I like Robo’s, especially Betterment as they appear much more human than the wicked Wealthfront. As an advisor myself I find that the strategies they implement offer a lot of food for thought in terms of offering the very best to our clients.

One thing that does bother me a trifle is the use of marketing with them though, as sometimes their claims could easily confuse the average investor. Today let’s look at the claim that they monitor your account for rebalancing daily.

First of all, a daily monitoring seems pretty cool. However, most strategies for rebalancing state that it should happen less frequently than daily, often looking towards a quarterly or annual approach. Kitces just wrote a good piece comparing the timing of this, which is available here. But, whatever, if daily rebalancing is possible, and it works, cool. I like that the robo aspect could allow you to at least say ‘we can automate the viewing enough to know on a daily basis if this needs to happen’.

Of course, there is plenty of other software that can do the same for the professional advisor.

For me, I instinctively look at rebalancing in tandem with tax loss harvesting, but you can’t always do both at the same time. In theory it is quite possible to find that you rebalance due to one investment entering loss territory or one screaming away in the lead. You can see two forms of portfolio drift below, one with a loss and one without, both do require rebalancing.

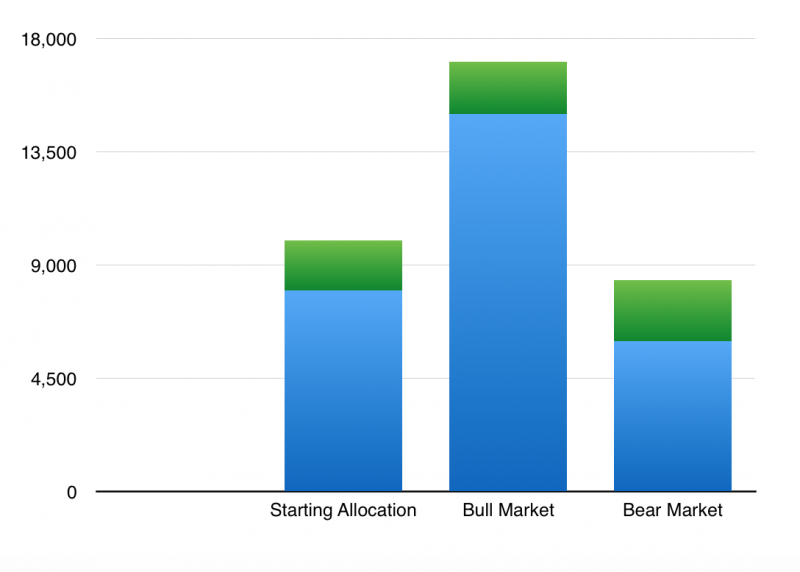

80/20 Portfolio valued at $10,000 ($8,000 equities, $2,000 fixed income)

- Bull Market: Equities rise to $15,000, Fixed Income Rise to $2100

- Bear Market: Equities fall to $6000, Fixed Income Rise to $2400

Both the Bull and Bear market would qualify for a rebalance (indeed, a lot sooner than in the example, which is showing massive drift in order to convey the notion). However, the Bear Market rebalance would allow for an integrated tax loss harvest, whereas there are no losses to harvest with the Bull Market example, as both positions have gained.

Betterment informs us that they monitor daily for rebalancing opportunities. Yet they also claim that there is no exposure to short term capital gains in the attempt to harvest losses.

- No exposure to short-term capital gains in an attempt to harvest losses. Through our proprietary Parallel Position Management system, a dual-security asset class approach enforces preference for one security without needlessly triggering capital gains in an attempt to harvest losses, all without putting constraints on customer cash flows. Source Betterment Whitepaper on TLH+

The Primary and Secondary Security Model

The idea here is to avoid the wash sale by swapping out from Security A to substantially different (yet similar) Security B when rebalancing in order to capture losses without triggering a wash sale. It’s neat, and until the IRS says otherwise it seems legit. However, the strategy is inherently contradictory with the rebalancing strategy, as having a limited number of pairs creates a conflict.

Rule 1

Check for rebalance daily

Rule 2

When rebalancing seek out with Tax Loss Harvest when stocks are declined to capture some sort of tax benefit (Alpha?) and never create a short term gain.

Rule 3

Only have a Primary and Secondary security in order to scale

The two fund trap

If we use robo’s to check rebalances daily, it sounds like an advantage to their service, because as we know humans and human advisors do not check balances on a Friday afternoon due to Yachting commitments. However, when the rebalance involves a tax loss harvest, which again, a selling point of the Robo allocation, their robo rules can trap them.

The Robo Advantage

The only real difference in terms of asset allocation and rebalancing with a Robo vs a Target Date fund is that the Robo uses granular ETFs and can extract losses through the rebalance, whereas the Target Date funds internal losses can not be extracted and subsequently applied against income. But when a Robo commits to Primary and Secondary funds only in order to build a simplified and scalable system, they can trap themselves into inaction.

Example

- Monday: Robo (and Human) Identify Tax Loss Harvest

Both are able to rebalance and tax loss harvest using a pair system, they move from Primary to Secondary security.

- Three weeks later: Robo (and Human) Identify Tax Loss Harvest

Robo checks daily for rebalance opportunity, using Robo power. Robo cannot rebalance and tax loss harvest because moving back to Primary ETF would contradict with the Prime Directive (do not kill your owner or create a wash sale). An exception to the TLH+ rule must be made if priority is given to the rebalance. This raises several questions:

- Do they rebalance and create a gain? They say never, but if bands are reached and no new money is forthcoming, how long will they wait with an account out of sync before triggering a gain?

- With a harvest opportunity, do they avoid the rebalance until the wash sale clock has ticked far enough ahead, and therefore they have broken the rebalancing band rule?

- Do they rebalance without a swap and create future tax lots for harvest?

Humans can make these decisions with greater flexibility. They can tax loss harvest, because they can add a third, fourth, or fifth ‘pairing’ as they see fit. They could also adjust granulation and go from multiple slices of a total stock fund into a single fund and vice versa. They can also take the gain if desired, because they don’t operate by the same rule system. A lack of rules can be a bad thing for investors, but being bound by them in exception cases can be a worse thing.

What does it all mean?

The sophistication of platform is contradicted by the limited rules of transaction, thus nullifying the value of daily checks for Tax Loss Harvesting. So when you hear that a Robo checks daily for a rebalance or a harvest, it’s worth questioning whether they are actually able to execute it or not. When you hear that they check daily, it isn’t necessarily that you can actually rebalance daily, but instead that your advisor, or robo, can look daily, but even when they find something that might fit the rebalance rules, if their tax loss harvest ‘rules’ supercede that, you might not get what you thought. Not that you’d ever know of course.

Why is Wealthfront wicked?

I’m sure they are lovely, but I find the guys at Betterment to be more approachable/better sense of humor… Of course it’s all irrelevant when we are looking at a Robo product.