Mutual Funds as a concept are a great idea. They allow access to a broad range of stocks, sometimes an entire market for a very affordable entry point. The purpose of investing in such a manner is to diversify your investments so that you are not overly exposed to one stock or sector.

Mutual Funds as a concept are a great idea. They allow access to a broad range of stocks, sometimes an entire market for a very affordable entry point. The purpose of investing in such a manner is to diversify your investments so that you are not overly exposed to one stock or sector.

However; Mutual Funds are at the same time created in a manner that will kill your investment, and I will explore a traditional mutual fund vs an ETF alternative in this post to show why it is so important to move your investments out of these dinosaurs and into Index Funds and ETFs ASAP. Stop throwing your money at Salesmen so they can enjoy a nice steak lunch on your coin.

Sometimes, if you are contributing to a 401K plan through work you have limited investment choices, and in those cases you have to just suck it up and keep on investing here, but don’t forget as soon as you can do so you should move it over to a self managed Index and ETF portfolio – watch out for any penalties when you do.

Why Mutual Funds are bad for you

Fees. Simple right? The fees you will encounter in a mutual fund will be as follows:

Front Loaded Sales fee. That is right, you have to pay a fee to enter the fund, which is essentially a sales commission split between the guy that sold you that fund and his company. You will be paying for a nice steak dinner for a sales guy who has no influence on the fund and investments at all, they are just there to get you excited and then take your cash.

Management Fees. The boffins that decide to sell or buy individual stocks within the funds need a nice paycheck to pay off their MBA school, and steak dinners and the like. You will have to pay their inflated salaries regardless of whether their decisions made you money or cost you money.

Trading Fees. Many mutual funds are ‘Actively Managed’ by those boffins mentioned above. This means they are constantly buying and selling stocks to attempt to time the market and capture gains, studies suggest that they fail at this miserably over time and lose more than just keeping the funds in a passive account which is periodically re balanced.

12b-1 Fees. The boffins work with the marketers to create a pamphlet that makes you believe you are about to become wealthy and live a fruitful life, they supply these to the sales guy and together with his artful banter and this glossy document you hand over the keys to the Ferrari to Blind Peg. These 12b-1 fees are the costs to make marketing material to lure more suckers into the fund, and yep, you pay for it!

Early Surrender Fee. Bought a fund, realized your mistake and try to sell quick? Nope, there is a fee for that. You have to keep your money with these firms for a while, normally about 90 days so they can leach out a nice paycheck from you, leave before they have and they will just charge you an Early Surrender Fee, damned if you do, damned if you don’t.

Total fees for Mutual funds can be around 1.5% per annum, without Load Fees.. compare that with Passive Funds below.

Passively Managed Index Funds

Were introduced by Vanguard in 1976, the first fund being the Vanguard 500. This fund mimics the S&P 500 whilst being a lot less costly due to the overall fees being much lower than those traditional mutual funds.

Lets look at the Expense Ratio for this fund, and compare it with other options for the S&P 500.

Vanguard 500 TickerVFINX Minimum Investment $3,000 Expense = 0.17%

Vanguard 500 TickerVFIAX Minimum Investment $10,000 Expense = 0.05%

ETFs are another great investment choice, they are similar to an Index fund with several differences in the way they are managed. The primary difference to the consumer would be entry point as you require several thousand dollars to enter into an Index Fund, the ETF can be acquired like a stock, with as little as 1 share as a minimum, which could be under $50 (however you would be paying a broker fee on that which would kill any earning, so you still need to buy quite a few pieces of the ETF).

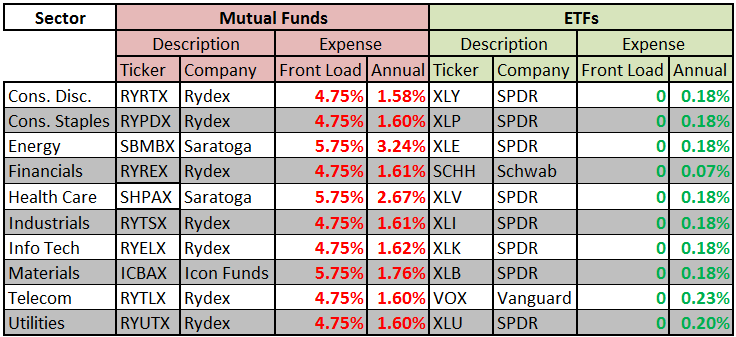

Comparing ETFs with Mutual Funds based on Sectors

The numbers speak for themselves. It seems like a no brainer here to go for the ETF option, lets drill down a little to compare what you get for the extra money between one of these Sectors. I’ll pick Telecom as Rydex seems to think it is necessary to pay 4.75% upfront load fee plus 1.60% per year to manage the Fund RYTLX whereas the Vanguard VOX asks only 0.23% and no load fee – note that as an ETF you would have to pay a brokerage fee to but this of $3.95 with OptionsHouse… whereas the fund would be ‘free’.

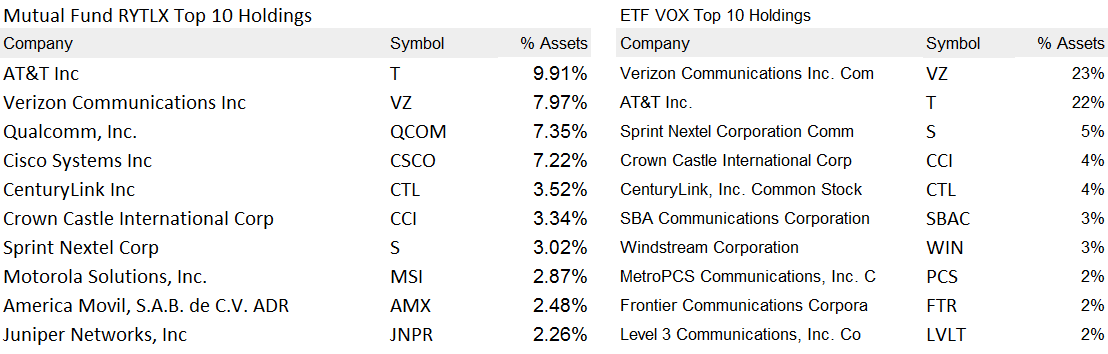

Major Holdings

As you can see, the holdings are a little different in structure, but still quite diversified throughout the sector. Both like AT&T and Verizon (as the top 2 Telecom Carriers its hard not to really) but RYTLX does have more diversity. That can be a good thing, but personally I prefer my Telco sector fund to have the 3 major carriers as its top 3 holdings. The other firms are a mix of smaller networks and network equipment manufacturers and service providers.

Here is the thing though.. none of these boffins really knows which stock will perform best, they have there quantitative and qualitative analysis; but it comes down to a gamble, “you pays your money, you takes your chances”. So what really matters, if you want to be in Telco is how much you get charged for your ownership. Lets look at an investment of $25,000 made by a 39.5 year old into their retirement fund. It has to grow for 20 years before you can withdraw it.

Person A Invests in the Mutual Fund:

- Load Fee $1187.50 (4.75% of $25K)

- Management Fee $381 Breakdown – 1.60% $23,812.50 basis (since you just paid $1187.50 for steak dinners and a nice bottle of Cabernet for your Mutual Fund Sales Guy your principle is no longer $25K)

- Total After Investing and before any profit or loss on the account = $23,431.5 (That is Correct, you just went from $25K down to $23.4K because you wanted to make money on your investment….)

Person B Invests in the ETF

- Load Fee $3.95 (the cost of an opening trade as a stock using OptionsHouse)

- Management Fee 0.23% $57.50

- Total After Investing and before any profit or loss on the account = $24,938.50

Immediately you can see that in order to break even person A needs to out perform person B by $1507 just to be on level ground. Or in other words, Person B needs $61.50 to get back to $25K and Person A needs $1568.50. As you saw from the major holdings, with these being vastly similar stocks in the portfolio how can one earn that much more than the other? Not possible without an amazing series of events.

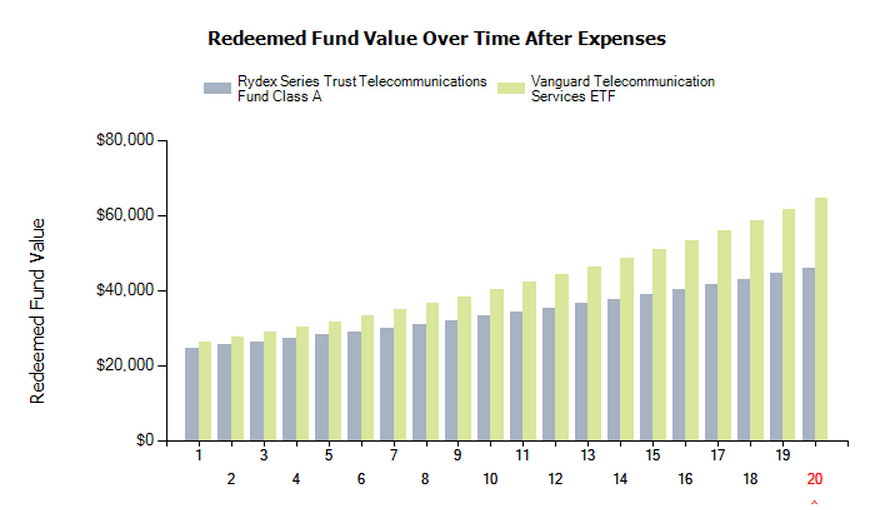

Lets plot that out of over the 20 years and see what difference it really makes to your bottom line, you might want to sit down as it is quite scary….I used the FINRA Tool for this, please feel free to run your own comparisons too – here is the tool FINRA Fund Analyzer

Mutual Fund RYTLX

And here comes the scary part – your expected profit (assuming a 5% growth per year) and the fees you will pay with it…lets compare the two approaches:

And by the numbers, a huge difference can be seen simply by the fees these two options charge.

For pretty much the same product and risk you get double the growth by keeping the fees low; this will impact your retirement massively. Now, one thing to consider is that Mutual Fund firms realized that people were jumping on the Index Fund and ETF bandwagon and decided to release their own versions of these, that appear to be similar but are in fact just as bad for the consumer. Furthermore, when you compare these new offerings with some mutual funds the Mutual Funds win. So, the lesson here is immediately look at annual management fee and front loading. One thing that I have noticed is that some employee retirement funds do not list the management fee – however they do list the ticker symbol so take the time to punch it into FINRA to check the fees and the ROI.

It is your money, be smart with it.

Right now I use http://www.mutualfundstore.com/ for my mutual fund. Which is better overall, Index or Mutual?

An index fund can never outperform the market, a mutual fund can both under perform or over perform.

Depending on your goals one might be better than another for you, but if you do need returns better than the market chances are your savings plan is off and you need to put more money in.