I just signed up for the CFP Course at NYU, and wanted to share some thoughts on the decision making process and the strategies I will be following in order to do this in the most efficient and value orientated way.

The Certificate in Financial Planning (CFP) is considered to be the Gold Standard in Financial Planning, and is overseen by the CFP Board. They offer the exam for this 3 times per year with a pass rate that hovers around 60% (lower for repeat takers). Certain people are allowed to fast track to the exam by sitting just one course, known as the Capstone Course which is only 8x 3hr sessions, the people allowed to take this fast track are known as Challenge Students and must meet one of the following criteria:

- Ph.D. in business or economics*

- Doctor of Business Administration*

- Licensed attorney – inactive license acceptable**

- Licensed Certified Public Accountant (CPA) – inactive license acceptable**

- Chartered Financial Consultant (ChFC)

- Chartered Life Underwriter (CLU)

- Chartered Financial Analyst (CFA®)

- CFP certification from the Financial Planning Standards Board Ltd. (FPSB) Affiliate located in your territory of residence outside the U.S.

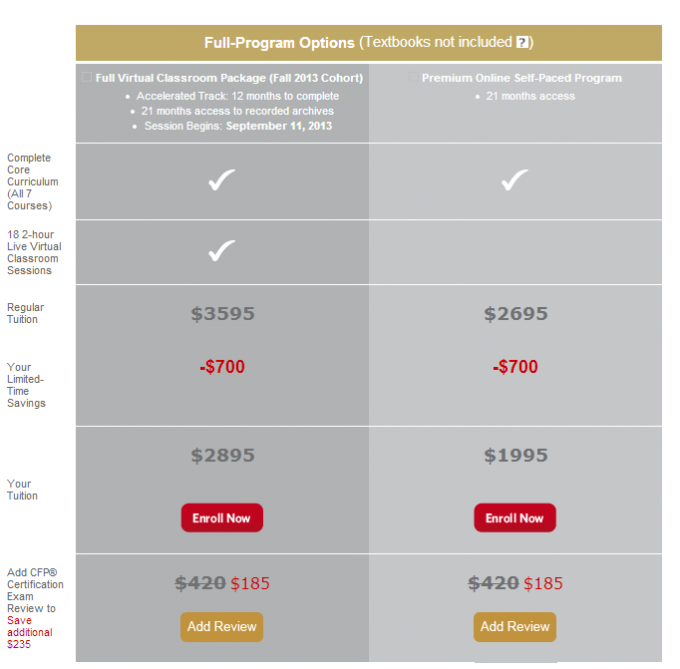

Unfortunately I don’t meet any of these criteria and as such I must sit through a 8 section course provided by an approved institution. I checked into several course options, and found the lowest for around $3,200 from Bryant Stratton College (online delivered) and at time of writing this found another offering from Boston University for $1995 or $2895 depending on your pacing.

Strangely as it might seem, I opted for a more expensive option at NYU costing around $5,850, and whilst it may seem odd to pay more for something there are a few reasons behind my decision:

Classroom format rather than online. This allows for networking opportunities with other students, teachers and access to companies interest in hiring from NYU through their careers program.

Prestige. This is something that I think is silly, but as much as might disagree with the notion people do care where you studied, and NYU has more clout than an online course from a lesser known school. I do think this is unfair because at the end everyone is sitting exactly the same exam which is administered by the CFP Board. Though in its defense there might be more rounded approaches to subjects that you get from working with world class teachers.

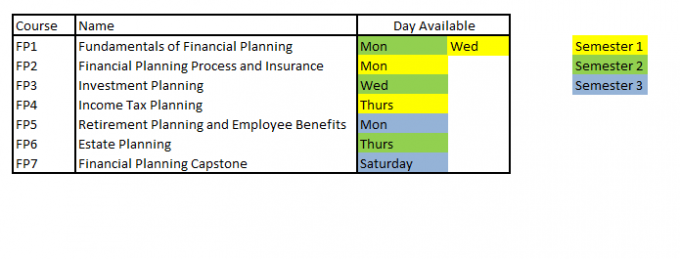

Acceleration of course. I’m a grown man, I don’t want to spend time in college to get in touch with my inner student, I want certification as quickly as humanly possible. In fact I am quite upset that I cannot sit for the exam without the course, if it is a comprehensive and well developed exam then it should be able to easily weed me out if I don’t have the required knowledge. The course with NYU isn’t perfect for acceleration, but it is the best I could find, here are the current subjects on offer (which are the same in each institution):

As you can see they have favored Monday for classes, so due to that overlap I cannot complete the course in 2 semesters, but I can complete it in 3, which is 33% faster than the fastest course offered by Boston University above. And even more advantageous than the Bryant Stratton course that wouldn’t allow any double subjects at all, making it a 14 month slog.

So, from a price perspective I opted to pay what will amount to 2-3x more for the course than I could have, but for me the price paid is not a pure ‘cheapest’ play, it is best value. Further perks include: the ability with NYU to pay course by course, meaning that I can pay for 3x courses at $800 each in year 1, and pay for the 4x courses at $800 in year two, making both years education expense under the $4,000 Tuition Deduction and as such allowing me to deduct the full $5,600 (there are some other minor courses that add onto this to make it $5,850) for those courses, with enough allowance on each year to also purchase supportive materials if needed.

Thoughts on Text Books

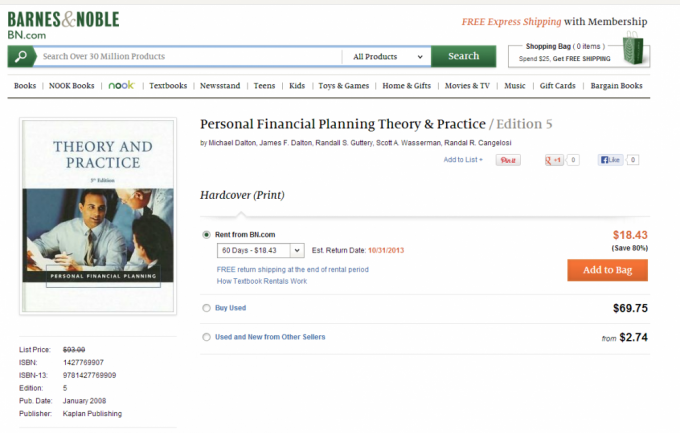

I haven’t confirmed this yet, but I doubt anything comes bundled in the NYU price so I am going to need to fork out additional money for text books. I have long felt that this is one of the greatest scams in the already highly scammed Education Business. A new text book each year adding a paragraph or two in strategic places means when the Professor states: “Open your book to page 32…” you will have to find out where that is in an older version if you aren’t consistently buying the latest edition.

One of the books that I think may form part of the course (I haven’t received a reading list yet) will be Personal Financial Planning: Theory and Practice (Dalton pfp series) which currently costs $93 from Barnes and Noble. To buy new, but there are many other options:

Buy Used ($69.75), Rent (60 days – $18.43, 90 days – $19.98, 120 days $22.20 , Buy Used from Elsewhere $2.74

Personally I have two choices here from the options above: I either buy NEW for $93 then attempt to keep the book in good shape until I want to sell it Used for $69.75. After fees and shipping that would probably be reduced to $55 for a holding cost of $38. The benefit of doing this rather than renting the book would be that I would be able to keep it as long as I wanted and use it for reference material prior to the exam, which will be at minimum 9 months from purchase date (likely longer due to there only being 3 exams per year offered by the CFP Board).

Renting here makes less sense because I would need to renew, and take it for 120 days plus another 90 or 120 day period (lets say 120 to be safe), for a holding cost of $44.40. For that price I would rather hold onto the book new and sell it when done. This is due to the type of course I am sitting though, as I cannot sit the final exam until all courses are finished and the final exam will reference work in course #1. In a Under Grad or Grad Credited Course I may not want to hold this long and renting would be better.

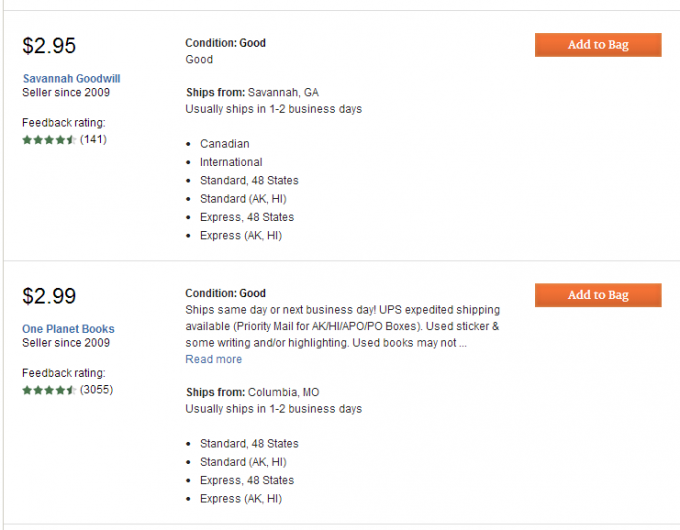

Of course, the obvious option is to reduce that holding cost from $40 to $2.74 by buying the ‘Used from Elsewhere’ these books are going to have some issues with them in that they are going to have some text highlighted already, which will likely annoy me, as I like to study in my own way and I may find myself distracted by the notes. In the past though, I picked up a copy of Dante’s Inferno that had some of the most fabulous notes penciled into it, so if you are lucky to have the prior owner be switched on, this could be a benefit, but if they happen to be one of the 40% of people who failed the course you might be led up the garden path…

My decision – Buy the super cheap used versions of the books. In truth as we can see from above in the big picture I would only save about 7X$37 over the course by doing this, so it is more a case of knowing what my habits are, and since I will be training in the gym daily I think these books will take some knocking about, which might prove a problem for returning the rentals or getting proper resale value.

What about the tax laws I hear you scream! Well, that’s the fear factor that motivates the purchase of the latest texts, that they will be teaching you in accurate data. However we are living in the digital age, and for any tables that I don’t already know by heart I can reference on the IRS website or other Finance and Law websites. I personally wouldn’t trust changing laws in any of the books I read because even the latest editions will become obsolete when legislation changes. It is concepts that we are using these books for, and supportive ones to the classroom instruction.

The beauty of picking the cheapest option here is that if I am way off base with this choice I can buy the latest version of the book and have it in my hands before the next class, and I would have only lost $2.74 by having made one bad decision and holding two books, it is a cheap, and easily reversible mistake if it proves to be one.

What do you think? Would have gone for the cheaper option, or pay the premium for the name, classroom networking and chance to finish the course in record time?

This is a good piece – you have me thinking about this. It’s interesting that you can fast track if you have CPA designation, so I am wondering would it ultimately be best to do the CPA first and then use that to do a faster CFP? Kind of a twofer on designations 🙂

I thought the same, but it is really not worth it. As the CFP you would just outsource the CPA work to a CPA.

You should study the CPA only if you want to act as a CPA, which is a very different thing from the CFP, which has planning related tax study elements.

The key to being a good CFP is having the ability to get the big picture, deal with the clients and know what elements require expert advice upon. Another example is the JD – which also fast tracks you, but you wouldn’t get a JD and become a Trusts and Estates Lawyer just to be a twofer, you would get the CFP and collaborate with T&E lawyers to implement the components of the plan needed.

Thank you…we share similar thoughts about the NYU Financial Planning program. I live in Greenwich Village and will enjoy going to a class room to interact with the professor and fellow students. This for me is the best way to digest the information. Additionally, networking is a key consideration for attending NYU versus other on-line programs.

Hey Matt, thanks for this post! I found this page when I was googling for more information on the NYU CFP program, and I had the same dilemma as you did.

Just wondering, since you’ve embarked for the course at NYU for over a year now, have you been able to do some classroom networking? What do you think of your instructors / professors so far?

Thanks!

Hey Clem,

Sorry I missed your comment. I enjoyed the course a lot. The professors are a bit of a mixed bag, and certainly will appeal or not based on personality. All know their stuff pretty well. By far the most enjoyable course was the Capstone, which was basically all leading up to delivery of a plan.

In terms of networking – yes, there was some, but not as much as I had hoped. I think the time of day (6-9pm) means most people want to bail out rather than hang out.

Good luck!

Matt,

THANK YOU SO MUCH for putting a review up. I am interested in the big name because clients come to my office and look on the walls for credentials. The CFP certificate would mean alot. Can you tell us if the course work is hard / tedious ? Also , I know Dalton education is affiliated either NYU and other schools ….. did you get buybthe guarantee to pass package ? I almost feels it’s a sucker’s bet. Last question ? Did you pass?

It’s hard to explain the difficulty level, we all think of hard and easy as different things. I can say that the exam requires a suggested 300hrs of study in addition to the coursework.

I didn’t use the guaranteed to pass, I bought flash cards from Zahn and a test bank from another firm, maybe Kaplan- total prep materials cost was about $200.

I also attended free FPA case study classes which were very helpful.

You need to know your way around the topics well- able to do any calculation in 30 seconds or less- such as retirement cost needs, college expenses, mortgage, sharpe ratios, duration. That is the easy stuff.

You also need to learn a lot about the CFP processes and discipline rules.

I passed.

Matt thanks for sharing. I’m 23 and I graduated college under a year ago with a degree in finance and I currently work for a brokerage/advisory firm in California. I have evaluated different options and found the NYU Online Self-Paced study to be the one that best fits me due to the fact that you can go at your pace, and there are no prerequisites. So my question is twofold: 1) Have you heard any reviews or testimonials on how the self-paced study option is and if so how was it? 2)I have my series 7 & 66 licenses and love the industry! I find myself constantly doing research online and trying to educate myself even outside of work. I started working a week after I graduated, and while I’ve learned a ton in the last 6 months, I have seen program descriptions recommending people have at least 3 years of industry experience prior to taking the education requirements. Maybe I’m too ambitious, but I want to get this done before I’m promoted and my boss highly recommends it as well. Any thoughts from anyone would be greatly appreciated!!

I wouldn’t necessarily go for NYU online. Personally I picked them only because it was in person and I wanted to network in the city. Online.. Go for whatever is cheapest!

You don’t need the experience, it’s a great value add to the career even just learning more as you go through the course, but note you can’t use the designation until you have 3 years.

Hey Matt, thanks a lot for this post! I found this post when I was searching for reviews on NYU’s diploma in financial planning program. I considered this program regardless of the price for the exact reasons as those of yours.

I wanted to know, if this is a “you-need-an-admission” or pay and study kind of course? I need to deicide if I should apply for several programs or if I can just submit my application for this one and relax. Can you also tell me, if you know, if these credits are transferable if I decide to pursue my Master’s/MBA in the same field?

Congratulations on passing the test. I wish you all the luck.

Thank you!

In hindsight, I wouldn’t do this. I would take the cheapest course available. Networking isn’t really great, and while I can name drop NYU I never have, and doubt I will.

I don’t think it transfers credit, but maybe if you worked backwards, Masters first, it would cover the coursework (check for a registered program here http://buff.ly/2ghTfZR)

I wouldn’t think an MBA is a natural step after that.

Thanks Matt! I understand what you mean but I prefer in person class to online and it’s the nearest available one for me. It’s kind of working out in everyway right now.

Again, do I need to get an admission for this program? Or is it pay and learn kind of course? I need to know this so that I can look for a fallback option too.

I really appreciate the reply.

Thank you 🙂

Sorry I missed that- I believe it is pay and learn.

Thank you. ☺️

I am changing in career after two years of grad that I did not enjoy current career im in. I am taking two courses – fundamental of fin planning and investment, both from cfp program online at UCLA which first I want to learn for self-improvement; however, I find the subjects of study are fascinated. Because the cost of tuition is expensive $5850 plus books ($200-300/each), I am seeking for the cheapest alternative schools and options to earn 300 hours of study. Do you have any recommendations?

ps. You are right. I don’t see networking at online program to be efficient because students are professional employees, most are at advisory firm, but more focus on self-study. Everyone has their own agenda.

Hi Pat, sorry, missed your post. I think you can get all in between $2-3k maybe with Bryant or Boston?

You said in hindsight, you wouldn’t do NYU in person if you could go back in time. (Sounds like the networking didn’t work out that well.) However, what if the in person is preferable, would you still

say it’s not worth it, in your opinion?

And an online be accelerated?

If it’s preferable then go for it, but it’s still not worth it 🙂

I’m not sure on all the rules regarding acceleration, but I would imagine you could.

If you are able to put in a good effort then 3-4 courses are viable in conjunction, but if you have a family or have work commitments then it will be a stretch.

Hi Matt,

Thanks for your post. I’m considering taking the NYU CFP courses in person as well. Currently I’m a middle school teacher. I’m very interested in personal finance. I want to make some career change. However, I don’t have any work experience in personal finance. That’s why I think the in-person course would help me do some networking. Do you think the course might help? Any advise on how to start my personal finance career?

Thanks very much!

Hi Sofia,

I really don’t think it will add much value, and would still suggest online for the price and flexibility of hours.

In terms of experience, I’d look into local groups like FPA and see if you can network your way into pro bono work or internships/ entry level roles.

Thanks very much, Matt! I truly appreciate your advice.

Since I don’t have any experience, do you think it’s a good idea to take the CFP courses first? I’m not sure about it but I thought passing the CFP exam would help me with internship opportunities. Or should I get some internships or entry level work experience in personal finance first before I start taking the CFP courses?

I want to become a fee-based financial planner. But I heard it’s hard to make a living that way. What’s your opinion on a fee-based financial planner?

Thanks very much!

If you find a good employer, they’ll pay for your course, but the online cost is only a few thousand, and it would be an investment. You could also start the course, pay for one or two classes and apply for jobs or internships stating you are currently engaged in study.

Fee base is a term to forget. You are going to be commission or ‘fee only’. Fee based is a term used to confuse the consumer, and the CFP board are fighting to get rid of it.

I’m fee only. It pays differently, you can earn good money selling products and life insurance, but that is transactional and doesn’t always have the same depth of planning.

Fee only is more relationship based, fees coming in may be smaller, but you can still make a good living. In the longer term, I think fee only can exceed commissions, but that is quite long term .

Thanks a lot!!!

Hi Matt, thank you so much for posting this article and replying to everyone’s comments. I am looking to get a CFP and wanted to clarify that you would recommend taking online classes through Boston or Bryant. Would that take much longer than NYU? I wanted to get through the classwork as fast as possible. Also, I have been a salesperson in the financial industry (fixed income), is that relevant work experience to get me in the program?

Thanks a lot!