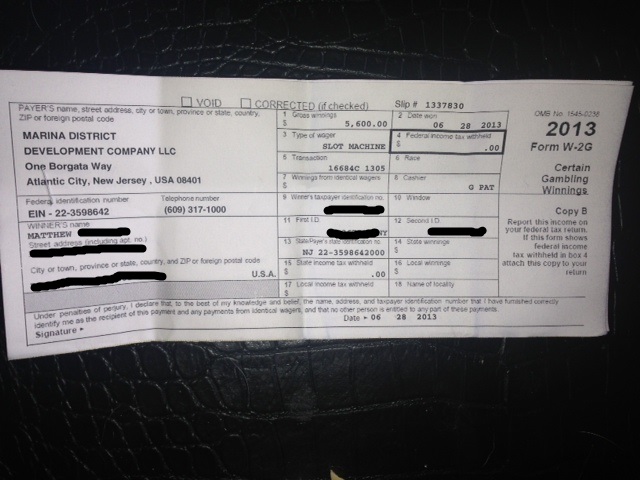

Every now and then we pop down to Atlantic City for a weekend away, as we get access to a great range of comped rooms, dining and entertainment. This trip we were lucky enough to be staying in the Borgata’s Opus Suite, which at 1000 sqft is bigger than my Apartment in Brooklyn, and has a ton more marble in it than we have! We spent quite a low key weekend, enjoying the restaurants and the suite without too much gallivanting around the town. I did take a little time out to play some slots during the trip and hit a Jackpot for $5,600. Which was very exciting, but at the same time a little annoying since your cash comes with a W2-G slip from the Casino.

The IRS Form W2-G is required whenever one of the following occurs:

- The winnings (not reduced by the wager) are $1,200 or more from a bingo game or slot machine,

- The winnings (reduced by the wager) are $1,500 or more from a keno game,

- The winnings (reduced by the wager or buy-in) are more than $5,000 from a poker tournament,

- The winnings (except winnings from bingo, slot machines, keno, and poker tournaments) reduced, at the option of the

- payer, by the wager are:

- $600 or more, and

- At least 300 times the amount of the wager, or

- The winnings are subject to federal income tax withholding (either regular gambling withholding or backup withholding).

Once you receive a W2-G Slip you are stuck with the knowledge that the Casino will be reporting the amount of your Win to the IRS, and as such if you fail to report your winnings too then there could be trouble come Audit time.

Casino winnings reported on the W2-G will add onto your regular income for the year, and you will therefore be taxed at whatever your current rate is. Luckily you can reduce the impact of the winnings by deducting your losses.

If you use your Casino Players card in slot machines or on tables (an absolute must in order to receive comps) the casino will be able to track your wins and losses and produce an annual Casino Win/Loss Report. This is useful to show you where you stand, but unfortunately are notoriously unreliable when it comes to accuracy. Don’t rely on this.

The Rules for Offsetting Casino Winnings for Tax Purposes

- You can deduct Gambling Losses up to the extent of Gambling Wins, so they can be offset, but if you lose more than you win you cannot claim the loss any further than your winnings.

- Gambling Losses unlike other forms of Losses cannot carry over from year to year. Therefore if you lost 10K in 2012 and won 10K in 2013 whilst you now may seem to have broken even, you will be subject to tax on the ‘win’.

- If you are planning to deduct losses it can only occur if you file your taxes in an Itemized manner.

- The IRS Requires you to keep accurate records of your Wins and Losses in the form of a detailed Gambling Diary, with any supporting documents that you might be able to muster. It is best to keep a current diary and complete it during every day of your trip, as your daily win/loss will be most accurate. You should keep copies of the W2-G forms (I scan mine and save them to a Dropbox folder for that years Tax Reports, where I also keep the Win/Loss Diary).

- For the diary, I keep whatever receipts I can, often including the Win/Loss Report if it is fairly accurate, along with ATM Receipts – though in fairness there aren’t many receipts available, and most of the inconsistencies come from Table Play as they are not able to track the players as accurately.

- Casual Gamblers are not able to reduce basis by claiming costs of business as a deduction, however Professional Gamblers are able to claim costs, such transport to the location, hotel etc. If you aren’t listing your profession as a Pro Gambler don’t try to claim any of these as costs!

So, good times were had at The Borgata, and we did quite well overall, sadly with Uncle Sam needing his share the win comes with a little more paperwork come tax time, but I think its a small price to pay. Check out some of our other Gambling experiences here – http://saverocity.com/travel/casino-gambling-playing-the-comp-game/ whilst on many levels Casino Gambling and ‘smart financial decisions’ is an Oxymoron, there are a lot of benefits to doing it right, as our $13,000 of free travel for 2012 is testament to.

I have this very same dilemma. Was told by my accountant that since I file single, I’d only be able to claim losses over the tax credit I already receive. I have acquired 3k in lottery losers to counter my 3k win but it appears futile effort. Still checking in with other finance people before I accept her answer. BTW, hit my hand pay at Caesers AC haha

Nice news on the hand pay! Yep, your losses cannot exceed your gains, but you have to look at all of your losses and gains, I’m not certain if there is a rule about ‘like kind’ or not but maybe the casino can offset the lotto?