The essence of this post is that by using this strategy you can elect to pay a lower tax rate, by selling an equity later, turning the tax treatment of it into a Long Term Capital Gain, you pay a premium to protect the gain, and when the premium is less than the savings in the tax rate spread you created, you have arbitrage.

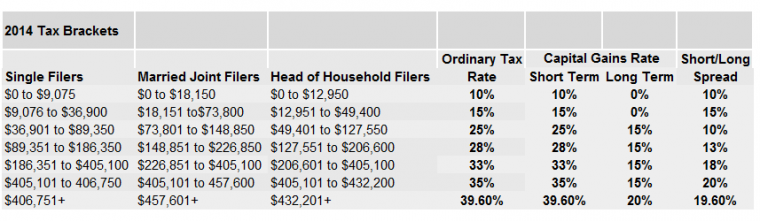

This post only explores one way to approach this subject, and only works in certain situations but hopefully will give you some ideas on how to maximize the investment income you receive and keep more of it within the family. This strategy relies upon Options to delay capital gains on profits, it only work when your position has drastically increased in value in a short period of time, and when delaying the capital gain from selling the appreciated assets results in paying a Long term vs a Short Term capital gain. The difference between Short Term Capital Gains and Long Term Capital gains is huge, and I don’t use that word lightly. Let’s take a look at the 2014 Tax Tables below, and see the final ‘Spread column’ this is the arbitrage that we are capturing in this system:

As you can see, there is a nice 15% sweetspot in the Married Filing Jointly category at the up to $73,800 income level, and then further along it appears towards the end of the income curve for high earning individuals, where savings are up to 20%.

Reminder – if you hold a position for more than one year it becomes a Long Term Capital Gain, if you sell under one year it becomes a Short Term Capital Gain

How to protect your short term capital gains

If you purchase a stock, fund or ETF which rapidly appreciates you may wish to cash in the profit, but if you do so within the Short Term Capital Gain window, you will be losing anything from 10-39.60% of the profit you make in the form of taxation. If you could instead hold onto that position until a year has passed since your initial purchase, your rate of tax would be from 0%-20% depending on your income (and the chart above).

However, if you do simply hold onto the position, you run the risk of losing the gain as the equity could decline in value due to the volatility of the markets, so you would be introducing Risk into the equation in order to capture that lower Cap gain rate. By purchasing a Put Option, you can defer that transaction without risking losing your profit, for the price of the Put Contract – you are buying insurance against downside risk, and by doing so in this situation you are not just buying insurance, but you are buying a cheaper tax bracket for your profit.

Put Options Explained

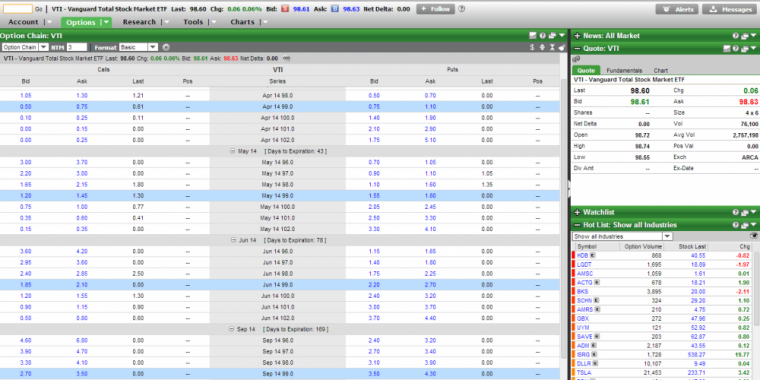

A Put option is the option to sell a security to another person at a predefined price, for a certain period of time. If we look at the ETF from Vanguard called VTI (Total Stock Market) we can actually trade options on this ETF to protect its position. In the image below you can see the current market price of VTI is $98.60. If you were to buy a $99 Put Option, that would mean that if the price ever dropped below $99 before the option expires you could demand that price of $99 from the person who sold you the option.

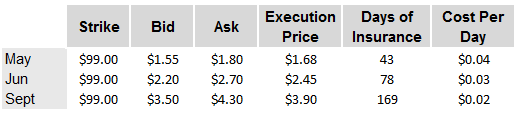

The price of the option for $99 would be something between the Bid/Ask spread on the Put Option (right side of the screen) page, to simplify that sales price, lets just pick a number in the middle of the Bid/Ask:

The Bid/Ask Spread is the range that people are willing to buy (Bidding) or Sell (Asking) in a free market there will be a spread between the two, the tighter the spread, the higher the liquidity of the trade.

Options are typically sold in lots of 100 Shares. Therefore if the June $99 Puts were to execute at $2.45 as per the simplified example above, the transaction cost would be 100x $2.45 for $245. You would need to purchase 1 Options Contract like this for every 100 shares of VTI that you wished to protect.

The price of $99 is as close to an ‘At the Money’ option as I could find, meaning that the Strike Price of the option is as close to the current market value as possible. In this example with VTI you could also consider purchasing the $98 Strike price, it would mean losing $0.60 of protection per ETF share, but it would also reduce the cost of your Put Option purchases.

There are only 3 possible outcomes – how they would work

Let’s say you purchased $100K of VTI back in June of 2013 (hypothetical numbers used), and they had appreciated by 20% in the interim. It is now April 2014 and you are sitting on a gain of $20K. Assuming the 33% Federal Tax Bracket. If you sold today, your gain would be a short term Capital Gain, and you would pay $20,000 *33% for a tax bill of $6,600 on that profit, netting you $13,400.

In order to buy $100K and for them to have appreciated 20% you would have bought at the price of $82.20 meaning that you bought around 1200 (1216 rounded down) shares of VTI. In order to protect those shares you would need to buy at least 12 Put Contracts, each one covering 100 of your shares. The current execution price of June14 $99 Puts is estimated to be $2.45 per 100, or $245 per contract

Total cost of protection would be 12x $245 for $2,940

Remember, Option Contracts Expire typically on the Third Friday of the month, make sure that if you are planning protection that you are covered until your initial purchase price has met the 1 year+1 day mark.

Outcome #1 in June 2014 VTI is trading below $99

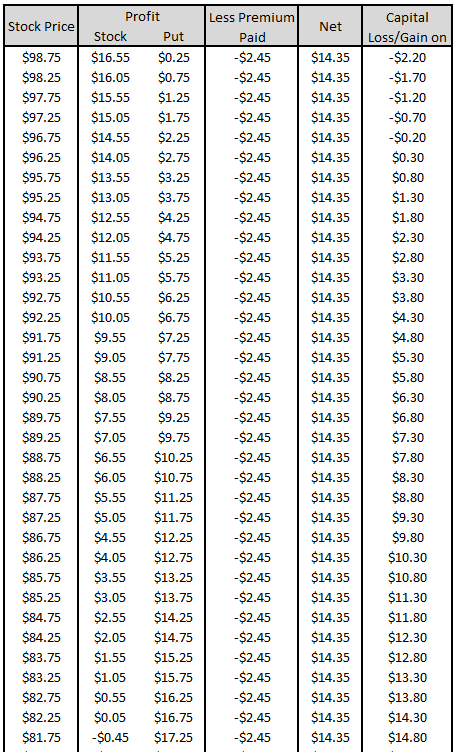

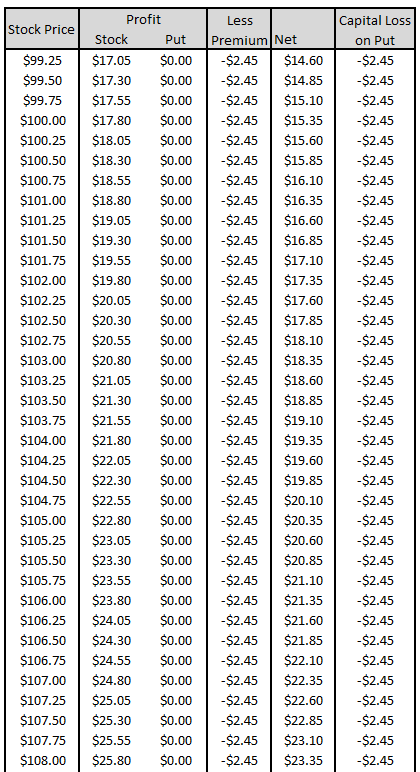

If the value has dropped below $99 then your Puts are considered ‘In the Money’ and have value to them. They will go up in value. The underlying stock of VTI will have decreased in value, but will be protected by the Put. There is some cost assigned to Time value, so the actual impact would appear as follows in the chart below:

That would proceed all the way down to a stock price of Zero, the Stock Loss would increase, but the Put option value would Increase. Additionally, you would be able to harvest a short term capital loss if the final trading price of the Put Option is below the $2.45 that you paid for it (shown in the first 5 price points above). As an example, if the final price of the VTI stock was $98 in September 14, and you sold it as a long term capital gain, the following would occur:

- Long Term Cap Gain of $15.80 per Share (underlying stock)

- Short Term Cap loss of $1.45 per Share (options contract)

- Total VTI Stock Profit $15.80* 1200 = $18,960

- Total VTI Put Option Loss $1.45 *1200 = -$1,740

- Net Profit $17,220

- Tax Due $17,220*15% $2,583

- Net After Tax Profit = $14,637

Remember – the original profit from just selling this stock would have been $13,400, so by holding longer, even with paying the ‘insurance’ of $2,940 you make an additional take home profit of $1,237 if the stock declines in value.

Note that the Put Option will turn from a Capital Loss to a Capital Gain when the stock price hits around $96.50, however the reduction in Stock Capital Gains offsets the increase in Option Capital Gains.

Outcome #2 in September 2014 VTI is trading at $99

If the value of VTI on the expiration day is exactly $99 then your Option would expire worthless, you would have gained $0.40 per share in appreciation, and converted all of your gains from short term to long term. You would also be able to harvest a short term capital loss for the full amount of the Options Contract:

- Long Term Cap Gain of $16.80 per Share (underlying stock)

- Short Term Cap loss of $2.45 per Share (options contract)

- Total VTI Stock Profit $20,160

- Total VTI Put Option Loss $2,940

- Net Profit =$17,220

- Tax Due $17,220*15% $2,583

- Net After Tax Profit = $14,637

As you can see, the price being exactly $99 results in the same outcome as in Outcome 1. Your profit is increased by $1,237 if the price remains around constant.

Outcome #3 in September 2014 VTI is trading above $99

If the Value of VTI is above $99 then the Put Option would expire worthless, the premium paid would be harvested as a short term capital loss, and underlying stock would have appreciated further, and changed into a Long Term Capital Gain, this is the most favorable outcome, as the profit/gain has no cap.

To calculate profit here, anything above $99 would be considered a gain on the $14.637 shown above, and furthermore the entire gain would be calculated at a Long Term Capital Gain tax rate rather than a Short term one. For example, if the price in June had risen to say, $101 you would have the following:

- Long Term Cap Gain of $18.80 per Share (underlying stock)

- Short Term Cap loss of $2.45 per Share (options contract)

- Total VTI Stock Profit $22,560

- Total VTI Put Option Loss $2,940

- Net Profit =$19,620

- Tax Due $19,620*15% $2,943

- Net After Tax Profit = $16,677

As you can see, in all three cases, regardless of the movement of the market, you make more money by buying the Put insurance, and it allows the upside to be unlimited.

They say it is impossible to predict or ‘time’ the market, however it is possible, using strategies like this one to create a guaranteed result regardless of the movement of the market. Furthermore, it can be used in conjunction with Passive Index investments as well as with individual stocks and bonds.

Buying Time isn’t Cheap

You have to pay a daily rate for the Put Option as an insurance vehicle, if you buy too much it will degrade the value of the arbitrage, however, 2-3 months makes sense, any less is increasingly profitable, and anything longer starts to lose value, it is a simple example of the law of diminished returns. The quick and dirty solution to finding out if buying time will work or not is to simply run two scenarios, the first at short term tax rates, the second at long term rates. If we go back to our previous example of 20K profit:

- Short Term Rate $20,000 * 33% = $6,600

- Long Term Rate $20,000 * 15% = $3,000

This gives you a ‘window’ of $3,600 with which to buy Put Options as your insurance – if that premium amount is enough to buy enough Put Contracts get you to the Long Term Capital Gains day then you have an arbitration opportunity. Also remember that because you can recapture the Capital Loss from the Puts should they expire worthless, so even spending the full amount doesn’t create a wash, it creates an opportunity to harvest capital losses.

Close enough can be good enough

The last thing to consider can be homogenization of funds. Even if you are carrying the bulk of your taxable brokerage account balances in mutual funds, you can typically correlate a broad index fund to that of your mutual fund (with the notable difference being the higher fees you are paying) so if you were to seek to protect a mutual fund until the 1 Year of Short Term Capital Gains period has expired, you could do so by marrying the Fund with an index based Put that is a derivative of a very similar ETF to your investment.

Conclusion

You should carefully consider the tax implications of selling constantly. If you can balance this correctly you can harvest capital losses, and defer gains to lower rates, which can offer massive value to your investments, and ensure that more of your profit remains in your pocket, rather than in someone else’s.

- Controlling the time when you elect to sell a position can control the tax rate on the profits.

- Put options can allow you to extend the time limit whilst locking in your profit against downside risk.

- Options can be tricky, make sure that you know exactly what you are doing with them before you buy or sell options.

Note, if you have less than $100K in non use assets (IE not including your home) then ideas like this one are fun, but they aren’t a substitute for knuckling down, earning more money and spending less. Once you start building solid equity from your ‘power years’ of earnings then being savvy with your investments makes more sense – it is simply that there is less ROI with lower net worth, and I want to keep your eye firmly on the prize, earn more when you are fit and healthy!

You realize this will fly over almost everyone’s head, but great ideas. I did something like this years ago when AAPL was going up and up.

I think that the real players from the other side of my site will get the essence of it- this is what it is all about really 🙂

I agree. Different players, but the same game.

Nice. I am pretty comfortable with options, so would definitely use this strategy.

Now when are you posting about equities that I can invest in that will warrant the use of this strategies.

Maybe for ‘Premium’ users? 🙂

Interesting ideas… But I especially appreciate the reminder at the end! Thanks!

Love your blog! 2 notes:

– If you are nearing the 1yr mark for capital gains, you can also Sell an “out of the money” call option and a higher price to help with the cost of buying the put option.

– Your first paragraph “and when the premium is less than the savings in the tax rate spread you created, you have arbitration.”. I dont think the term arbitration is the same as arbitrage opportunity. I think arbitration is like a mediation. Not trying to be a d***, just wanted to point it out.

Keep up the good work!

Hey Nate, thanks for the correction – I would typically blame that on my ‘British English’ but I think I should just confess I made a boo-boo… and yes, a Collar would be a good idea, thanks for sharing that!

Generally this type of insurance is too expensive in practice. It’s a really tough sell to convince the client to spend 5%+ of the position on short term insurance.

Plus if you liked it at 100 why wouldn’t you love it at 120? That’s when I would really push the position (or maybe I’ve just read Reminiscences of a Stock Operator one too many times). 8)

Implied Vol is ridiculously (IMO artificially) priced at the moment so I’m not sure a broad market ETF is the best example.

I think it’s much likely to occur at single stock sniping rather than a ETF- an acquisition bump etc. The sell should be simple- if you sell you net x if you cover you net x+y