I’m in the middle of reviewing Wealthfront, a technology based, self proclaimed advisory firm based in California. I found my review was being distracted by more generic issues with Robo-Advisors in general, so in the effort to keep that review on point I thought to share the generic issues here. The term ‘Robo-Advisor’ is given to financial firms that are tech centric, rather than following a client/advisor person to person model.

There has been a steep rise in popularity of firms like Wealthfront and Betterment in the past few years. Many were founded around the time leading up to the last financial crisis and they are taking full advantage of that. Consumer sentiment towards the establishment is at all time lows, and rightly so after the despicable manner in which people and institutions have been caught operating in. The marketplace is ripe for a new, cleaner, more trustworthy solution.

I do like Robo-Advisor firms, however I do have an issue with their marketing. It pretty much starts there and ends there, and for me it is a big deal. When I reviewed Betterment originally I disliked the product, but after speaking with some of their team I warmed to it, with the exception of some marketing strategies.

I’m not sure who produced the below graph first; the first time I saw it was on Wealthfront, and today I see a very similar thing on Betterment, but this is the sort of thing that really bothers me. As someone who has presented financial plans and scenario models I know full well that graphs can convey data effectively, which is a powerful tool, but they can also be used by savvy marketeers to convey a message that stacks things very much in their favor.

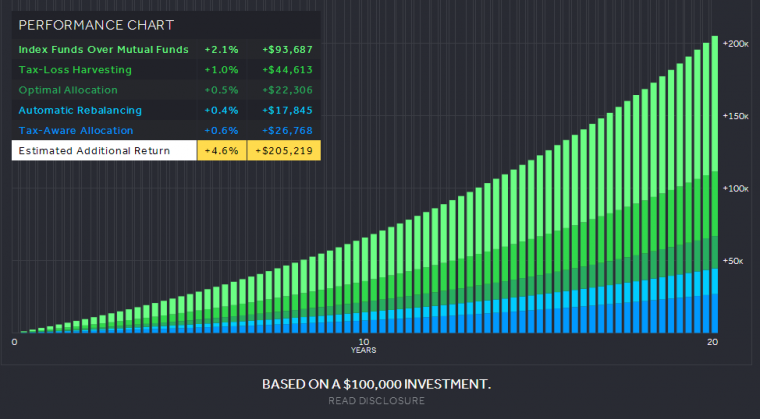

Wealthfront’s Edge Graph

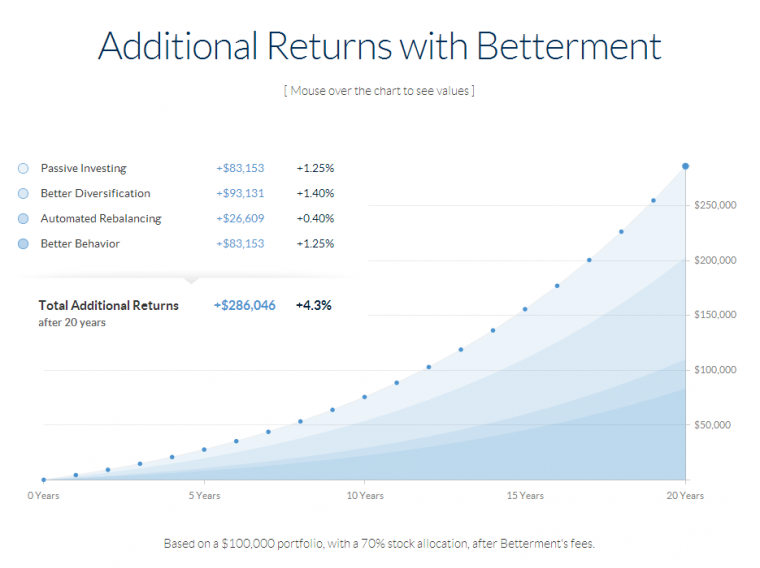

Betterment’s Edge Graph

You see how they both offer a very similar visual? It is a great selling tool. What I find interesting is that the marketing boffins at both firms managed to offer almost the same upside edge using their methods – which is somewhat odd when Wealthfront offers Tax Loss Harvesting (accounting for about 1/3 of that upside) whereas Betterment does not… yet they still come out very close.

When I say close, I mean as percentages, since Wealthfront states a 4.6% upside ($205K gain) and Betterment a more modest 4.3% upside ($286K gain) I guess that Betterment have better calculators?

I’d hazard a wild stab in the dark here and suggest that the marketing folk at Betterment saw that super graphic at Wealthfront and somehow got the numbers to match up, while not offering the same level of solutions. Now, before you think this is turning into a “why Wealthfront is Better than Betterment” post, keep reading, because it won’t.

Where are they getting their benchmark data from?

This is the root of my marketing issue. Firms like Betterment and Wealthfront both appear to be targeting generation X,Y investors, and they clearly are happy to sell their product as an alternative to a stuffy, untrustworthy, expensive traditional advisor. We all know that comparing a product with the Wall St sleazeballs is a simple win. It is like Gatorade marketing their newest energy chew snacks and comparing performance against stopping to smoke a cigarette at halftime. Yes, they are both snack time solutions, but are they really equal?

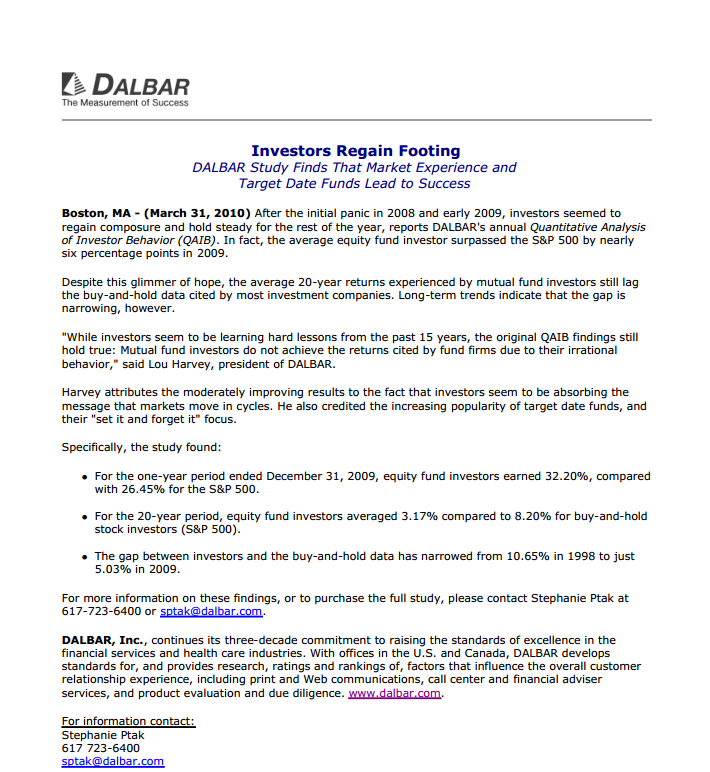

If you look under that chart from Wealthfront you get the ‘disclosure’ section. They cite that the 4.6% additional performance is against 20 year average performance of Mutual Funds. OK so we are comparing energy chews and ciggies, but that is to be expected. I guess what is more interesting is the date of that report. It isn’t cited in the disclosure, but the hyperlink does take you to a release dated March 31st 2010:

This document was released 4 years ago, the year after the financial crisis. We have since gone through one of the greatest recoveries and the markets are at all time highs. I’d like to propose that it is by no mistake one of their key marketing tools uses older data. The benchmark they are working against is 3.17%

But wait! The chart shows only additional growth!

The chart states it shows the edge or advantage of Wealthfront. And that over 20 years, compounded annually that is the difference you would see. I can understand based on that an argument that states the benchmark doesn’t matter.. but it does. Let’s skip the pretty graphs and look at the numbers:

- Wealthfront claims that 4.6% upside is offered and it will be worth an additional $205,219

- Betterment claims that 4.3% upside is offered and it will be worth an additional $286,046

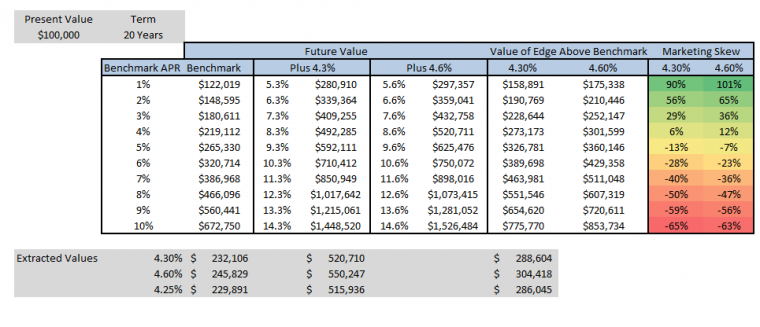

My HP10B2+ Financial Calculator states that the 20 year, annually compounded growth of $100,000 would be:

- $245,829 @ 4.6%

- $232,106 @ 4.3%

The reason we have four different numbers implies the marketing boffins are up to something -and perhaps the guys at Betterment win this marketing battle? Remember what we are looking at in the charts is advantage or edge, so when we see a growth of $100,000 to $205.219 that isn’t the final number that Wealthfront is suggesting our wealth will be worth. It is instead saying that it will be worth benchmark plus $205,219.

Taking another look

Betterment doesn’t directly show their benchmark, it references a 70% stock allocation, and as a reminder Wealthfront opted for a 3.17% benchmark. When looking at the impact of a fixed percentage it is obvious that proportion matters, adding 4.6% to 1% makes a much greater impact than adding it to 10%. In the chart below I labeled this incentive to find a lower benchmark ‘marketing skew’.

The calculation I used was simply to take the annually compounded benchmarks of 1%-10% and divide into that the 4.3% and 4.6% compounded returns respectively. The purpose of this is to show the marketing skew attractiveness of finding a lower benchmark, or a measure of incentive to find a PDF from 2010 to back up your chart….

From a benchmark perspective, in order for Betterment to be able to offer $286,046 for an additional 4.3% of gain it seems they must have used 4.25% as the compounded growth of 8.55% is $286,045.

Here’s as close as I could get to understanding the numbers at Wealthfront:

Which isn’t close at all – it seems to me that if they are claiming to outperform 3.17% by an additional 4.6% then their number of $205,219 makes no sense. Maybe I am just too dumb to figure out their math. I did just call them up to ask about it and the person I spoke with had no idea whatsoever about this chart. I’m sure that I am missing something obvious and hopefully one of my savvy readers can help me out here.

What is clear to me from this data is both Wealthfront and Betterment are proposing more than 100% ROI over the ‘competition’. It just seems like a wildly high number, and I feel it is perhaps because the marketing teams have surpassed one another in terms of excellence.

In case it isn’t clear (because I am definitely picking on them) I do like both of these firms. I just want more from them. I truly see a gap in the market and the ability to do right by the investors who have been so atrocious treated by the banking industry. It would be good to see a touch less ‘skew’.

The Financial Advisor Moniker

I dislike it. Neither firm should call itself a financial advisor. Though I would certainly advise going with them over those two bit shills you find at places like Metlife – just because any old clown can call themselves an advisor doesn’t mean everyone should.

A real financial advisor will look at things holistically. As I am wrapping up my Certified Financial Planning course now I have been exposed to the following areas of study:

- Insurance

- Investments

- Tax Planning

- Retirement Planning

- Estate Planning

Financial advice needs to bring all of those pieces of the puzzle together, and these Robo-Advisor firms only focus on the Investment stuff. I would argue that they actually do that more efficiently than a Planner could, and I am not saying I wouldn’t recommend their products to my clients through the RIA side, but they are limited.

This bothers me more with Wealthfront. Their real edge (despite all that marketing) over Betterment in that they offer Tax Loss Harvesting. However, this is a very dangerous tactic to automate. It is easy to simulate the profit from a Tax loss harvest, but a true strategy for this needs to factor in things like income (and its projections) and also other investments. If the Wealthfront client has assets with another firm what happens when one person buys and one person sells and they cancel out harvesting through wash sale rules? It is very hard to automate just a segment of ones investments and very easy to miss things like this.

Conclusion

I feel that the marketing efforts of Robo-Advisors to capture market share is projecting a misleading image to the consumer. Such firms do indeed offer considerable value over traditional methods of investing, but not so clearly over low cost index fund solutions. Essentially what they are able to offer is a more sophisticated target date savings program, that allocates based upon risk and rebalances in the same way.

I would recommend both Wealthfront and Betterment to people who are seeking a simplified investment strategy, and I would recommend to both Wealthfront and Betterment to step it up and stop comparing themselves to the dinosaurs of the investment market, and instead challenge firms like Vanguard with their value prop.

Interesting read – thanks for doing the comparison and number crunching. I started playing around with Betterment late last year but have been thinking about Wealthfront recently. So far I’ve just been putting in $100/month to see how the product works but was considering rolling over an old 401k.

Obviously I’m not an active investor at this point so the idea of a fire-and-forget retirement savings product appeals to me. I do wonder if just putting the money in a total market index fund would be the right way to go vs products like these though.

Depends on your age and how far you are to hitting your financial independence. If you are young and have a ways to go then total stock will be fine, but if you have built up a solid savings amount then these firms offer diversity along the efficient frontier.

You can emulate that somewhat by selecting an appropriate target date retirement fund (I would suggest drifting that date out away from your ‘actual’ retirement fund to make it more equity heavy.. or you could just go with these guys. They aren’t bad at all, and take away a lot of the work from you.

I think that they offer a good service, and they charge for it – the .25% is the tax on what you could do with vanguard yourself.

Hey Matt, trying to catch up after a long day. I am at Starbucks being hit left and right by Chase Ink card links man, it’s just brutal today.

I have seen outfits like this before. Let’s see how many last after they go through an ugly bear market. Yeah, advisors can be more expensive of course but do not underestimate what they can do, which is primarily behavior modification. In other words, we keep clients from doing stupid things with their money 🙂

Anyways, they key is of course advising only after you have a comprehensive view of their finances, themselves, their current situation, attempt to gauge risk tolerance (huh, expect surprises!) and of course goals, goals, goals.

I have lots more to say but need to finish darn next TBB blog post.

I think that the bear market bank run mindset will hit these guys hard. Without the emotional connection it will be difficult to retain customers. That for me would be a real place to focus marketing efforts- building a zealot like loyalty to the brand and the best practices would offer a lot more long term value than taking market share from the wirehouses.

I certainly do prefer these guys over the pimps pushing product, and think that they have a bright future if done right.

My wealth manager is one of the richest men in the world with a 40+ year track record of beating the market. No lockup or performance fees. His fund is publicly traded with high volumes so solid liquidity. His portfolio spans private equity, bonds, derivatives, and public companies. Why would I go with a company which has no track record with advisors who are not on any Forbes richest list? How many of these so-called advisors (robo or not) are among the top 25 richest people in the world?

Sleep at night, focus at what you are great at, and leave the investing to Berkshire-Hathaway. 🙂