I brought some Estate Planning concepts into a post talking about Frequent Flyer miles in order to help people re-frame their risk models. One of the matters that was discussed was Estate Taxes for amounts that are above the 5.34M basic exclusion amount. I only wrote about it as an aside, yet some of my readers picked up the notion of Portability, which I thought showed a great degree of sophistication from them.

My reply to the comments was that Portability was not permanent, to which I was directed towards the writing of Michael Kitces which shows how it was indeed made permanent as part of the Tax Payers relief act of 2012 frankly, it seems like I was wrong, so I dug a little further and want to share my thoughts with you here.

What is Portability?

Portability refers to the transfer on death of a spousal share of unused lifetime exclusions. It only affects a very slim sliver of society. It has relevance to married couples that have combined wealth between $5.34M and $10.68M (at time of second spouse to die) who have unbalanced asset titling. One could argue that it continues to have relevance above $10.68M however it will start offering diminishing returns. Let’s look at some scenarios to help us understand the impact:

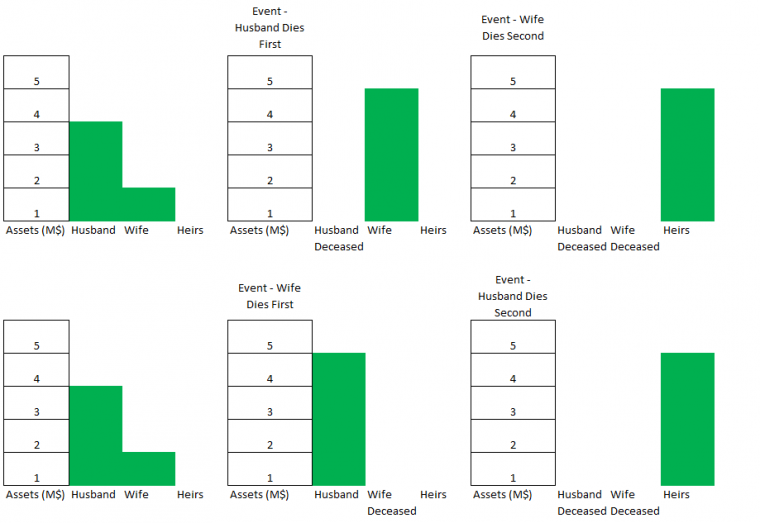

Example 1 Combined Wealth less than $5.34M – Without Portability

Portability in this example is not necessary and makes no impact because at the time of the death the second spouse has assets that total less than $5.34M

As you can see, regardless of who passes first, the surviving spouse in this example has an estate of $4M. The Husband passes $3M to the Wife with no tax consequence as $3M is under $5.34M, and the Wife can pass it onto the Heirs because her $4M also less than $5.34M.

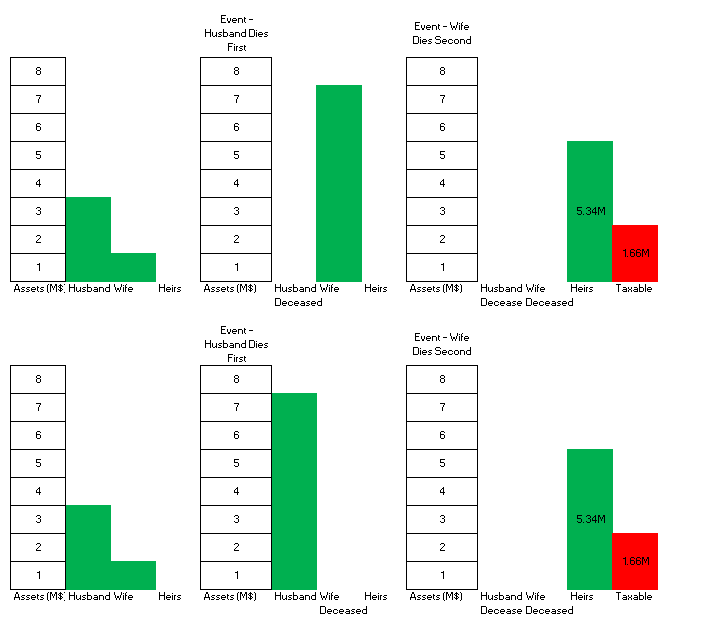

Example 2 Combined Wealth greater than $5.34M – Without Portability

In this example, let’s look at the second spouse (either one) surviving long enough for the wealth to grow to $7M.

Even though the Husband only inherited 1M from the Wife her entire $5.34M allowance was terminated at her death. This means that if the surviving spouse’s assets later grew to be valued above $5.34M at the time the second spouse dies, they will owe estate taxes on the balance ($1.66M in this example) when they pass on to their heirs.

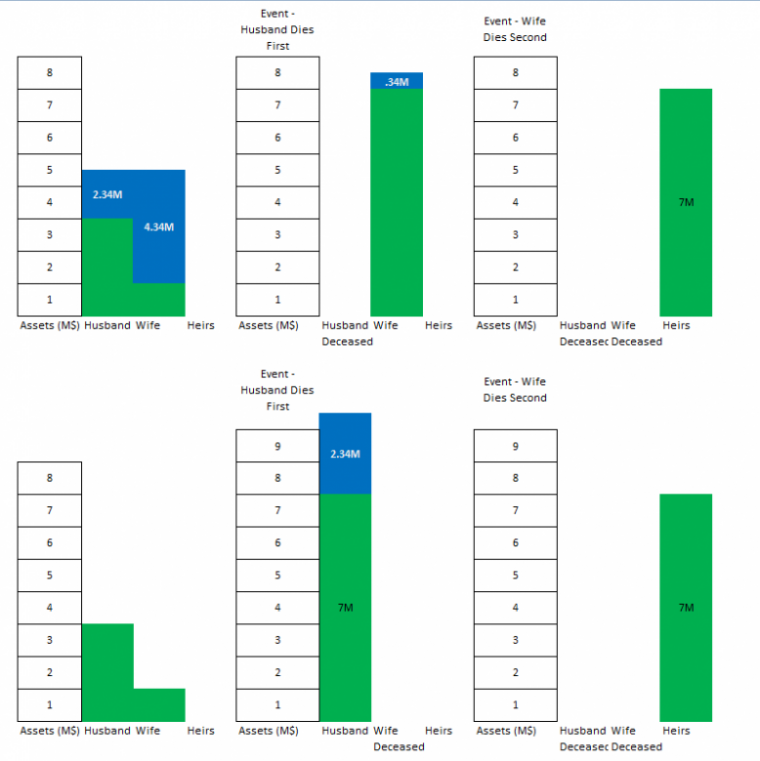

Example 3 Portability in Action

In this example, the surviving spouse not only inherits the wealth, but also the unused part of the exclusion amount.

So why isn’t it permanent?

Well, it is permanent, I was misinformed. I spoke later with the people who told me it wasn’t really permanent to see if I was missing anything and as Kitces stated in his comment to me it was more a case of Trust and Estate Lawyers selling on fear to keep business thriving. However, there is some wisdom to the T&E argument… and it goes like this:

If you read this far, and you don’t have between $5.34 and $10.68M in assets then it is quite possible that you think Portability is a bunch of baloney. Why should the rich get richer and have all these extra breaks?

The T&E sales pitch is that the government is particularly sensitive to things like this in public opinion, so it could well become a bargaining chip for future elections, and could be removed. The difference with a Trust is that you can redirect assets today to a financial plan of your choice. For the government to attempt to bust into that trust it would take huge legal challenge, perhaps even at the Constitutional level, in other words if you pay for the trust you are a lot safer.

If instead you rely on Portability, it could (fear sale) be removed in the future, meaning your plan fails. However, even if it is removed in the future it will only impact a slim sliver of the already narrow field. It would be the people who didn’t react to the change in legislation AND were also within that financial demographic.

Who it could affect

Let’s consider the surviving spouse, if they are sitting on an estate with a value greater than the exclusion amount and were relying upon Portability to cover this then there is a chance that they could be impacted. There is also a chance that the Government would allow people who have already ‘inherited’ DSUEA to retain them and not be impacted.

Therefore, my advice would is that if you are aware of Portability and are leaning on this in your plan that you keep a watchful eye on any changes, and adjust accordingly. It would be prudent for you to have authorized powers to people who can be trusted in your stead to take such actions should you be aging, and unable to action this yourself. For most people in this bracket, based upon my investigation into Portability I would not recommend using a Trust when this legislation will do what is necessary to achieve goals.

Important Note on Retro-activity

Please note that Portability is retroactive until at least 2011, and includes Same Sex couples who were legally married in their State, but previously not recognized by the Federal system. If you know of someone who has passed with a large Estate in recent years it would be wise to quickly explore if Portability can work for them. The ability to look back and take the Portability Election is limited, so do not waste time in connecting with a planner on this.

Portability as described in this post applies to Federal Estate Taxes. Taxation at the State and City level is not impacted by Portability rules, which does also raise some valid arguments for those who think Portability alone does not replace Trusts and Estates.

“At the extreme, if the Husband owned exactly $5.34M and the Wife exactly $0 if the Husband died first his portability would wasted, the Wife would only have her own $5.34M when passing to heirs vs if they had titled things 50/50 prior to death which would create a surviving spouse lifetime exemption of $8.01M”

I think you have this wrong, or I don’t understand what you are saying. If husband owned $5.34M of assets, and wife had zero–husband could transfer $5.34M of assets to wife and would be eligible for marital deduction. See I.R.C. 2056. If he made no taxable gifts during his lifetime, he could then elect to port over his $5.34M to his wife. His wife would now have $10.68M exclusion that could be applied at her death. I’m pretty sure portability along with the unlimited marital deduction solves the titling of assets problem completely.

I think you are right, I agree with this and didn’t explain it very well… Will revise. I adjusted the post accordingly and agree it removes the concern, other than in the summary which applies to State tax rules. Thanks for catching that, I was having a blond moment and made a rather large error there.

I had meant to circle back on your post and see what you were getting at for not permanent. Its fantastic that Kitces came over and posted on your blog. I am big fan of his writing.

There is still a place for bypass trusts if one expects further appreciation of assets post death (e.g. May/December marriages with a kids). Doesn’t exactly make for an analogy to miles since they are prone to devaluation, not appreciation.

Thanks for coming back!

Anything makes for an analogy if you can believe it 🙂

I personally don’t think the appreciation/depreciation matters since assets going into trust don’t need to appreciate in order to benefit from its protection. The point is that if you leave ‘point assets’ unprotected vs growing them within something like SPG as a protective vehicle you are more exposed to losing value. I think that is a fair point and using trusts is just a fun way to explain that.

I’m glad Michael popped over too, I enjoy his stuff in the FPA magazines.

Cheers, Matt