From a tax perspective, a Solo 401(k) AKA Individual 401(k) is one of the most attractive retirement solutions for solopreneurs. The Solo 401(k) also allows you to cover your spouse, if you have other employees though, you have to consider other options, such as a more traditional 401(k) program, or something like a SEP-IRA or Simple IRA.

People often shy away from a Solo 401(k) despite the upside it offers because they are fearful of the complications it presents over a SEP, so let’s walk through the components of how to actually set this up, and demystify it a little.

Payroll

Technically, you don’t need payroll to run a Solo 401(k) but many self employed people may wish to run their business through an LLC or Corp structure. There are many different ways to run payroll, prices and service varies, here’s a few that I’ve used myself or am familiar with:

- Bank driven Payroll – I used to do business banking with Citibank, and their payroll service was around $30 per month. It was a little annoying to use since you had to log in via an archaic business portal with a key fob ‘passcode’.

- Paychex – prices vary, but I’ve seen quotes from $50-60 per month.

- WaveAPPS – I’ve used this for a few years. $15 per month plus $4 per employee. This is really barebones and requires you to mail off checks to the relevant tax authorities… a painful and laborious approach.

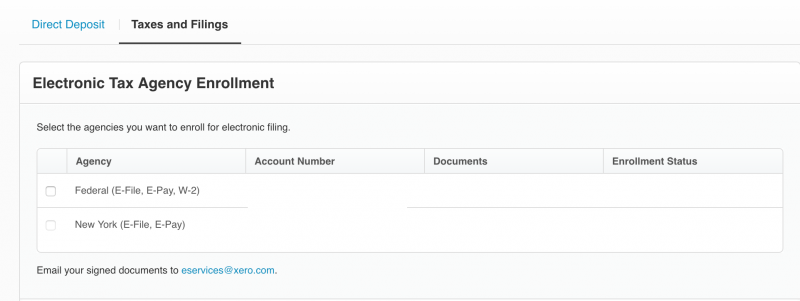

- Xero – I’ve just started using this, $30 per month, with 40% discount on the first 6 months using code 40XERO16 Xero is like Quickbooks, but I personally find it a lot cleaner and easier to use. The advantage to Xero over the other pure payroll solutions in the list is that you can link business bank accounts to track profit and loss, store inventory, etc. Xero has direct deposit options too, allowing you to split payments into several accounts, and electronically pay taxes and file quarterly returns. Unfortunately it isn’t available in all states yet, but they are coming soon, so check before you buy this!

When you establish payroll for your company you need a few pieces of information:

- EIN (for Federal reporting)

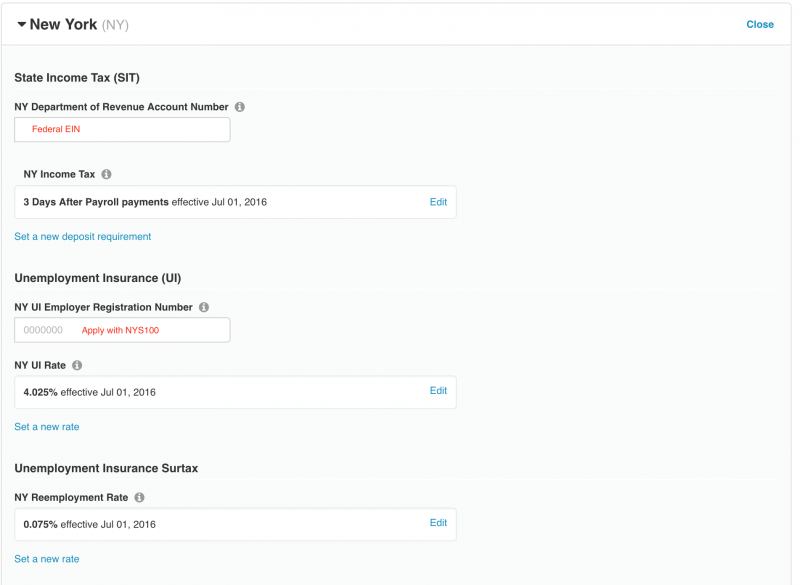

- Local State and City tax numbers for various items. For example, New York State requires a number for State filing (they assign the Federal EIN for this) and a number for the NYS Unemployment Insurance fund, if you are doing this yourself you’d need to file form NYS100, which can be done online here.

Xero Setup the Payroll rules

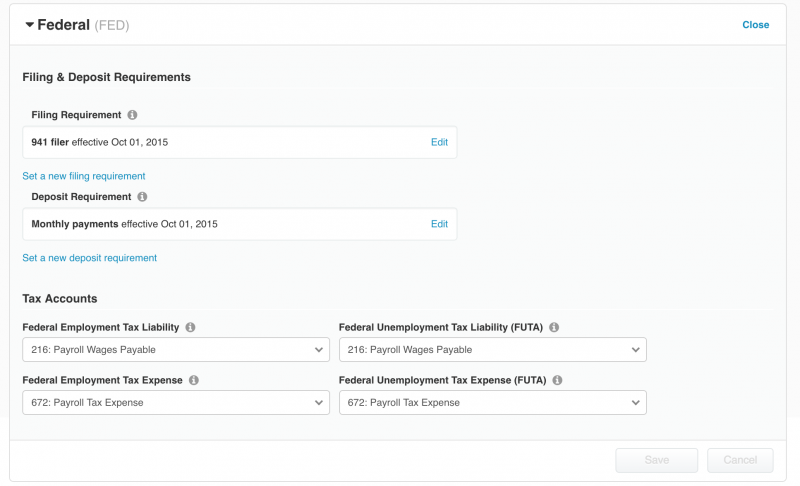

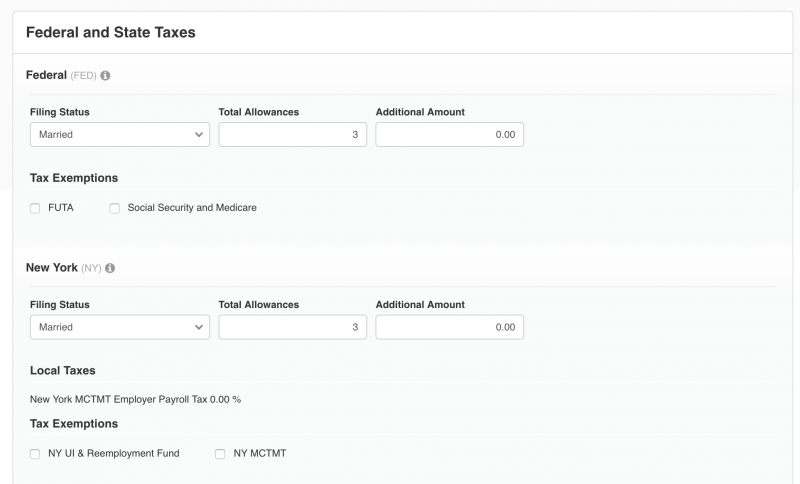

Here’s how you might set up Xero for Federal requirements

And then State

Filing taxes

Filing is required generally on a quarterly basis – consider this an informational return telling the tax authority how much payroll has been processed for the period. This will also allow you to generate W2’s.

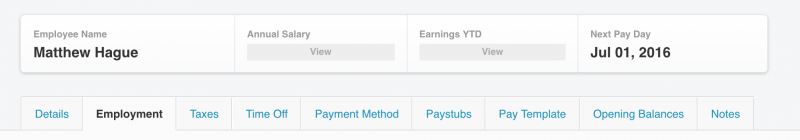

Xero set up the Employee Rules

You can have up to 5 employees on the $30 plan, they can all have their own pay rate and deductions.

The Details Tab is personal information, name, position title etc.

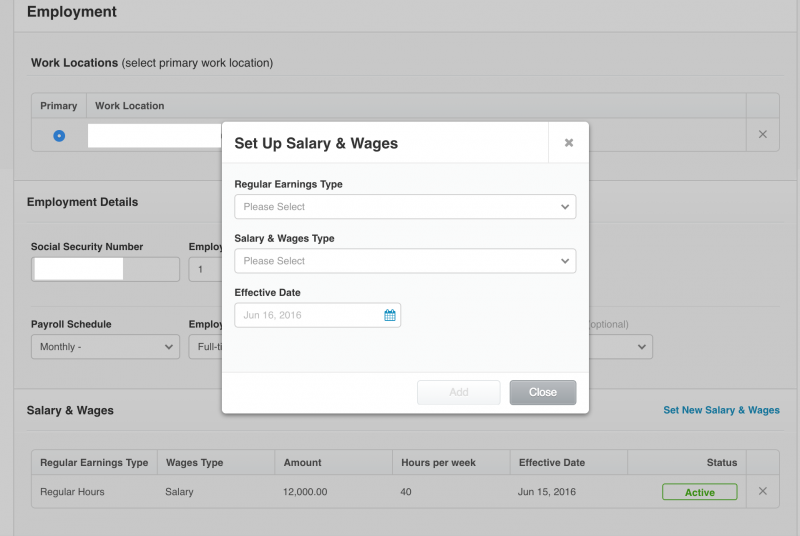

The Employment Tab is quite useful, and allows you to set the salary for your ’employee’, in this example I set a salary of $12,000 per year for me.

The Taxes Tab dictates how much is deducted in withholding tax each pay period.

Allowances here are 1 for me, 1 for spouse, 1 for child.

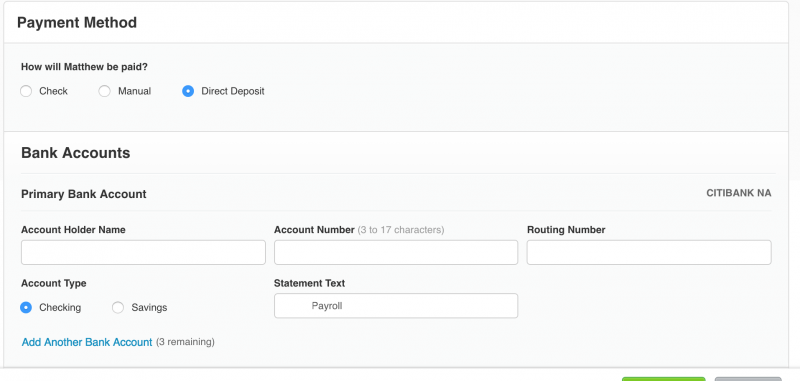

Payment Method Tab – this allows you to select direct deposit, meaning your linked business bank account within Xero can ACH to your employee’s personal account (up to 4 different receiving accounts)

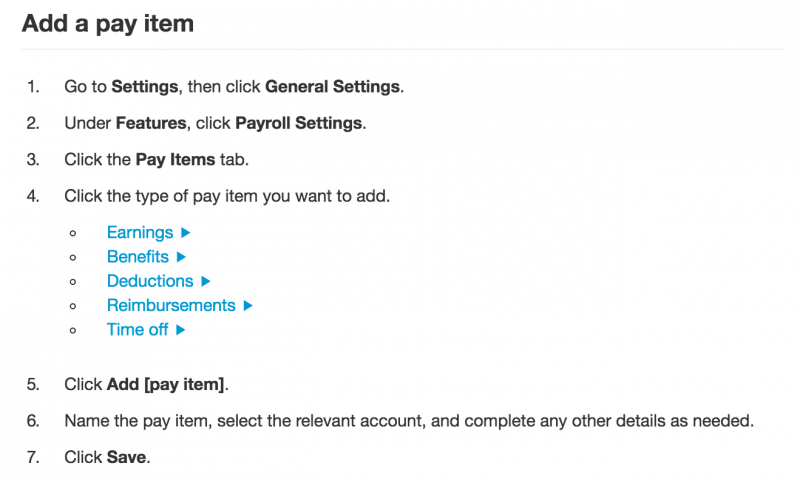

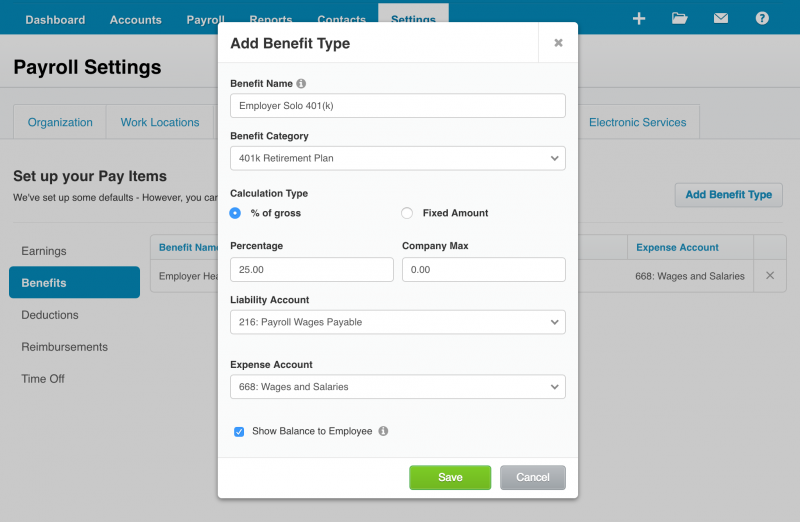

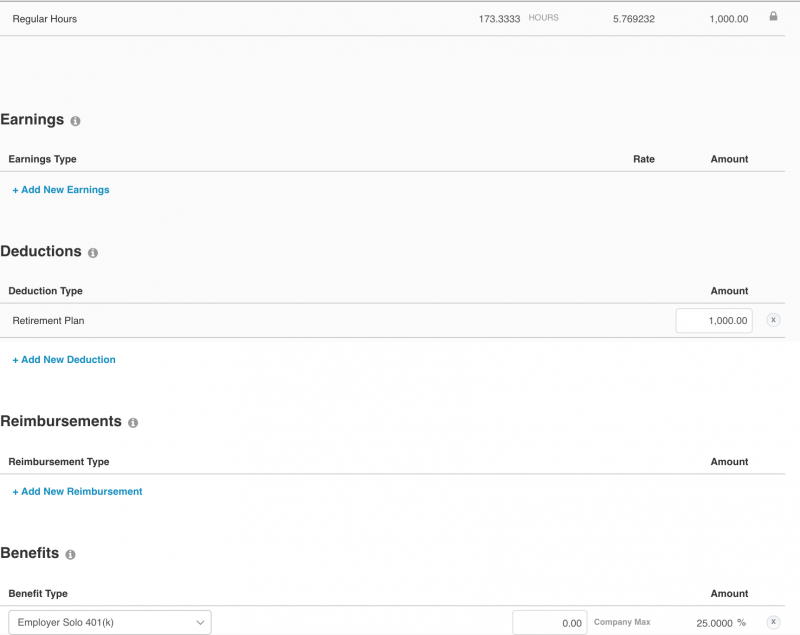

The Pay Template Tab is where you would add in the Solo 401(k) contributions. Remember there needs to be both an Employee Deduction (reducing salary, just like a Traditional 401(k) along with an Employer Contribution, which can be 25% of salary when run through an Corp. By default, Xero doesn’t list the Employer side, so you’d have to add that:

The Pay Template Tab with deductions

That’s basically it, you’ve set up a payroll to pay you $1000 of which you deduct $1000 into a retirement account, and your company adds $250 on the top.

The Solo 401(k)

The Solo 401(k) is a distinct entity from the Payroll. The payroll will not push money into the 401(k) monthly because the 401(k) wants someone to tell it whether the income funds are to be allocated to the EmployEE or EmployER side. This means a manual ACH push each month into your Solo 401(k) is required in most cases, where you tell your business bank account to send $1000 EE and $250 ER.

Even though the money is considered separately at contribution time, it goes into one pot for investing. The reason they want to know about EE or ER is to make sure you do not exceed the limits for each.

Plan Docs, Reporting, and Custodians

These are the trinity of the Solo 401(k). The Plan Documents dictate the rules of the 401(k). If you build a custom plan you can say whether it can receive rollovers, or be a Roth, or many other elections. If you take an off the shelf plan you have to accept the limits of such a plan. The decision here is primarily cost and return on the investment. A custom plan document should start around $365 with someone like Ascensus, with an ongoing $99 annual fee for reporting.

Reporting isn’t that bad.. you can use IRS Form 5500 EZ but it is only needed once the account balance is greater than $250K. So for many start ups that will be several years down the road, and when it is needed, it isn’t that complicated to do, or have done for you.

Custodians hold the funds, they are brokers such as Vanguard or TD Ameritrade.

Some custodians will have their own prototype plans in place, such as Vanguard, where you can take the off the shelf plan, fund it monthly from business checking, and report the value to the IRS once it grows beyond $250,000. Others will allow you to host your funds (they take ‘custody’ of it) providing that you have the proper documents in place, this is a simple trust account with the plan dictating the rules of the trust.

There you have it! While you don’t need to run Xero to run payroll, the value add is that you can manage all income and expenses quite easily with it, and Payroll is just a component of that. Once up and running you can easily set up a Solo 401(k) for yourself and deduct your salary. Here’s some more information on how the different retirement plans ‘integrate’ with existing employer plans or other small business plans you might have established> Retirement Plans

Great Stuff!! thank you