I wanted to bring in a couple of ideas here, and hope you’ll help me out with how you deal with these questions… the tough one for me isn’t when I could afford a dog, rather a second car, which I’m struggling with, but let’s see what that clickbait title is all about.I still recall […]

Getting out of Debt? Make sure the punishment fits the crime

I read a post last night shared by a couple of behavioral finance guys. It pissed me off. I get annoyed when people who seem like industry experts share something that makes absolutely no sense whatsoever when you give it more than a moment’s thought. Want to read the post, it’s right here: How one […]

Equity Risk Premium at 3.25%

I recently wrote a post asking you to think about how much you value a fixed rate of return. If you missed it, check it out here: How much is a fixed rate of return worth to you? I came across a post today via a twitter share from the CFA institute, which (it seems) […]

Is dry powder worth the price?

Dry powder in investment terms means having a source of funds ready to move at a moments notice. The etymology, for those who care, seems to come from the use of gun powder in battle, and perhaps was first heard when used by Oliver Cromwell. A lot of financial pundits promote the concept of dry powder, […]

How much is a fixed rate of return worth to you?

Here’s one of my classic questions to advisors, and to arm chair advisors. “Should I take out a Home Equity Loan to invest in stocks?” My gut feeling is that most people would say that this was a bad idea because it is ‘risky’ and perhaps ‘gambling’. But in the same breath, they’d have no problem recommending […]

Morgan Stanleys 5 indicators are green!

Holy smokes batman!Morgan Stanley announced that their 5 key timing indicators are a flashing green light to investors (not sure if that is more exciting, or more risky than a steady green light or both..) they call it a ‘full house’, from poker, that game where you gamble.Apparently, they have a set of indicators that […]

Should you hold, or sell?

There’s a lot of froth in the markets right now, and one common theme that I hear repeated is ‘don’t buy high and sell low! Variations on this include holding for the long term, not worrying about volatility, etc etc.It’s all solid advice, but in one situation, I might suggest that selling is a better […]

Did the Robo sell when the master said hold?

I’m not trying to Roboadvisor bash here… there’s enough of that going on. This is a sincere question. Do you know the answer? I don’t, and it would be great to find out.Roboadvisors like Wealthfront and Betterment “sell as a virtue” the idea of automated, algorithm derived tax loss harvesting. This sounds amazing, but what […]

DIY rebalancing

The markets are pretty rough today, reflecting a strong sell off in China. If you have a 401K account you have a couple of smart options: Don’t look. Just keep working. Rebalance. Option 1 isn’t the most efficient, but it offers value for those who might get emotional over the results (a very natural reaction) […]

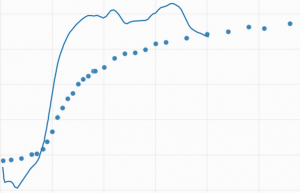

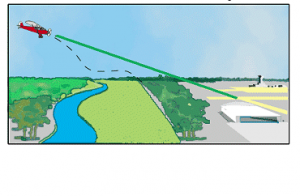

Glidepath Averaging and Diversification

The concept of a glidepath in personal finance is taken from an aircraft. As it reaches its destination the characteristics of its propulsion are adjusted to help it land safely, and smoothly.You will see this manifest itself in many ways, one might be in a Target Date Fund, here’s an image from Vanguard showing their […]