I just walked past a large gathering of folk from Citigroup Inc. (C) in TriBeCa New York, all donning the company colors as they went about what was apparently a fun run for a ‘Healthy Heart’ and gathering in the square of their building here for a pep talk prior to dashing off to save themselves. I did note that most of the participants appeared to be fresh faced graduates, rather than the bloated middle and senior management types that spend most of their day gorging on Steak and Cabernet’s beyond my price point on my dime.

I just walked past a large gathering of folk from Citigroup Inc. (C) in TriBeCa New York, all donning the company colors as they went about what was apparently a fun run for a ‘Healthy Heart’ and gathering in the square of their building here for a pep talk prior to dashing off to save themselves. I did note that most of the participants appeared to be fresh faced graduates, rather than the bloated middle and senior management types that spend most of their day gorging on Steak and Cabernet’s beyond my price point on my dime.

I thought to myself, how hypocritical, these guys doing good, but the cause is good enough, awareness of Heart Disease and Exercise, and likely linked to a Charitable donation, why am I bitter about these whipper snappers? It could be partly due to the $12K I lost betting on their turn around occurring 2 months before it did (timing, is everything when you trade Options…) but beyond that I think I was upset that these guys were having fun (or more likely faking it but whatever).

These events cost money, there were lovely refreshments on hand, all heart healthy of course, and no doubt Pizza and Beer for the people who finish the run, all paid for by Citi. And now my mind is churning – I bank with Citi! It’s something I have thought about ending for some time, but I still have my business banking and personal banking relationships there, not to mention the fantastic AAdvantage Credit Card offers I have taken AAdvantage of over the years… they are spending MY MONEY!

But then I thought harder, and realized that Citi actually pays me to bank with them.. strange as it might sound I pay nothing for monthly charges, have most of my Credit Card annual fees waived automatically (or manually when I call up) and the give me around 1000 Thank You Points per month, which conservatively is $10. So I’m getting free money from them. In a better economic environment one could also hope for some interest on my savings, but then again, pigs might fly.

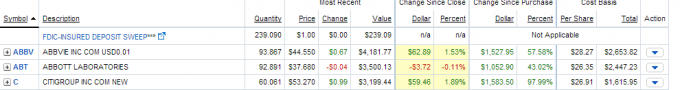

I’ve also held onto some Citi stock that I purchased at a low, when I realized the chance of my Options trade paying off was so slim due to the low share price I picked up some shares, so I have tracked their gain and am happy to see that they have almost doubled in price, and still these guys are spending MY MONEY! Now as a shareholder I am miffed that they allow their young-lings to frolic at my expense.

So how are Citi making so much money, that the stock price has doubled, and they can afford matching T-shirts and complimentary quinoa/tofu wraps for all and sundry?

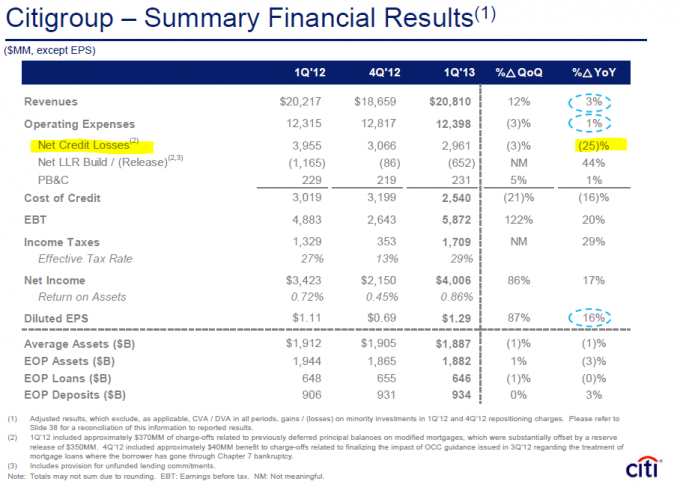

My first thought was that somewhere along the line they were making more profit, and therefore were much more attractive, however, it seems that Citi has worked hard to correct itself over the past few years, under the helm of Vikram Pandit, who resigned in October 2012. Michael Corbat took charge after Mr. Pandit and has pledged to continue cost cutting…

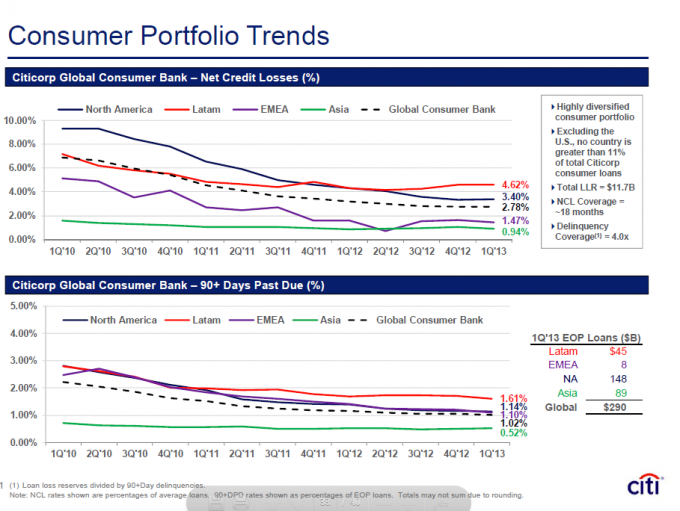

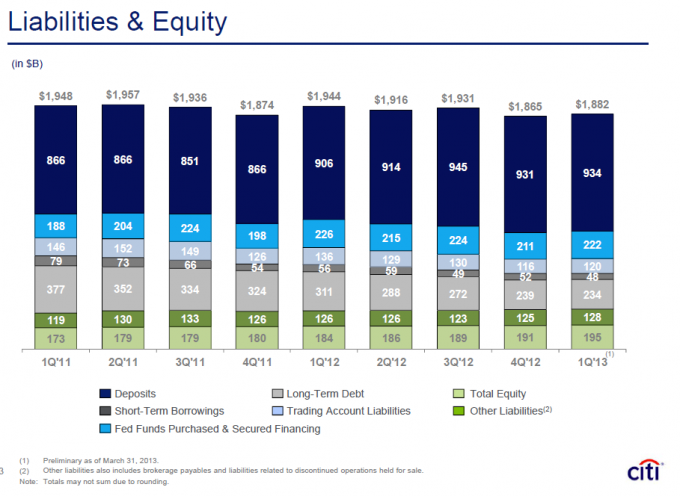

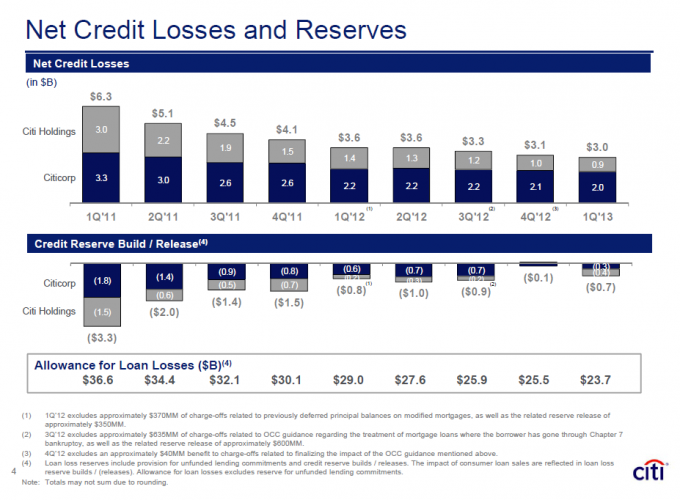

So, the secret to their success is that they are currently losing LESS money, and as such they make more… that’s from the big stuff at any rate. They are also lending less, which is good in some ways, although at one extreme it can cause a recession, giving out too much credit is the primary cause of the last crash we suffered, so a happy medium is fine withe me.

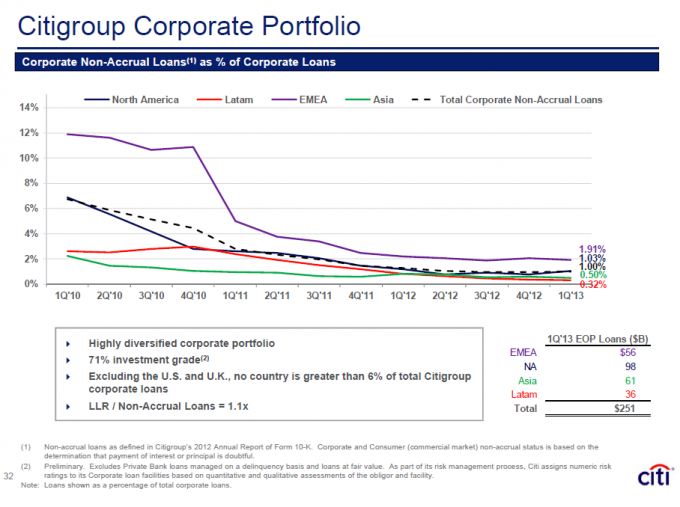

The question remained, was it that they are slowly writing down their bad loans and issuing better ones, to people of better credit worthiness now, or are they locking the vaults, throwing away the keys and holding on until their bad debt memories fade away… based upon current lending patterns it seems that they are still offering liquidity to the market, which is good, providing that it is in a more measured manner.

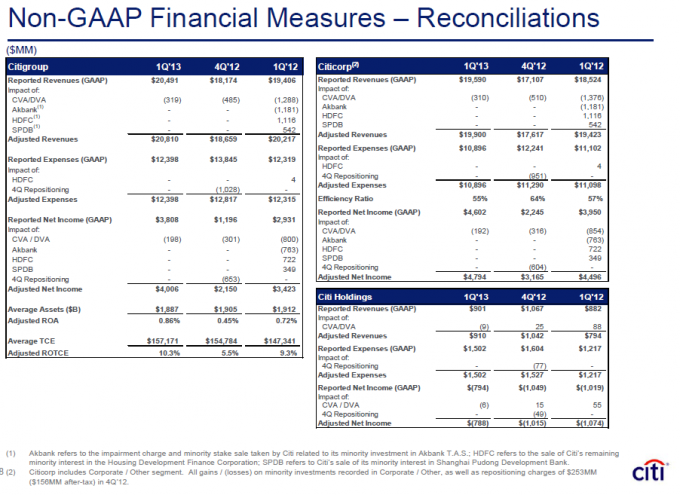

Based upon my research, I have forgiven Citigroup for their antics today, and think that they are on the right path to rebuilding. They aren’t out of the woods yet though, and the recovery will likely take another 4-5 years to occur. In that time they need to wind down their ownership of CitiHoldings and focus on CitiCorp, the former is basically a weight around their neck for now, and is hosting a lot of the toxic assets that they are trying to eradicate. The hope is, that they can make it that far before another larger scale socio-economic factor impacts the markets…

It is good to see that Non Gaap results for CitiCorp is looking good, and CitiHoldings whilst being the ugly stepchild is looking like its clearing up its act a little, and hopefully can be carried out of its current state, wrapped up in chains and dumped somewhere far out to sea.

I’m currently considering doubling down my position in Citigroup Inc (C) and also purchasing some water balloons to hurl at those peppy kids running through Southern Manhattan in their Citi Shirts.

Leave a Reply