Target Date Retirement Funds are an interesting beast indeed. There is a lot of buzz about them in the financial community currently; despite them being around for some 20 years now, first introduced by Barclay’s Global Investors (BGI) in 1993. They are growing in popularity, and could make an interesting part of your Investment Portfolio if used correctly. This post is an introduction to them as a concept so you can determine their fit in your retirement planning.

Target Date Retirement Funds are an interesting beast indeed. There is a lot of buzz about them in the financial community currently; despite them being around for some 20 years now, first introduced by Barclay’s Global Investors (BGI) in 1993. They are growing in popularity, and could make an interesting part of your Investment Portfolio if used correctly. This post is an introduction to them as a concept so you can determine their fit in your retirement planning.

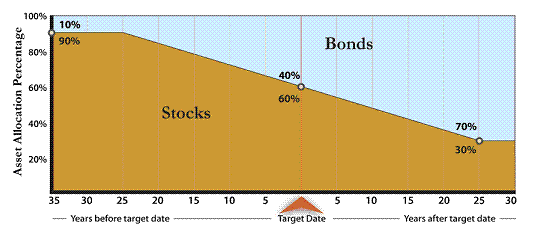

Target Date Retirement Funds are a managed investment strategy designed to peg portfolio Risk to Age. It is generally accepted that the older one gets, the less risk they want in a portfolio, as they are unable to recover from market volatility over time. Therefore when selecting assets Risk and Volatility are correlated to your Age (amongst other factors) simply because lose the ability to earn money from working after a certain age. This alone is a very in depth subject, and I hope to delve into it further in future posts.

Target Date Retirement Funds are labelled by the expect date of retirement for you, so if you are currently 50 years old, with about 15 years to retirement a pick a Vanguard Target Date 2025 or Vanguard Target Date 2030 (the funds move in 5 year brackets). In doing so you are saying you want to pick a Retirement Date of 2025 or 2030.

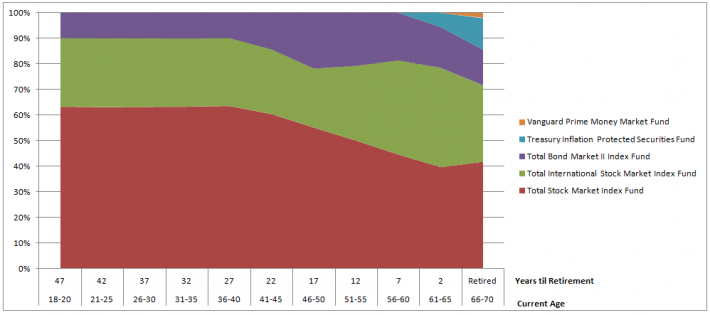

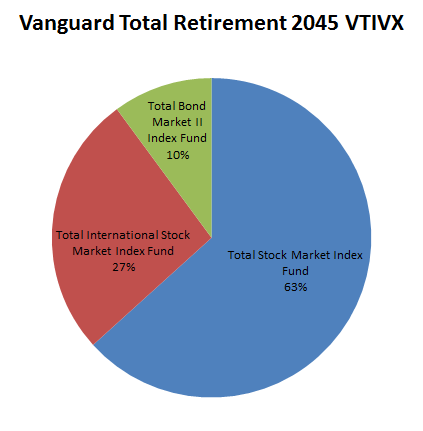

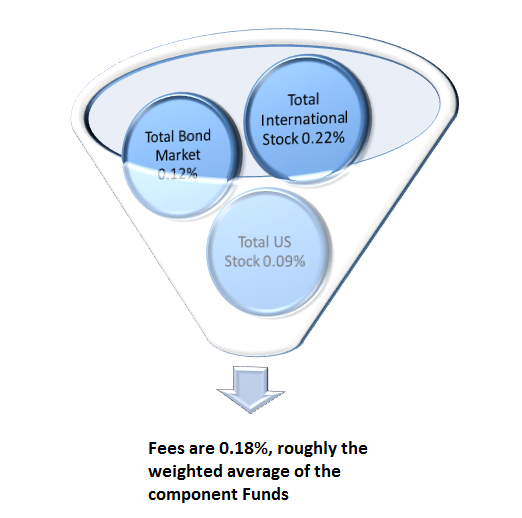

Vanguard has quite a simple model for the structure of their Target Date Retirement Funds, they use three major Vanguard Funds:

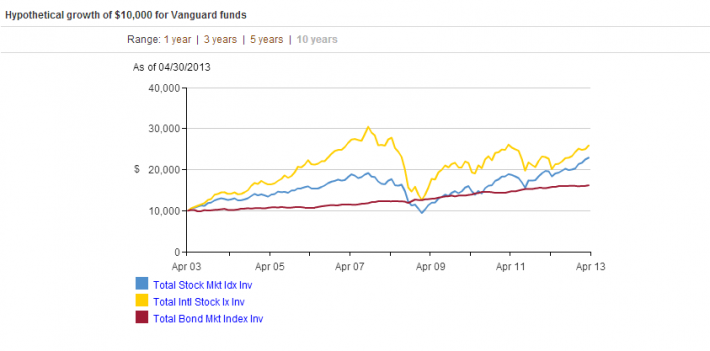

- Total Stock Market Index Fund (quite volatile, and second best gains)

- Total International Stock Market Index (most volatile, but also best gains)

- Fund Total Bond Market II Index Fund (least volatile, least gains)

In addition to the three core funds you see above, they also have a Treasury Inflation-Protected Securities Fund (holding a Basket of 39 TIPs Securities) and a Money Market fund – these two additional funds start when you are about to enter retirement, and the timing of that nicely sums up the rationale behind Target Date Retirement Funds – as time progresses the Assets become less volatile, since your ability to weather the impact to your portfolio is reduced when you aren’t able to replace losses with new investments from your salary, and cannot dollar cost average your portfolio.

One thing you might notice between these Target Date Retirement Funds is that since they are sold with 5 year blocks, they appear to suddenly change allocations at these five year intervals. This is what happens to your fund, when you buy it at a certain allocation, such as the Vanguard Target Retirement 2045 (VTIVX) it will start today as a mix between the three Funds you see below, but the shift to the next stage will actually be gradual, rather than a large jump, as they spread the transition over each year.

Portfolio Rebalancing for Target Date Retirement Funds

These funds rebalance on a daily basis, and they are constantly drifting towards the next 5 year allocation. They have assigned a rate of about 1% per year change, on a Quarterly basis. You can look at this as a smooth landing from a plane, as it gradually moves to the next level, rather than waiting for the next 5 year ‘hurdle’ to occur as the portfolio graduates from heavily in Stocks, to more in Bonds. For more on what Portfolio Rebalancing is, and how it keeps you on track please see this post: Portfolio Rebalancing For Passive Investors

Conclusion

Target Date Retirement Funds come in many shapes and sizes, I will explore other approaches to this solution in the future. I think that the Vanguard model is a very good one in terms of keeping the approach simple, and whilst it is constantly shifting to a less risky asset allocation model, for the first 25 Years of the investment little change is noticed, after which it starts moving more noticeably towards an wealth retention rather than accumulation strategy.

Leave a Reply