Dividend Reinvestment Programs, known as DRIP ‘s have long been lauded as an excellent way to accumulate wealth. And they are something that I have been a fan of for a long time. However I am wondering if it is coming to the time to turn the tap off, and stop the DRIPing…

As an overview, some (not all) stocks will pay a Dividend periodically, it can be a monthly, quarterly or annual amount, and the amount you receive from them will be transferred to your brokerage account either in the form of Cash, or if you prefer they can be automatically reinvested via a DRIP program.

The benefit of a DRIP program typically is the absence of a Trade fee for the purchase, for example if you receive a small dividend of $20 from your investment, if there was a trade fee of $7.95 you would lose over One Third of your money of Fees before you even get started. DRIP programs don’t have this fee, so you can build wealth cheaply using the power of compound interest.

A few useful terms when it comes to Dividend Reinvestment Programs

Dividend

The amount paid out for each piece of stock that you own is called a Dividend. You could think of it like interest on your investment, paid off in cash at predetermined dates.

Yield

This is the amount of the Dividend given as a percentage of the stock price EG a stock with a price of $200 and a Dividend payment of $10 per year (regardless of how many payments made up that $10) would be said to have a Yield of 4.4%.

Date of Record

Dividends will be paid to people who were the registered owner of the stock on the Date of Record. What that means is that if you sell your stock before they have paid you out the dividend you still get sent the dividend, providing your name was on the trade on Record day.

The Ex-Date aka T+3

Shorthand code for the date when purchasing the stock will not grant ownership of the dividend. There is a transcation period of Date plus 3 Days (T+3) which means that if you buy a stock even two days before they announce the Date of Record is due, you wouldn’t get ownership, because the trade is slow, you would have to buy the stock on the Date of Record MINUS 3 days to be owning the stock and qualifying for the next dividend payout. This only applies to your first purchase of a Dividend stock – and catches out a lot of people. Make sure that the Date of Record for a Dividend stock is sufficiently far out to capture the payout as the true owner of the stock.

Dividend Tax

You will be required to pay tax on your Dividend, regardless on if you take it as cash or immediately reinvest it into the stock position via a DRIP program. This tax can only be avoided by holding the stock inside a Tax Advantaged Retirement Account, or if you are a low earner, with total income within the 10% or 15% Income Tax level. Currently there are two rates of Dividend Tax 15% and 20%, the latter being for wealthy people earning in excess of $400,000 ($450,000 for couples)

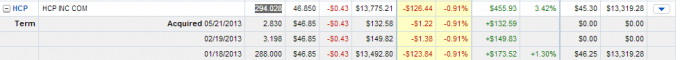

A real life example of a DRIP in action looking at HCP Inc (Ticker HCP)

Current Market Price $46.84 | Yield 4.4% | Dividend Paid Quarterly at $0.53 per share | Initial Investment 288 @ $46.25 for $13,319.28

Dividend Payments will be sent to holders of HCP on the following dates, though not yet announced we can assume a similar amount to be generated on August 1st and November 2nd:

| Record Date | Pay Date | Amount of Dividend |

| 05/06/13 | 05/21/13 | $0.525 |

| 02/04/13 | 02/19/13 | $0.525 |

In January I earned my first Dividend, 288 x $0.53 = $152.64 as I was enrolled in a DRIP Program my broker automatically swapped that payment for additional stock in HCP. I earned 3.198 additional shares, bringing my total up to 291.98 shares.

For the next Dividend Payout date, in May, I now get to earn more Dividends because I own slightly more shares – my take now is 291*$0.53 for $154.23. my broker swapped that out for more HCP shares, but the price had risen, so despite having more money than the first repurchase I actually picked up slightly fewer shares this time, 2.83 instead of 3.198. My new total is 294.28 shares of HCP.

As you can see the value in a DRIP is that your total number of shares keeps on rising, and providing that the Stock continues to offer a similar Yield, you can keep on earning more and more, it is one of those long term strategies where compound interest really helps your portfolio.

However, as you can also see, despite having more money in the second reinvestment, I earned less shares from it. That is because the underlying price of HCP raised up to a high of $54 before dropping down to its current level of $46.84; buying when it was high was less efficient, so my dividend did not pay out so well.

It started me thinking that perhaps we should look at the overall market,and wonder if it is peaking. Personally I feel a little nervous whenever the market breaches new highs -as a contrarian Value Investor at heart I don’t like buying into an expensive market. History has told us that markets ebb and flow (and more recently they boom and bust).

Say for example you have a stock that has a very high level of parity with the market as a whole, if that stock would devalue by 40% in a downturn, would it be better to have held those Dividend Payments for when the price is beaten down, and jumped back in at a low, rather than just plugging away at the investment and buying it on the rise?

The risk here, is that the stock doesn’t drop in value, if it continues to hold steady, or rise, then you will continue to receive your dividend payments, but each quarter you wouldn’t be getting any more than the previous one as you wouldn’t be adding more stock each time. If this happens your cash bank roll will continue to rise, but you will not be compounding it for that period.

The question then becomes, is the loss of compound interest worth the value in being able to pick up deeply discounted shares when they drop?

Systematically reinvesting dividends (particularly into stocks that grow their dividends over time) is the best way to build a stream of income for retirement..bar none. I love giving the people the following example:

With Phillip Morris stock, $2,000 invested back in 1980 would’ve grown to over $670,000 today and would be paying over $9,600 a year in dividends.