Certificate of Deposits (CDs) are savings tools that people typically hold to maturity, however for a variety of reasons people decide to exit the CD before maturity (for a penalty that typically impacts interest earned) when that happens, the CD that you used to own is not dissolved, it is instead sold on at a discount to amalgamate brokerages. These CDs are then put up for trade on a secondary CD market. When there is a market, there is the potential for profit, but it is often wise to consider that fools rush in where wise men fear to tread.

The first danger you need to be aware of when it comes to secondary CDs is marketability and within that, the concept of liquidity. An individual can use the same platform that they purchased the secondary CD on to resell it, but the demand is very low for such items, as such you will need to price at an attractive point (meaning you might will take a loss) in order to stimulate the sale. You should not consider trading CDs here, it is a buy and hold strategy that you need to focus on.

Effective Rate Vs Nominal Rate

The coupon payment is how much per year you will be paid to hold the CD, for example a coupon payment of 5% on a $1,000 CD would offer a yield of 5%. This is would be a Nominal Rate of 5%. However, it gets a little more complex… using the Time Value of Money, compound interest can impact the yield in relation to when it is received.

For example, if your $1,000 CD earns $50, paid in December each year it is not as attractive as one paid semi annually. If you were to receive $25 in June the december coupon would be more, because it wouldn’t be 6 months of interest at 5% on $1000, it would be 6 months of interest on $1025, so you would earn 5% on the $25, compounding your earnings faster. in this situation the Nominal Rate remains 5% but the Effective Rate would actually be 5.0625%.

This is an important distinction to make when looking at CDs, since you could find one that offered a lower Nominal Rate, but paid monthly and would actually earn you more money since it compounds more frequently.

Yield is what really matters

Yield is a result that looks at how your Effective Rate of return and compares that to the price you paid for the investment. When you look at a Primary Market CD (a regular new issue from any financial institution) you don’t have to worry so much about this equation, since CDs don’t offer discounts or premiums on the principle. However, in the secondary market this happens constantly, and here is why:

- The Coupon Rate is Fixed at issuance – if it says 5% for 10 years that is what you get.

- The Payment Schedule is Fixed at issuance, if it is semi annual, then your 5% becomes effective 5.0625%

- The Competition is Variable what this means is that if you have $1000 to invest and are considering buying a CD issued in 2008 with a fixed price and payment schedule you have the option to also buy one from 2009, or issued today. The coupon (interest you can earn) of a CD is created with an eye on overall interest rates.

Because Item 1 and 2 above; the Rate and the Schedule are fixed, yet the competitive environment is variable we have to find leeway in some aspect of the CD in order to make it Marketable. The thing that changes in relation to this dynamic is inevitably the price. If you have a CD that pays say 6% from back in the hay-days of CD ownership, it is kicking off a much more attractive premium than what you can get today, which is capping out at about 3% for a 10 year CD.

Since owning that 6% CD would be so much better for you, in order to take it from someone you need to pay a premium on the price. Likewise if you own a 3% 10 year CD today and the rates start rising, it would need to be sold at a discount in order for you to find a buyer. This is no different from the Bond market currently, with expectations being that prices will drop as an Interest Rate rise is overdue.

Screening for Bargains

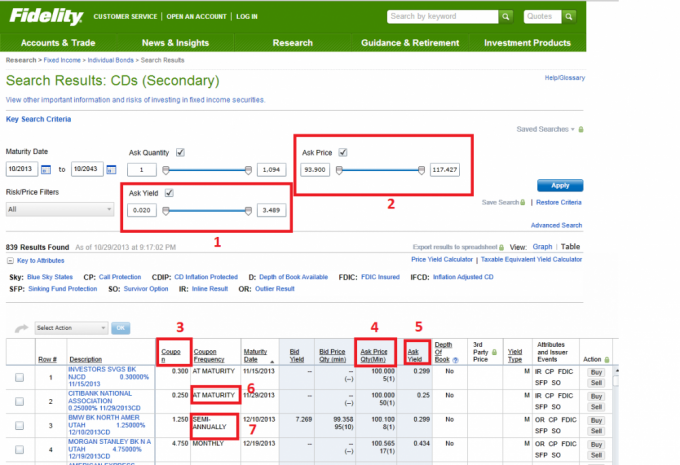

Now we have a grounding in the concepts, lets look at the Secondary CD Market Screen from Fidelity, one of the few brokerages that allow trading in this area.

I’ve highlighted the things that I look at first when hunting for a bargain – the other items of data are also important to consider, but when screening this is how I look at things for the sake of time and efficiency, the numbers in the diagram correspond with below:

1. Yield is what really matters! Therefore the first thing I do is look at this yield range and see if there is anything here that is more attractive than the current market.

2. Ask Price Range I glance at, just because sometimes there are things hiding in price that I might look for later, such as something selling at a discount that has a close maturity, that can mean a quick payday since if I pay 93.900 as per the lowest price on that scale, I cash in for 100, meaning a 6.1% gain at maturity, it does matter if timing to maturity is very close. Glancing here reminds me to look later for that cheap CD to see what the story is.

3. Coupon, my eye flicks here mainly to check the numbers are correct, though it is more of a scan across to compare Coupon to 4 and 5 below.

4. Ask Price – is it above or below Par (100) and why? This is also a way to have the market remind you that an attractive seeming CD is actually not so attractive.

5. Ask Yield – the Key

6. Coupon Frequency Is it at Maturity (which means it doesn’t compound) or is it annually, or in the case of 7 semi annually, which makes it more attractive.

The above diagram is great for showing how the main number many people look for Coupon Value (3) is misleading without the others. Since the CD#2 from Citibank National Association offers a 2.5% Coupon at Maturity it trades at less than the CD#3 BMW BK North America 1.25% because that one pays out semi annually, and the compounding on that means you earn more money from it.

Where are the bargains?

The truth of the matter, based on what you can see here is that there probably are not any bargains in this market, and therefore it is not worth an investors time. Lets confirm that by looking at some of the best options, for a bargain hunter they would be:

A CD that is selling at a deep discount that can reap a profit at maturity or A CD that offers a Yield that is beyond the scope of today’s market

The best bargain?

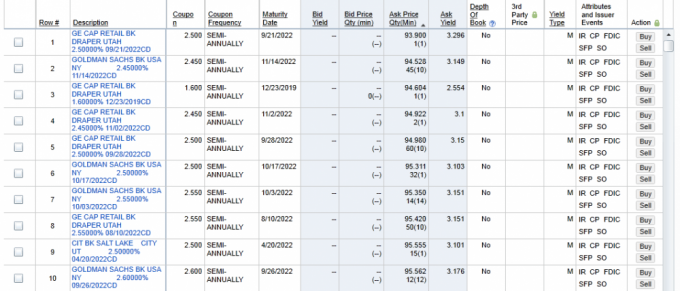

The winner here is the GE Cap Retail BK 2.5% Semi Annual. Selling at 93.900 on the dollar. It sounds like a deep discount, but you need to hold that until 2022 for the value to return to 100 (though it will gradually return there on the way). It offers both the lowest initial price, and one of the highest Yields.

The Actual return you would gain from this CD would be 2.5% per year interest, compounded twice per year plus a final one time bonus payment of 6.1% as the CD will return to its face value upon Maturity. The thing that is confusing about this CD is that it is cheap, and yet pays a reasonable rate of interest compared to what is readily available right now, so have we found a bargain?

This is where understanding context is key. There is only one reason that an investment is offered at a bargain rate when on a free market, the other buyers don’t want it. That doesn’t always mean it is a bad acquisition, but it means that if you don’t know why they don’t want it, its likely you are in over your head.

One in three people is a sucker, look to the person to your left, look to the person to your right – if you cannot tell which one it is, it’s probably you….

Don’t buy a bargain unless you know why it is a bargain

The factors that you should consider with the CD that are making it cheap other than present interest rate/competitive environment:

- Risk of Default – if you are buying an asset that comes with a high risk of defaulting it will become cheap, like a Junk Bond. Money can be made in high default plays, but knowledge of the market and deep diversification is required. A good thing to check is to see if the investment is FDIC insured. In this case the CD we are looking at is, and the issuing bank seems to be in decent enough shape. This risk is considered low here.

- Future Trends – The key with this CD is that has 9 years remaining on a 10 year CD. What that means is that if you buy it and hold it between now and 2022 you are subject to the future impact of the environment. It seems likely to many that the future economic environment (within the next 9 years) will include both rising inflation and rising interest rates. This risk is considered high.

If you are aware of the impact of inflation and interest rates on the investment and have priced that into your financial strategy then you could consider the purchase, but the yields will have to be adjusted according to your lost opportunity value. It is my opinion that the reason that they are trying to offload the CD for a discount is that it is a bad investment, and they are trying to get someone to be stuck with something that will in the future become more of a liability than an asset.

Think of it like selling a Bedouin Tribe a large cube of ice to keep them cool during the summer… seems great at the time, but will be nothing but a puddle of water due to the effects of time and the environment. And nobody is going to buy that puddle of water back from them.

Having looked through what is on offer, I would steer well clear of the Secondary CD Market. My recommendation in this current economic cycle is to have short term CDs or ladders thereof, nothing longer than 1 year. I would advise keeping an eye on small banks and credit unions as they offer rates way beyond the big names, and you can actually find Savings Accounts that are offering above 1% right now with ease. Don’t accept less than 1% for a 12 month CD (as of 11/2013)

Wow! I had no idea there was a secondary CD market.

Yeah, I thought it was pretty neat, but having looked at it don’t like it for the novice investor,

Not unlike the secondary bond market. Given the interest rate environment, chasing rates here seems like a bad idea esp. with long term options. I would not want any CD right now more than 2 years.

The whole area is very murky right now, like you I would be inclined to steer well clear of longer issues.

Completely wrong. The coupon rate is the original APR. The ask yield to maturity is what you will get paid…not the coupon rate. You have it backwards in the article….dangerous.

Hi,

What I am trying to say here is that if the coupon rate was 5% at issuance (original APR) you would get $50 for a $1000 bond. That $50 will still be $50 when the bond is worth $1200, but the yield will be different.

If that is unclear could you show me where and I’ll look to adjust it?