If I had a dollar for every article I have seen lauding the magic of compound interest I’d be able to go have a nice steak dinner somewhere. Or I could invest it, and over time, magically become a millionaire. Compound interest really is a fantastic thing, but we need to understand the components, and […]

Understanding averages and investment returns

An average is given to a series of numbers for us to attempt to make order from chaos. There are several ways to calculate an average, though the term is most commonly associated now with the arithmetic mean. This mean is calculated as the sum of numbers divided by the number of numbers in a […]

Income-Based Repayment and Loan Forgiveness: Implications on Student Loan Debt

This article originally appeared in The Journal of Financial Planning, April 2015by Jarrod Johnston, Ph.D., CFP®; and Ivan Roten, Ph.D., CFP®When it comes to paying for college, student loans are indeed the norm, rather than the exception. The majority of undergraduate students in the United States have received some type of student loan, and the […]

Taxes are due on April 15th, regardless of when you file!

April 15th is commonly known as the tax deadline. However, this can be pushed back by up to 6 months by filing an extension via IRS form 4868. This creates a new deadline of October 15th, this can be later if your return is complicated by living abroad.However, even if you do file the correct extension paperwork, […]

Is your financial advisor churning your accounts?

Advisor signup bonuses have now topped 400% of ‘production’. Production is the annual revenue that advisors generate from selling their clients products. Think of it like you are a cow, and your advisor is milking you each year. Whenever they need some more production revenue, they head on over and sell you a new product, charging […]

Understanding your retirement number

Your retirement number is the amount that you need to have saved in order to retire. I want to dive into this today and explore some really important things that come along with this. I’m going to define it ‘my way’ and bring in concepts such as the Investment Policy Statement, asset allocation, risk taking, […]

It’s Not only a paper loss…

While chatting with an established financial advisor earlier in the week he brought up a line that I hear propagated within the planning community. The line is The biggest financial mistake that people make is selling at the bottom of the market. This really isn’t an accurate statement, and while some people know the difference, in the […]

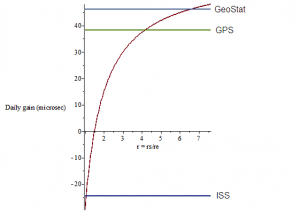

The Relativity of Money

According to Planck, and later Einstein, there is a theory that things may appear relative to the observer. A common example used in this theory is that of time dilation. This concept states that time can appear to move at a different rate depending on either the relative movement between the two observers, or if they […]

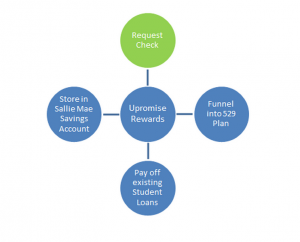

Upromise what’s hot and what’s not

Upromise is one of the more underrated options out there. Personally, I still haven’t got the card because I am dazzled by the lofty signup bonuses of other options, but its time to admit that it is worth going for, and look a bit further into the program.I’ve already written a lengthy review of how […]

Who wants to be a Millionaire?

I came across this story today, promoted on twitter by a Financial Planner, using it as an example of what appears to be a great strategy to follow…. Janitor dies at 92 with $8M saved. You can read it here. My synopsis: someone worked all their life, drove a crappy car, dressed in clothes held […]