The Pattern is what I call the path of most efficiency, the order in which things should be done. Everything has a Pattern, here’s one you might understand and can apply to other things. For my morning coffee I sometimes have to wash a French Press. This means that I need water from the one tap in the kitchen. If I decide to wash the Press before filling the kettle my elected navigation is slowed by my own blocking of the pipeline.

In contrast, if I first fill the kettle with water, and allow it to boil while I am cleaning the Press, I’ve created an efficient Pattern. Effectively, I’m employing the kettle as an assistant, and outsourcing a role to it while I do something else. The coffee example is pretty fixed, it will always take 60 seconds for the water to boil, and 30 seconds to wash the Press. It is my choice whether the process takes a total of 60, or 90 seconds.

Some things are fixed in duration like the coffee and others have a variable nature. A variable pattern comes in with probability decisions. I use this for booking elaborate travel. I know that the airline seats are vastly more limited (especially when seeking 3 business class seats using points) than finding a place to stay at my destination. The rules surrounding the pattern are important.

- Coffee rules: water boil time, press clean time.

- Travel rules: value of plane ticket vs hotel room leans in favor of plane, and cancellation rules allow me to act faster and fix errors later.

With finance, I see an interesting pattern. Many people like to take on debt at the same time as save. It’s a broadly encouraged attitude where people look at arbitrage, but what happens to the pattern when the reality doesn’t meet the theory? Let’s look at a simplified example first, with just two mediums, a debt vehicle (30 yr mortgage, 4%) and brokerage account, with indexing and inflation rising at 3.69%

- Age 30

- $80K Salary

- $20K living expenses

- $300K Mortgage ($1265 pmt)

- $0 Brokerage Account

Let’s look at some different scenarios

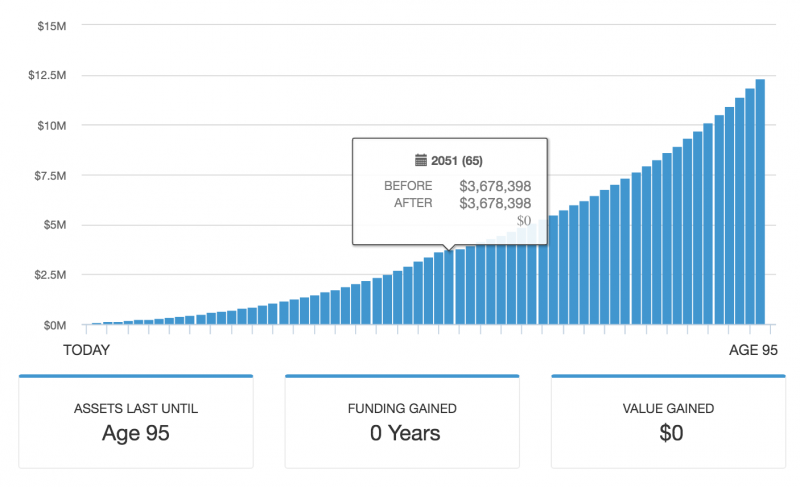

Brokerage Rate of Return 4.62% Pay mortgage monthly

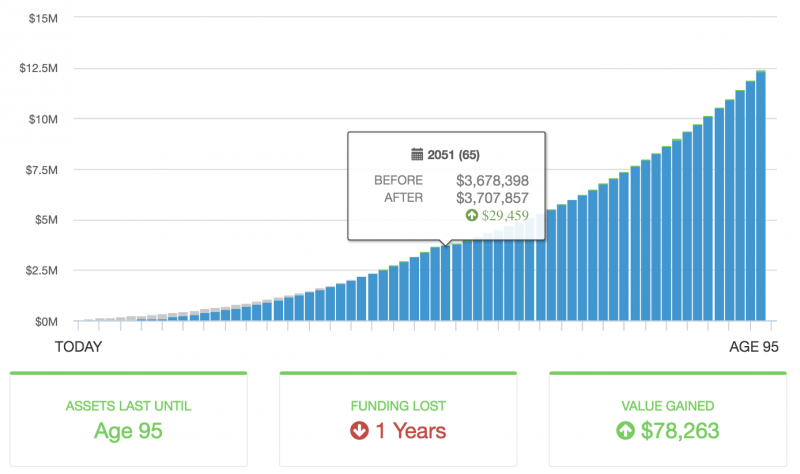

Compare that with scenario 2, where no money is invested into the Brokerage account until the mortgage is paid.

We get a lifetime gain of $78.263, and by age 65 a gain of $29,459. There’s actually some upside to paying off the mortgage at this level. However, if we swap the Brokerage rate of return to 7%, the following happens.

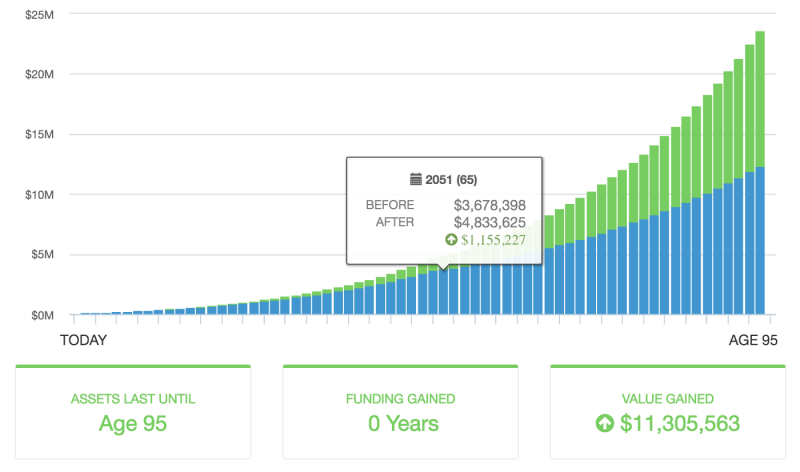

Brokerage Rate of Return 7% Pay mortgage monthly

The increased rate of return from 4.62% to 7% creates additional portfolio value of $11,305,563. Whereas, if the person had elected to pay their mortgage early, their gain would be less:

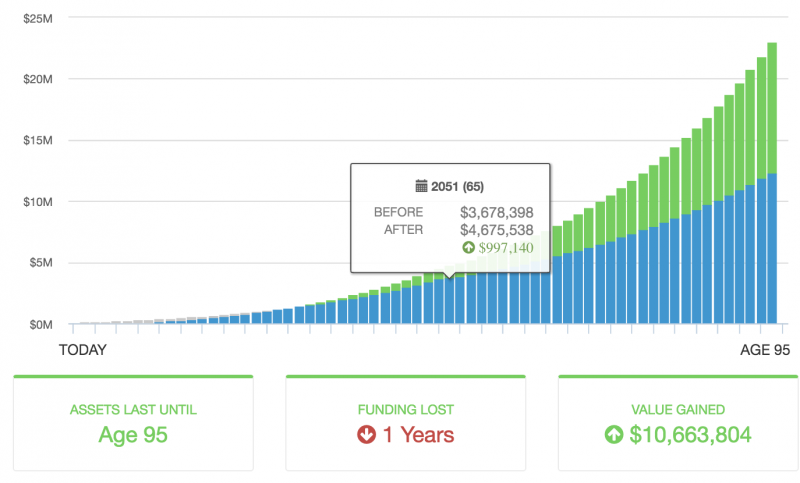

No money invested in Brokerage until Mortgage Paid (7% brokerage rate of return)

As you can see, the pattern when the rate is 7% is clearly in favor of retaining the debt and paying the mortgage slowly, as you are borrowing low in order to invest high. This is the classic case of debt arbitrage at play.

However, what these charts are not showing is Probability of Success, which is very different from what you see above. Probability of success when the plan relies more on removing debt (a fixed rate of return) is higher than when relying on a variable rate of return from the market. When it comes to building a financial plan and thinking of the ‘Pattern’ many people forget the value of the probability aspect, and focus on the notion that a variable rate of return has historically produced a higher amount than the cost of their debt.

Probability when it comes to a financial plan is the key to everything.

When you look at various charts or models, keep this in mind as you decide on the Pattern, it isn’t what you ‘might’ get, but what is the minimum that you need to get with the lowest possible chance of it not happening. When planning in a more sophisticated manner, tax law comes into play. The relative valuation of a fixed liability in relation to a tax advantaged account vs a taxable account is different, so an order must develop. It might be that due to your tax bracket a 401(k) before paying debt is favorable, as the reduction in taxes creates greater cash flow. In another case, when income is low, and debt prices are high, it might be better to skip the 401(k) altogether and take the guaranteed rate of return first.

Patterns of most efficiency are everywhere. When looking for them remember that there are fixed and variable components. Try to visualize yourself being a manager, outsourcing roles. When it comes to the coffee, make sure someone is boiling the water while you are using it for something else, when it comes to debt, consider if your outsourced debt is working for you (in positive arbitrage) or against you, as real returns might not be at their historical levels.

I wish you had been blogging and I had been reading your blog when I was 30 😉 ! Great advice; I hope all you young’uns take it!

Been following Matt and the other Saverocity bloggers for a little over two years now! I’m more than thankful!

Also, can’t wait for the new podcast (if it hasn’t been published yet…).

Thanks Both! The podcast should be up soon, next week hopefully.

Great post. I somewhat fit the profile in the example.

This could be a completely ignorant or stupid question. But is assuming that there will be a constant 7% (Or any other number) yearly return unrealistic? We know that any investment strategies have risks and the returns fluctuate somewhat (although in the long term, should probably be steady) (?)