The decision to pay off your debt or save is faced by many people, a particularly strong segment of people come from Graduates who have entered the work force, and with the increased disposable income from their enhanced salary they face the decision of accelerating the repayment schedule of their loans or to save for a new home or retirement.

The answer to the question, whether you are in the Graduate situation, or at a different point in life, is not complicated. The answer is: ‘what does the IRS say about your debt, and your savings goal’. The explanations of how this work might seem a little complex, but the rule to keep in mind is clear – will reducing my tax bill be better for me than paying the interest on a debt. Both are burdens on our wealth, and both can be influenced.

If you are looking at a savings or investment vehicle that is not tax advantaged then the break even point for your decision should be the 30 year Treasury Bond, minus taxes. As of today, September 2013 the Yield of a 30 Year Treasury is 3.71% Minus your effective tax from that number, should give you something under 3%. You are going to have to hold that Bond to Maturity.

If your debt interest is lower than that ~3% number then you would be better off to save, if it is higher than that number you would be better off to pay down your debt first.

Any other investment than this Treasury Bond contains additional Risk in the price, so if you are able to borrow at 4% for a real estate investment that will offer a 10% gain, it might seem that it is a simple and easy 6% profit, but you must remember that the 6% is there to offset the inherent risk that is associated.

The key to making the paying off debt or increasing savings is understanding the tax treatment of both, because based upon the high rate of Tax you pay, 9 times out of 10 the interest earned on an investment, or interest paid on a debt is dwarfed by the rate of taxation. Play the tax rules correctly, and you will end up in the best financial situation.

Step 1 Is your debt tax advantaged or not?

Tax Advantaged Debt is better than non Tax Advantaged Debt. The former has many things going for it, not only is the interest you pay on the debt tax deductible, but it is frequently at a lower rate than non Tax Advantaged Debt. We could call this good debt and bad debt.

Examples of Tax Advantaged Debt (good debt)

- Student Loans

- Mortgages

- Home Equity Loans/Lines

- Business Loans (for valid Business Expenses)

Examples of Non Tax Advantaged Debt (bad debt)

- Personal Loans/Lines

- Credit Card Debt

- Car Loans

Also, brokerage account margin interest is considered tax deductible, but I would not call it good debt as you shouldn’t be buying investments on Margin, especially when you have debt/savings concerns.

Action Item – Make a List of all of your debt obligations that fit into the above categories, sort them by APR (Annual Interest Rates of the debt, with the highest on top). Bad debt goes first, and good debt goes underneath it on the list.

Example of a Debt List ordered correctly:

- Credit Card 19.5% APR Balance $5,000

- Car Loan 5.5% APR Balance $15,000

- Student Loan 6% APR Balance $34,000

- Mortgage 4% APR Balance $200,000

Note that Car Loan is listed as higher priority to pay down than Student Loan, despite being a lower APR, this is because the interest is not tax deductible, whereas the Student Loan and the Mortgage are. What that means from a pure payment perspective is that if you were to opt to pay down your debt, this order would be the cheapest over time.

The $64,000 question is, at what point do you stop paying down, and start saving?

Step 2 Is your saving vehicle tax or otherwise advantaged or not?

The excess cash that you decide to allocate has different impact based upon where you decide to place it. For example, if you keep it under the mattress it will lose value at the rate of inflation, where as if you place it in a CD it will lose money at a rate of inflation minus the after tax APR (which is almost the same as sticking it under the mattress currently).

More important than asset allocation is asset location. The differences in earned interest are marginal, the secret is the difference in money kept within the household. If you can capture the tax advantages of certain accounts, you can make massive impact to your wealth generation efforts.

From a kept money/earned money perspective there is no better vehicle for you than a company 401(k) or 403(b) plan. The reason for this is that they offer a double benefit. The most impact is seen from the tax deduction that this can make, which puts more money in your pocket, and a bonus impact is that companies frequently offer a matching program for their 401(k) or 403(b) subscribers where they actually agree to pay you more money if you are part of plan, this is called Employer Matching.

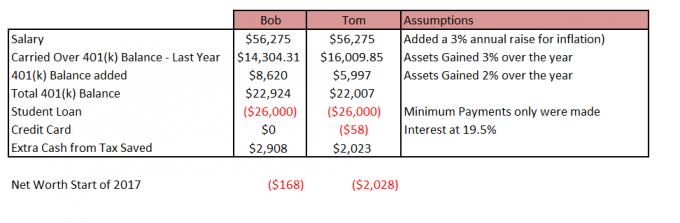

Example Bob and Tom, the new Graduates

- Graduate with starting salary of $50,000

- 401(k) Employer Matching Plan up to 3% of contributions

- Student Loans $30,000 at 6% Interest

- Credit Card debt $5,000 at 19.5% Interest

- Single Filing Status

Bob Decides to Pay off his Credit Card using his newly improved salary, whilst Tom decides to pay the minimum on the card to avoid default, and instead focus the remainder of his available money on building a 401(k).

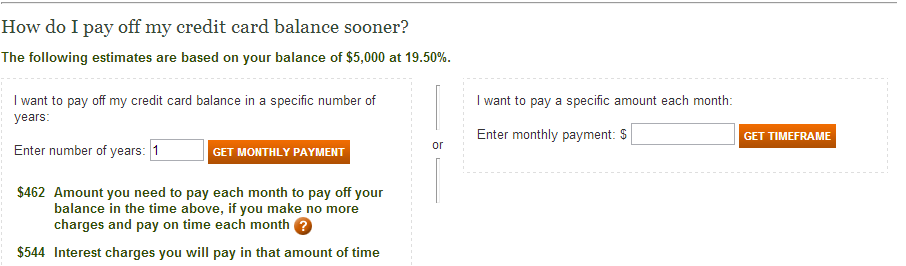

Credit Card Payment Option ( paying off debt )

According to the Federal Reserve Credit Card Tool if Bob wanted to pay down his card in full it would require a monthly payment of $462 and by the end of the year he would have paid a total of $5,544 of which the Principal was $5,000 and the interest was $544. He would be Credit Card Debt Free, which is certainly a good thing.

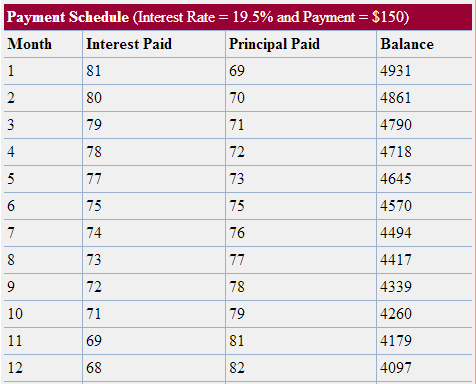

Tom, on the other hand opted to pay the minimum amount due on the card (lets put that at a $150 per month, or 3% of the initial balance) after 1 year he would have made 12 x$150 payments for $1800, and reduced his Principal from $5,000 to $4097. Doesn’t sound great so far… Out that $1,800 only $903 went towards paying off his debt, and the power (in a negative manner) of compound interest on the Credit Card debt ate up almost half his payments.

However, by opting to assign only $1,800 of his $50,000 salary to paying off his Credit Card Debt he has the ability to allocate additional resources to his 401(k) plan. If we were to select the number of $5,544 as the total cost of paying down the Credit Card debt in a year, and then minus $1,800 from that number we would have $3,744, which could be used for the 401(k) contribution.

- Bob $5,544 paid over 1 year to fully clear the card.

- Tom $5,544 paid over 1 year, $1800 towards credit card, $3,744 towards 401(k)

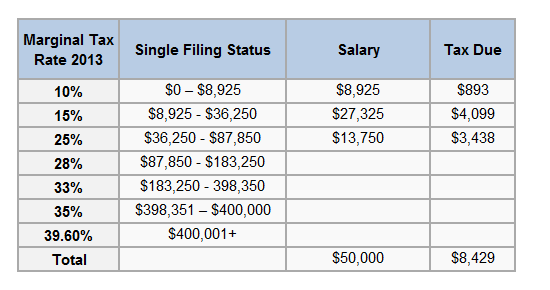

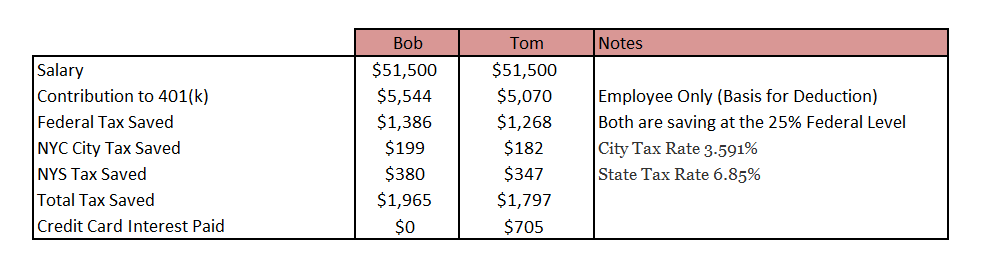

As we mentioned earlier both Bob and Tom earn a salary of $50,000 per year, and the way a 401(k) contribution works, is that it would reduce your taxable salary by the amount of the contribution (at it shaves off the highest rate of tax). Tom has a portion of his salary taxed at 10%, another portion at 15% and a final portion at 25%. Any reductions in his salary via a tax advantaged account will reduce his top rate of Federal Tax, so the amount he pays at 25% will be lowered.

Therefore a $3,744 contribution to the 401(k) would otherwise have been taxable income and paid to the IRS for the tune of 25% of $3,744 which would be $936 in tax.

Let’s also take this time to remember the Employer Match of 3%. $3,744 * 3% is a further $112.32 that would be added to your 401(k) balance making your 401(k) valued at $3,744 + $112.32 for a total of $3,856.32.

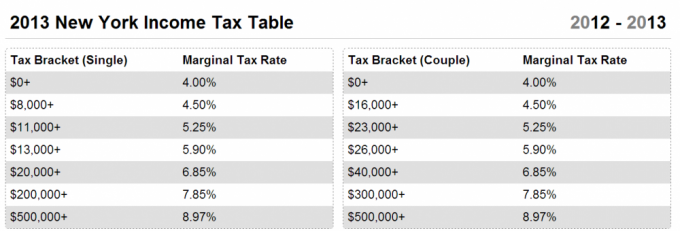

Don’t forget State and City Taxes too – the contribution to the 401(k) reduces the salary of Tom from $50,000 to $46,256. That reduction applies also to City and State Taxes, should you live in a State that implements these. In New York for example, They have a City Tax (rate schedule link) AND a State Tax (rate schedule link)

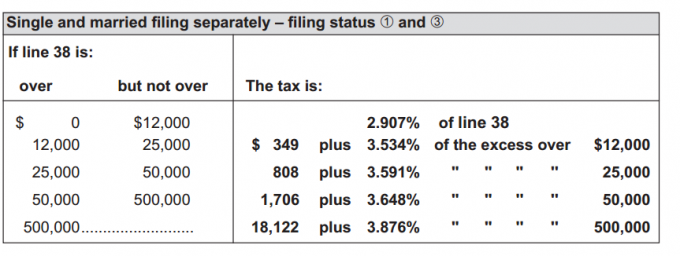

For Tom, with his $50,000 salary if he was living in New York the reduction of salary by $3,744 would be worth the following:

- City Tax Rate 3.591% of $3,744 $133.54

- State Tax Rate 6.85% of $3,744 $256.46

Total City and State Taxes saved by paying into the 401(k) = $390

When it comes time for taxes next year, Bob will pay $936 Federal, and $390 State and City more than Tom does. Leaving us with this situation:

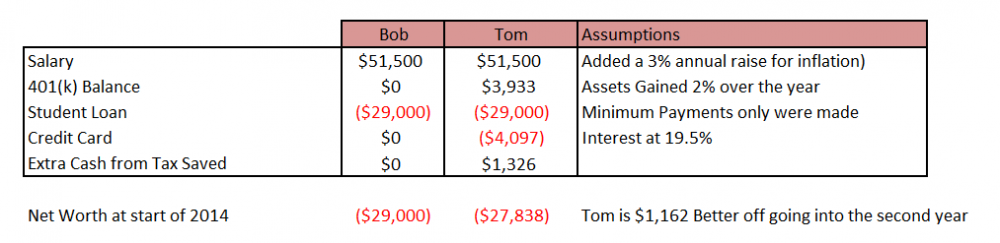

As you can see, Tom’s decision to put money in the 401(k) and pay the heavy interest on the Credit Card has resulted in a gain for him over the year of $1,326

We should be clear here, this is not because of the investment gaining money on the Stock Market, I selected a very modest gain, that can be captured in a very low risk strategy (avoiding Stocks altogether) on purpose. The reason that Tom is better off is because the money saved on Taxes saved him that much more money, even with having to pay the interest.

2014 – Bob is Debt Free! Tom, is burdened with Credit Card debt…

Let’s see what happens next, now that Bob has put the effort into clearing his debt he does have a very good platform for paying into the 401(k) himself, he will appear to be the slow starter, but now Tom has to keep on paying into the 401(k) and also paying down that Credit Card.

Bob decides that he was easily able to manage to save the $462 per month he saved in 2013 and won’t miss the money, and since he received an annual raise actually feels a little wealthier for it. By the end of the year he has saved $5,544 into his 401(k) which the company then matches with 3% making his balance $5710 by the end of the year (before any interest earned).

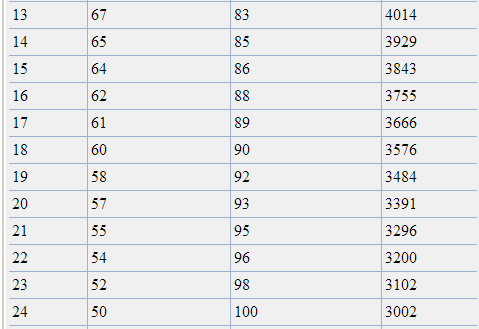

Tom remains steadfast in his approach and pays $150 per month against the Credit Card, for $1,800. Since he has been chipping away at the principal he has managed to pay down more than last year:

Tom’s $1,800 has reduced his Credit Card debt from $4,097 to $3,002, meaning that he paid $1,095 in Principal and $705 in Interest payments over the year.

To keep things fair I am going to say he still will only spend $5,544 total (though with the small salary raise he could easily put a bit more in there) So, just like in year 1 he is able to allot $3,744 plus company match for $3,856.32 into his 401(k) however, let’s not forget that he also has that extra cash from saving taxes at the end of year 1. So he also puts that full amount into his 401(k) for a further $1,326.

Total 2014 Contribution to 401(k) would be $3,744+$1,326 = $5,070 (his basis for deduction) plus the company kicks in $112.32+$39.78 for a total contribution of $5222.10

This year Bob can save more than Tom, but lets not forget that whilst Tom is carrying a Credit Card Debt, he also has a year of 401(k) balance and interest ahead of Bob:

2015 and beyond – Bob is Debt Free! Tom, is still burdened with Credit Card debt… but it has a dent in it.

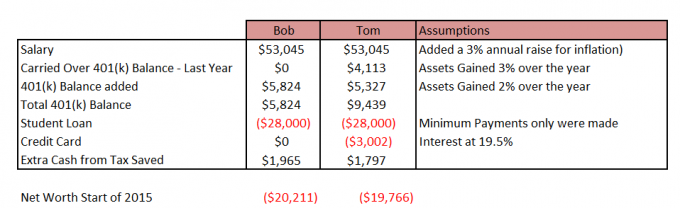

2015- Both Bob and Tom decide that they will keep to the initial monthly amount of $462 and will also both add on their Tax rebates. Bob, since he is able to put more into the 401(k) than Tom (due to his ongoing $150 per month assigned to the Credit Card is also able to put the extra money in his Tax Rebate into the 401(k)

2014 Tax Savings

- Bob – $1,965

- Tom – $1,797

2015 401(k) Contributions

- Bob $5,544+$1,965 = $7,509 (taxable base)+ 225.27 (company match) Total Contribution of $7,734.27

- Tom $3,744+$1,797 = $5,541 (taxable base) + 166.23 (company match) Total Contribtuion of $5,707.23

2015 Credit Card Debt

- Bob $0

- Tom $1,672- he applied $1,800 to his debt of $3,002 at $150 per month, reducing the Principal owed to $1,672 (paying $470 in Interest)

Snapshot at end of 2015

Finally Bob has caught up with the wealth of Tom, and in 2015 due to the increased Tax Benefits that he will reap in March 2016 from putting the extra money into the 401(k) Bob is currently, on paper, better off than Tom for the first time. 2016 is the pivotal year, since based upon paying the $150 per month over these years it is the final year that Tom will be paying down his Credit Card.

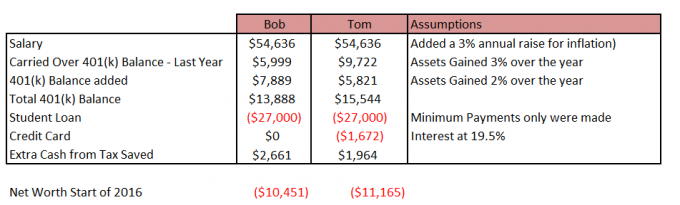

2016 Tom is almost there, but still has to make his payments every month of $150

2015 Tax Savings

- Bob – $2,661

- Tom – $1,964

2016 401(k) Contributions

- Bob $5,544+$2,661 = $8,205 (taxable base)+ $246.15 (company match) Total Contribution of $8,451.15

- Tom $3,744+$1,964 = $5,708 (taxable base) + 171.24(company match) Total Contribution of $5,879.24

2016 Credit Card Debt

- Bob $0

- Tom $58- he applied $1,800 to his debt of $1,672 at $150 per month, reducing the Principal owed to $58 (paying $70 in Interest)

Snapshot at end of 2016

So, as you can see in this example the winner over time happened to be Bob, by deciding to pay down his debt first, however I did control the variables here, and by adjusting them to your own situation you could get a very different result.

I specifically chose the most aggressively negative form of debt in this example to show you that even letting that accrue interest at a huge 19.5% the tax advantages were still massive. In fact, if Tom was operating at a higher tax bracket than 25% Federal he would have come out ahead of the game.

Variables from the Bob and Tom Example:

- Tax Rate -the higher the rate of tax you pay, the better the 401(k) route will become.

- Debt Interest rate – the higher the rate of the Debt, the more important it will be to pay down

- Loan Repayment Rate – By adjusting the numbers slightly, say to a $200 monthly payment would change the dynamic significantly

- Option to plow Tax Rebate back into 401(k) this gives a rapid acceleration to the savings plan

- Capital Appreciation, I deliberately offered conservative numbers, should you believe you can reap a 6% yield then the 401(k) route becomes more attractive.

I was going to include a calculator to make this easy for you, but I think you will get more out of the exercise if you sit down and work out the math yourself. There is both the danger of spoon feeding incorrect information, and simple lack of buy in from the reader if it is too easy. But I am here to help and please leave me a comment if you need guidance.

The tools you require to make the decision are as follows:

- Pen, Paper, Calculator (or a Spreadsheet)

- Helpful – Credit Card Calculator you can use this for any form of Non Tax Advantaged Debt, such as a Car Loan too.

- The charts used in this post, and additionally your own City and State Tax rates if applicable

- The ability to identify if your Debt Interest is deductible or not

Remember – if you are thinking of ‘saving’ without it being a tax advantaged account, then your profit will be very small, the most you can make like this is 3.71% (and you pay tax on that income). If that is your goal, then pay off your debt first.

Don’t forget to factor in Tax Status of Debt when deciding which of your Debts is the highest priority to pay down.

If you are thinking of ‘saving’ as a 401(k) or IRA account that reduces your taxes, then the chances are that you will be better off saving than paying down most debt, especially low cost debt like Mortgages, Student Loans and so forth. The higher your tax bracket, the more you will benefit from leaving the debt on a slow schedule and focusing money into Tax Deferred Savings accounts.

Please use the comments section to explore the concepts in this post, or if you are stuck working out the maths to make this decision let me know where and how and I will help you make the decision. In closing, remember this: if you do not pay down your debt swiftly it remains a liability, and as such you need to factor in an emergency fund that can cover the payments should you lose your primary income source.

Leave a Reply