April 15th is commonly known as the tax deadline. However, this can be pushed back by up to 6 months by filing an extension via IRS form 4868. This creates a new deadline of October 15th, this can be later if your return is complicated by living abroad.

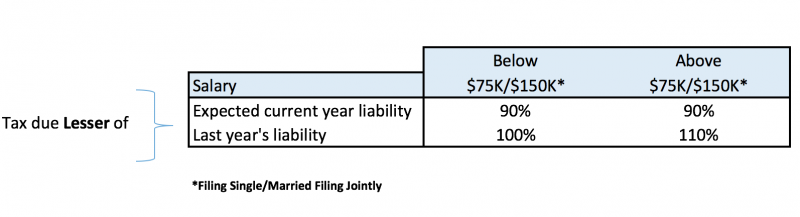

However, even if you do file the correct extension paperwork, you still need to pay your taxes by April 15th! The amount that you need to pay depends on whether you are considered a high earner or not. This is called the safe harbor rule. For people earning less than $75K/$150K (filing single/married jointly) your required payment is the lesser of 90% of your expected liability, or 100% of last year. If you earn more than $75/150K then the amount increases to the lesser of 110% of last years return, or 90% of expected liability. If you need to make a payment, this site lists several options to use Debit or Credit cards.

Penalties

There are two key penalties to be aware of regarding tax filing, Failure to File (FtF) and Failure to Pay (FtP). If you forget to file for the extension, and miss the April 15th deadline you trigger the FtF penalty. Additionally, if you haven’t made sufficient tax payments, you trigger the FtP penalty also.

- Failure to File = 5% of unpaid taxes per month (and part month) up to a maximum of 25% of unpaid taxes.

- Failure to Pay = 0.5% of unpaid taxes per month (and part month) up to a maximum of 25% of unpaid taxes.

Note that these do offset one another, so if you fail to both file and pay, your FtP reduces the FtF liability, example:

Billy owes $1,000 in taxes, he forgets to file for 4 months, his penalty is:

- FtF $1000*5%*4 = $200

- FtP $1000*0.5%*4 = $20

- Final Penalty is $200-$20+20 for $200

More reading on penalties: Eight Facts on Late Filing and Late Payment Penalties

For those who do remember to extend, but don’t remember to pay, the penalty would be just the FtP at 0.5% per month. In the same example, the total FtP would be $20, however there is an additional rule which states:

60 days after the due date or extended due date, the minimum penalty is the smaller of $135 or 100 percent of the unpaid tax.

For what it is worth, I have been hit with this in the past, and was able to have the IRS waive the $135 penalty simply by calling in and asking nicely.

If you really cannot get your taxes together in time for April 15th, be sure to file an extension, and if you do that, make sure that you still pay what you owe!

Got questions? Head on over to the Tax area of the Forum