The decision as to when you decide to take social is not to be taken lightly. Taking payments early will reduce the monthly amount, and delaying them will increase it, for the duration of your life. This post will attempt to shed some light onto the factors that come into play in this decision.

Calculating your PIA

The first consideration when looking at social security would be to understand the monthly ‘base’ payment. You start with a number called Primary Insurance Amount (PIA) which is calculated based on how much you have paid into the system over your lifetime. The calculation is:

(a) 90 percent of the first $826 of his/her average indexed monthly earnings, plus

(b) 32 percent of his/her average indexed monthly earnings over $826 and through $4,980, plus

(c) 15 percent of his/her average indexed monthly earnings over $4,980.

Source SSA.gov PIA Calculations

Note that the max PIA that can be attained is $2663 in 2015, this is prior to boosting it by electing a later distribution.

It is important to know when your payments into the fund are considered 100% vested, also known as the ‘Full Retirement Age’.

| Year of Birth * | Full Retirement Age |

|---|---|

| 1937 or earlier | 65 |

| 1938 | 65 and 2 months |

| 1939 | 65 and 4 months |

| 1940 | 65 and 6 months |

| 1941 | 65 and 8 months |

| 1942 | 65 and 10 months |

| 1943–1954 | 66 |

| 1955 | 66 and 2 months |

| 1956 | 66 and 4 months |

| 1957 | 66 and 6 months |

| 1958 | 66 and 8 months |

| 1959 | 66 and 10 months |

| 1960 and later | 67 |

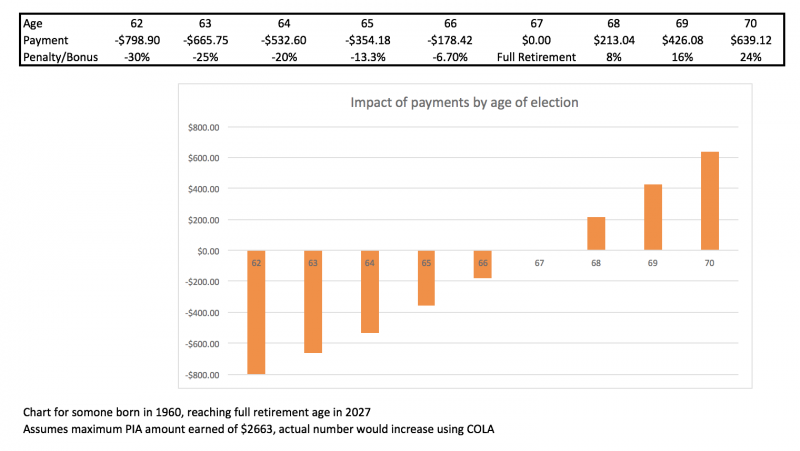

From the table, people who are born after 1960 have a full retirement age of 67. This means is you elect to take payments prior to this age you will be penalized for early distributions, an if you elect to delay receipt of this you will actually be paid a bonus rate when you do elect to receive distrubtion.

The full rate table for penalty and its impact on spousal benefits is here. The bonus rate table is found here.

Note that the earliest you may elect to receive social security is at 62 and the latest that will incur the bonus is 70 (you may defer later, but it stops gaining the boost). As an aside, it is possible to receive social security payments in the event of death, where a surviving spouse will may receive it from 50 (at a reduced rate) or at any age if the spouse is caring for a child 16 or under.

The impact of the bonus on monthly payment

The maximum penalty is 30% and the maximum bonus is 8% per year of deferral.the penalty is calculated based on how early is ‘early’ in that it phases out. The maximum bonus depends on your year of birth. Anyone born in 1943 or later would get the full 8% per year.

Should you delay payments?

The penalty and bonus amounts are calculated actuarially. That means that the SSI administration decided that overall, this will average out for them. So the question really comes down to how long you plan to live, and where is the breakeven point. Wade Pfau wrote a great piece on this topic and shows the breakeven level for delaying to be around age 79-80.

The way to figure out the value here is to consider the payment starting at 62. In another example, If you were to die at age 90 that would be 28 years of reduced payments. Compare that with if you delayed until 70, and received only 20 years, but at an enhanced rate.

| Adjusted PIA | No. of Payments | Total Received | |

|---|---|---|---|

| At age 62 | $1,864 | 336 | $626,338 |

| Full age | $2,663 | 276 | $734,988 |

| At age 70 | $3,302 | 240 | $792,509 |

In the example here, I set the life expectancy at 90, and as you can see the money received from the SSI fund is $166,171. Clearly, the decision here ‘appears’ wiser than taking the early payment. But there is another thing to consider:

The Discount Rate

In today’s low rate environment the guaranteed increase in SSI payments of 8% is attractive. However, a factor in that is the rate of return that could be earned on the penalized payments. We need to remember that by delaying 8 years (from 62-70) we are opting out of the ability to invest that reduced monthly payment.

As such, one of the biggest considerations regarding the delaying of social security is the underlying interest rate that could be earned between the age of 62-70. Interestingly, this rate could be a lot higher than many expect if there was any family debt. A simple example might be if there were large car loans. The interest on these could be avoided by prepayment via the additional cash flows of social security.

A more sophisticated approach might be to consider interfamily lending opportunities. For example, if a child or grandchild had student loan or other debt at a high rate, they could receive a loan from the parent using the IRS Applicable Federal Rate table this could create value opportunities for family wealth. There are many opportunities to put the cash flow to work and some may offer an edge even with the penalized level of payment.

Further considerations

Opportunities abound within married couples, including same sex couples. A classic strategy would be to elect to defer one of the couples social security payments so that it gains in value, while drawing off the others as spouse. This would work as follows:

If Sam and Bob are married and both have a PIA of $1500 at 67, Sam could elect to defer his payment to age 70, gaining a 24% upside at that time. In the interim Bob could elect to receive $1500 per month at age 67, and Bob could claim spousal benefits (50% of PIA). As such that would mean that for the three years between 67-70 the combined monthly payments would be $2,250 and at age 70 Sam would swap to his own payments at the enhanced rate. The new benefit level would be $1,860 meaning a combined income of $3,360 going forward.

What about taxation: continuing to work while receiving SS? Thank you.

The way that works is you can earn ‘some money’ without it making SS taxable but once you go over a threshold it makes some of you SS taxable, and if you go through another salary threshold it makes more taxable. The highest rate is 85% meaning 85% of your SS income could be considered taxable income when earning a salary.

The rate tables differ based on filing status (single, married, jointly etc)