energy Bill Savings of $1550

- Annual Energy Sold back to grid $216

- Duration 30 Years (covered by Solar City for repairs and insurance)

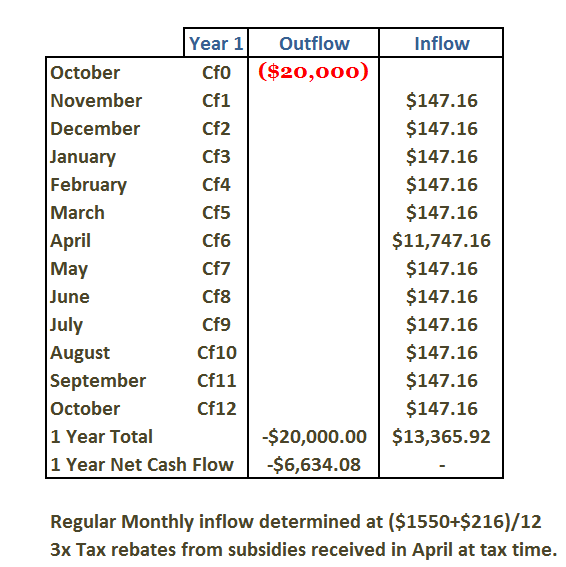

Cash Flow Analysis (monthly)

In an over simplified calculation you can see that after 12 months you would have a negative $6,634.08 from the investment. However, you do still have 29 years of monthly $147.16 inflows before your equipment is considered to be at the end of its natural life. At that rate, you would be cash flow positive within 45 more months (57 months in total) as I mentioned earlier, it may be that the data is off a little, but even if it is then the return on investment is generally calculated around the 5 – 6 year mark. The example here is shorter as it doesn’t factor in the discount, or opportunity rate.

When making these value decisions it would be unfair to compare the ROI from a pure cashflow perspective. Going back to our original concept, if we opted to not invest in Solar equipment there would be an opportunity for that money to be invested elsewhere. If, for example we select an alternative rate of say, 5.64%, the final value of the putting $20,000 into an investment instead of solar would compound to be $103,724 over 30 years. If the solar payoff is less than this then Solar is an inferior decision.

What is the correct discount rate?

Actually, before we decide on the correct discount rate it is best to clarify it – the discount rate is the required rate of return, or ‘opportunity cost’ of alternative investments. By baking this in to the calculation we get a much fairer decision.

The applicable rate we should select for comparison should reflect investment risk and investment time horizon. If we were buying for the full 30 years then we could argue for some time on whether we can select an aggressive rate of return, such as a 8% stock market average, or if we should opt for the safest, perhaps a 30 year treasury at 3.28%, the 8/5 market close. The discount rate is somewhat arbitrary and therefore should be realistically set. In this case I selected 5.64% as the simple average between the risky stocks, and the low yielding treasuries. If you are more aggressive you should select a higher discount rate, and if you are more conservative a lower one.

I like to look at present value, and its cousin, Net Present Value (NPV) when exploring deals. The NPV formula examines cash inflows vs outflows, after removing the initial investment from the equation. It’s all about the profit (or loss) and is a great way to explore that Solar installation (outflow) against the savings on the electricity bill and acquisition subsidies. When we look at NPV we must remember that it is simply a forecasting tool, and if we put garbage in we will get garbage out.

The NPV Formula

There are three possible results for a NPV formula, they are:

- Negative NPV – this result means that you would be better to not invest in this deal.

- Par – or $0 – this means that the deal is neither better, nor worse than the alternatives.

- Positive NPV – this result means that it would be better to invest in the deal than the alternatives

It is worth noting that NPV is an oversimplified method, and as such Negative NPV projects may be viable as loss leaders, or through their value in diversification. Projects should be considered holistically, and not solely decided on a NPV number.

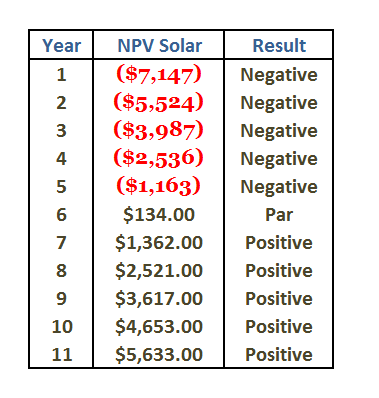

The Solar NPV

I calculated NPV manually, using the 5.64% discount rate. As you can see, for the first 5 years on the investment it is an inferior choice, but from that point onwards it is superior. What that means is that if the project time horizon has less than 6 years, you shouldn’t do it. This assumes a zero resale value of the system. I opted to call year 6 Par, though technically it is a positive NPV threshold.

At this point it is important to bring in resale value. Most assets are considered to depreciate with time. The opportunity here though is that we have a fixed price of asset at $20,000 that has been discounted by federal and local subsidies. When these go away, as they start to in 2016 the starting point for depreciation will focus more on the gross price paid than the net price. Indeed, even with them still in place people look at gross not net. We benefited from this recently when we sold our last apartment and captured the $8000 first time home buyers credit, there was no talk of reducing our cost because we had earlier received a credit.

A 2011 study from the DOE Berkeley Lab found that homes with a Solar Array would fetch a premium between $3.90 and $6.40 per watt installed, meaning a 3.1Kw system would add $17,000 to the price of a home. This is very close to the original gross purchase price, so the home owner could capture the tax credits, and the new buyer would pay close to full market value for the unit.

Personally, it would be too aggressive for me to expect a 100% return on this, but luckily it is not necessary. Perhaps a conservative resale amount after 3 years could be $10,000. If we were to project that amount then clearly, the project is profitable very quickly indeed. However, I would still approach a Solar decision as a longer term investment, and aim for the 6 year breakeven. The beauty of which is knowing that the installation has already paid for itself, and you could give it away for free to the new owners and still be ahead of the game.

How many people could afford a $20,000 home improvement?

A great point raised was that even if it was a great investment, how many people could actually afford $20,000? Personally I think this is an excellent opportunity to get real, firm data, and make an even more informed decision. The reason for this that if you finance, you can take the financing rate as your required rate of return and seek arbitrage opportunities. As we know, Solar here is replacing a fundamental shelter need. You either need to paying out each month to the electric company to ‘rent’ electric from them, or you could instead apply that $120 to debt service payments on an electrical supply system of your own.

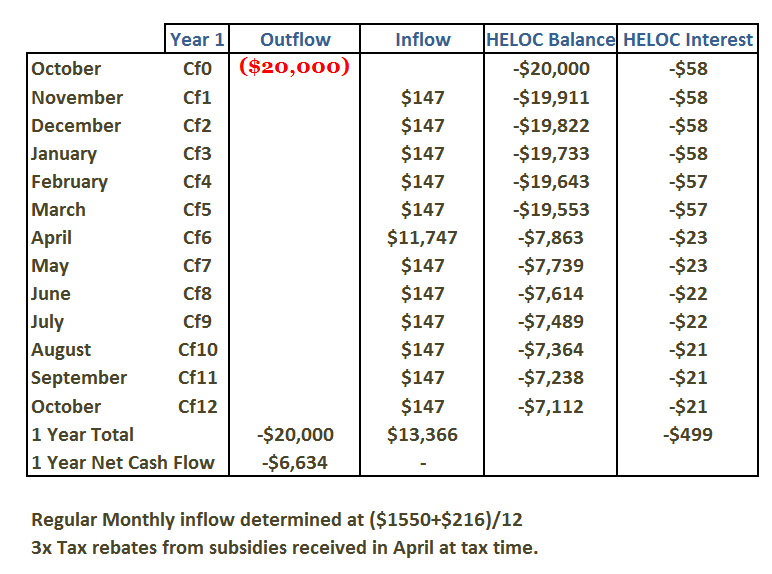

Home equity line of credit (HELOC) interest payments can be deductible up to $100,000 per year. Therefore, if you couldn’t afford to buy the solar array, but instead took out $20,000 from your HELOC (3.5% APR) the following would occur:

You take the monthly payments that would have otherwise gone to the electric company, plus any income from selling back to the grid, plus all the subsidies, and use them to pay down the HELOC. This results in a tax deductible interest amount of $499 for the acquisition of the solar unit. You would go into year 2 with free energy, and a debt of $7,112. If you were to use the tax savings to attack the principle, the debt would be paid in full in about 5 years from origination. Some money would have been paid in non-deductible interest during this time, but it would be recaptured in less than 1 year once the payments were complete.

Conclusion

When calculating the value of a deal it is important to be able to view it from many angles, the biggest risk to applying such analysis is that you are overly optimistic in terms of in the inflows, and I often suggest making ‘doomsday plans’ or, how bad would it have to be to not make sense as a deal. Forecasting is always something of an art, as well as a science.

Something that we didn’t really delve into in this example was the type of inflows that are created. The real reason that I like this solar concept is that electric bills are not deductible expenses for residential properties. Therefore if we can find a way to remove them from our family budget we no longer have to pay for them with after tax dollars. This means that the inflows from the investment can be considered tax free, which adds in further value. Additionally, we are locking in this tax free income source now, and if rates do rise in the future then we are protected against that inflation.

For me, this is a rent vs buy analogy again, from personal perspective, the perks are that it seems better for the environment, and has a higher zombie survival rate than reliance on a company to provide you energy. OK, more practically speaking, you are less exposed to risk of rate rises when you produce your own energy.

Great post!

We used a 0% APR credit card for 1 year with no fee to float the debt while we waited for the repayments from the utility and our taxes.

I am not convinced that having solar panels adds to the selling price of our home. It will add to the attractiveness for the right Hippie. We will put in a micro heater once our water heater dies. Any future improvements will have a green theme in mind.

It depends on the realtor in some ways- if they can show the savings per year that can be seen easily as an asset. Might be wise to prepare a one page chart focused on the money side more. But yeah, as I mentioned it’s better to plan for not selling it at all, and still works out.

Thanks very much for the data you sent me too.

I missed your first post or I would have commented there. Please consider a few items from someone who was in the “sell side” of the PV solar panel industry (not for Solar City) for awhile:

Make sure you understand how the state tax incentives work, including the filing, timing, and conditions of these. They comprise a large chunk of the value of an installation. I am not intimately familiar with NY state, but I believe PON 2112 has a cap on total incentives that can be distributed over the duration of the program.

I’d be curious to know if the savings Solar City quotes are 1st year or averages over the 30 year life. The energy savings quote in particular seems really high, and implies a high $/kwh rate. Do they provide any details about how they came up with the $1,550?

The performance of solar panels degrades slightly over time (0.5% per year), so your energy savings and ability to sell power back into the grid will decline. Utility companies also have mixed feelings about net-metering (selling back into the grid), so be aware that regulatory impacts could change this. Not a big a driver as the tax incentives, but it will impact you.

None of this impacts the methodology behind the NPV calculation that is the subject of this post, just some additional solar info!

Great info thanks! A lot of the data was suppositions by myself and may be too high.

You are correct on PON too, though I think there was money in the pot when I checked for this post.

Generally speaking this is just a chance to share how I think about a deal initially, I then go on to check further details prior to pulling the trigger- data points from you and Mel have been very enlightening and will help me make an informed decision.

Get rid of the outrageous subsidies and solar remains a lousy investment. Energy prices have actually fallen for the last 5 years (especially if you have natgas and coal fired generation), so many of the calculations that solar companies bandy about (up to 7% annual energy inflation) makes for rubbish analysis. I suspect most people would be far better served to add insulation, replace old windows and appliances with high efficiency units and convert lighting to LED.

I ran the numbers without the 7% inflation and it’s still a good investment, even without subsidies (clearly less so).

I totally agree about the insulation and efficient energy products too.