Upromise is one of the more underrated options out there. Personally, I still haven’t got the card because I am dazzled by the lofty signup bonuses of other options, but its time to admit that it is worth going for, and look a bit further into the program.

I’ve already written a lengthy review of how Upromise works, so will save the waffle for now and focus on the good, bad and ugly.

Upromise shopping portal tends to offer 5% cash back on pretty much anything I am looking for. Most people don’t go for it because they think Upromise = the money must go into a 529 plan. This isn’t true. Repeat after me. Upromise is cash back.

You have 3 main ways to redeem

- Fund a 529 plan (don’t bother)

- Fund a savings account (reasonable enough)

- Request a Check (that’s hard to argue with)

The 529 option isn’t worth it to me. 529 plans do offer value and are great funding vehicles, but if you are tracking them for state deductions, or for overall basis then you don’t want to be messing around with odd lot payments. Just take your cash in real money and load in rounded dollar amounts to your college planning. Same thing applies for the Fidelity Amex and the option to fund a 529 or an IRA. Just take the damn cash back and invest cleanly. You’ll thank me in years to come when you are asked to explain where it all came from.

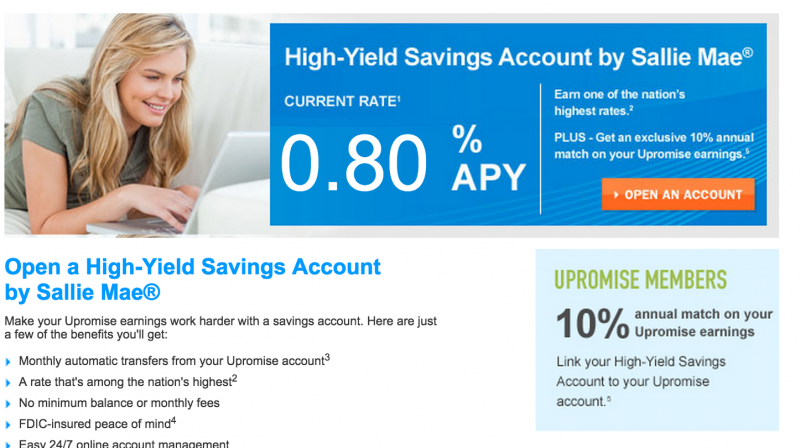

Savings Account 10% bonus

Worth it? Maybe… and more so if you have the Upromise card too. The credit card stacks with the online shopping so you can earn 10% online. And then anything you transfer into the savings account gets a 10% annual bonus. The catch? $5000 min balance in order to qualify. At 0.80% it isn’t that bad on the surface, but there are better options out there, up to 5% APR.

If we compare $5000 @ 5% we are looking at an annual interest payment of $255.81. The 0.8% rate creates $40.15 so you have a deficit of $215.66 to make up. That means that your first $2150.60 of annual earned cash back is a wash, and you need to gather more than that in order to profit. Frankly, that’s not so easy to achieve for the average person, especially when we note that can take up to 6 months to be paid out from Upromise. Either option sadly kick the backside of the guys on the high street offering around 0.1% or less in APR.

Edit – per Alonso in the comments, you can get the match with just a $25 monthly deposit – so its actually pretty good!

Verdict

Upromise online shopping coupled with the Upromise credit card will often be the most generous cash back portal for online shopping. Even if you don’t want to get the credit card, you should remember that it is not necessary to fund 529s or savings accounts with the cashback, you can just request a check. Be prepared for long waits… but eventually they tend to pay out, unless you are doing something fruity to game the system….

Where are you getting a 5% APR on $5000 for savings? I’d be interested in that.

Personally I don’t do it, but you can get close to it via Mango Money and a bunch of prepaid card options. They typically have some fees and hurdles but you end up between 3.8% and 5%.

I recall seeing a CU offering 5% recently somewhere too.. but the name escapes me.

The CU with a 5% account is at MyConsumers.org

Keeping $5,000 in the account is only one way to get the 10% bonus. The other way mentioned in the Terms is: “1. Set up an Automatic Savings Plan with a monthly deposit of $25 or more (“ASP”).”

I’ve been using that option since last year and my 10% bonus posted in February this year.

Other then that, I agree with your article. I’ve actually gotten a surprising amount of use from my uPromise card. As with all portals, rewards can be a bit slow to post but I haven’t had too many issues with it.

Also, if you have the SallieMae card you can redeem your rewards for money into your uPromise account so you get the 10% bonus on that as well.

Great info – thanks for pointing that out!

You can also get access to the Upromise portal by opening a 529 through nysaves.org (529 – think Roth IRA, but for college expenses). This is one of the better 529 plans out there (uses Vanguard, so very low expenses on your investment). This can be a pretty good option, especially since you don’t have to be a resident of NY and 529s can be transferred to family members, so you could even open a 529 with yourself as the beneficiary and later change it to a child/niece/nephew, etc. Even if you’re not interested in a 529, you could just open the account and fund it with the $25 minimum to get portal access.

What do you mean by access? I think anyone can have access? Or perhaps I just signed up for it so long ago I forgot that I did that…?

Ah, good point, didn’t realize anyone can sign up for access. I guess what you’re getting at is using the Upromise credit card with the portal gets an additional 5% cash back instead of whatever you would get with a different credit card.

Yeah- discover used to require signing up for the card access shopping portal but I don’t think Upromise did- if so yeah, the 529 would work and you still don’t need to actually fund it.