This topic is particularly useful for those who run their own business, and particular boring for those who do not. Long story short, you might hear about how ‘businesses can deduct their costs’. Well, these three factors are a key part of that:

- Section 179 Property

- Bonus Depreciation

- Regular Depreciation

What is depreciation, and how does it impact your taxes?

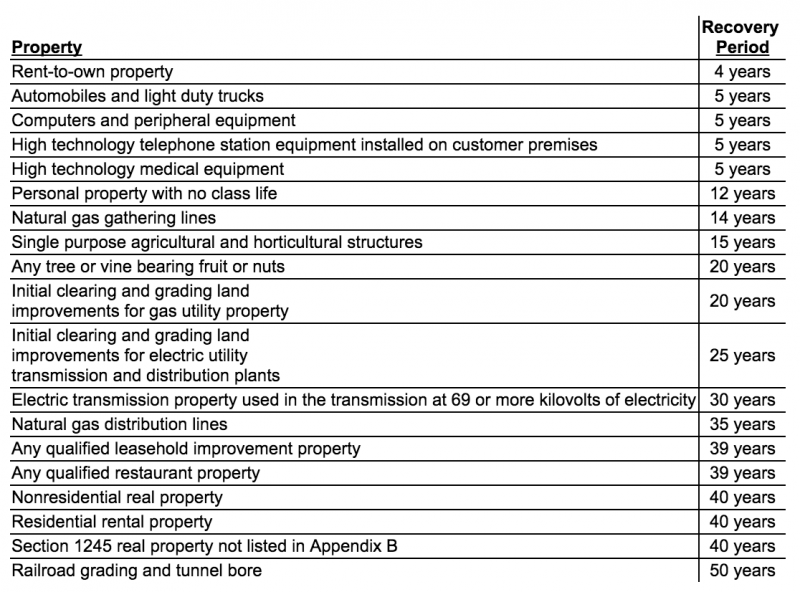

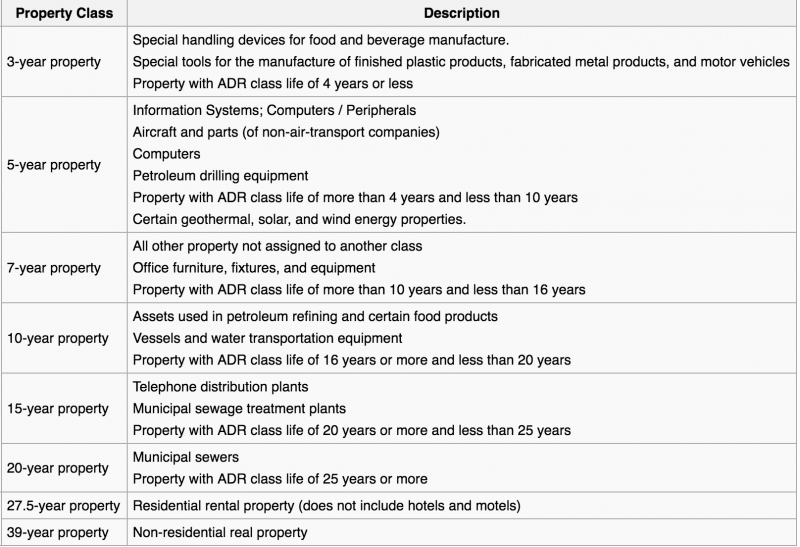

Depreciation is the concept that certain use assets will lose their value over time. In business, you are allowed to claim this phantom loss on an annual basis even if you haven’t actually disposed of the property. The US follows the MACRS system, which has two types of schedule, GDS and ADS, within that, there are three methods of depreciation under GDS and one under ADS:

- The 200% declining balance method over a GDS recovery period.

- The 150% declining balance method over a GDS recovery period.

- The straight line method over a GDS recovery period.

- The straight line method over an ADS recovery period.

ADS Property

GDS Property

The method that you must use (ADS or GDS) is optional, unless certain criteria are met:

Required use of ADS. You must use ADS for the following property.

- Listed property used 50% or less in a qualified business use. See chapter 5 for information on listed property.

- Any tangible property used predominantly outside the United States during the year.

- Any tax-exempt use property.

- Any tax-exempt bond-financed property.

- All property used predominantly in a farming business and placed in service in any tax year during which an election not to apply the uniform capitalization rules to certain farming costs is in effect.

- Any property imported from a foreign country for which an Executive Order is in effect because the country maintains trade restrictions or engages in other discriminatory acts.

All of the above relates to what I term ‘regular depreciation’ though, it is clearly a little confusing.

Section 179 Property

This property may be depreciated in full, up to a maximum of $500,000 per year (there’s another cap that comes in at $2M to be aware of also). For example, rather than depreciate a computer over a five year period, the business owner may elect to deduct the cost in full in year one. This is what you hear a lot about when people talk about ‘writing it off for the business’. Not all property is considered Section 179, but a lot of it is.

Section 179 property must be used more than 50% for the business, and any personal use cannot be deducted.

The SUV rule

An SUV with a gvwr over 6000lbs (and under 14000lbs) would qualify for a section 179 deduction if it met the business use criteria. SUVs are weighed without load, and trucks would include load and fit under these rules. The limit to the deduction for such qualified vehicles here is capped at $25,000.

50% Bonus Depreciation

This is a special rule which allows you to depreciate 50% of the value of the item in the first year, and can layer on top of both the Section 179 deduction and regular depreciation.

The Reseller’s example

Let’s imagine someone built a profitable reselling business and needed a SUV to source/collect materials and send them off for shipment. If the vehicle was a qualified SUV they might:

- Pay $60K for a

fancyfunctional SUV- Deduct $25K as a section 179 expense

- Deduct $17.5K as a 50% bonus depreciation expense

- Deduct $3.5K as a 20% depreciation expense

Total first year deduction $46K, the balance being depreciated over future years.

Last thoughts and caveats

- The company needs to be making enough money to cover this deduction for it to work.

- Business use must be at least 50%, and any personal use cannot be deducted.

- Depreciation reduces the basis in the property – if you depreciated the SUV by $46K in year one and sold it for $50K in year two, you’d have a gain of $36K, which would be taxed at ordinary income rates.

- Section 179 deductions make ‘writing off’ genuine business expenses much easier, but don’t forget that you are really reducing the basis, so just like the SUV, if you later sell the property, or reclassify it as personal use, recapture can occur.

- This isn’t specific tax advice. Take the idea here and talk it over with your advisor.

In the SUV example, is the business depreciation in addition to business mileage? (which I thought was supposed to cover maintenance and depreciation)

If you depreciate any way other than straight line eg if you section 179 the car you can’t use the IRS mileage election and instead have to use real expenses which you need to keep records of.

Thanks, good info…I’m keeping track of mileage as well as real expenses. We’ll see which makes more sense come tax time.