Risk, purportedly, is linked to reward. However it is quite possible to create risk in your portfolio without the reward attached to it. But when we think of ‘risk’ as investors we are often told to complete a form, from simple to complex, and invest based on that. This is the tail wagging the dog, […]

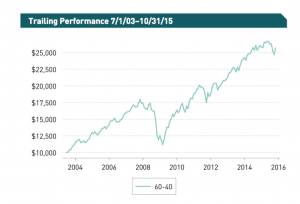

Understanding Total Return

It’s been a rough year for the market thus far, when looking at the return of your investment it is important to not just look at the price of the stock, bond, or fund, but rather its total return. This can be measured using the Internal Rate of Return (IRR) and Excel can show this […]

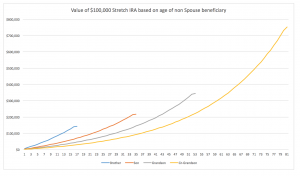

Understanding a Stretch IRA

A Stretch IRA is the term given to finding younger generations to be beneficiaries of IRA accounts in order to prolong the lifetime of the IRA vehicle post mortem. In order to understand the application of a stretch IRA it is important to be aware of the required minimum distribution (RMD) rules. Traditional IRA accounts […]

Retirement planning with TIAA CREF Retirement Accounts

This post will explore retirement options for holders of TIAA CREF accounts, with a focus on the RMD impact of holding vs rolling over to a lower cost option. If you know an education professional approaching retirement age please share this with them, and I’d be happy to answer questions in the comments. Understanding RMDs […]

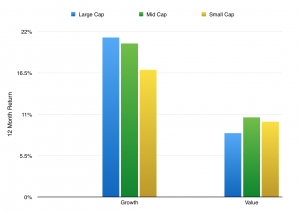

Planning for lower returns

I’ve spent most of this week working on growth projections for financial plans, and wanted to share some of the results with you for your own planning needs. Those hit most by this will be the people working with financial planners (or brokers) who have been given a growth projection by some fancy software.Unfortunately, using […]

Should you do a Sidedoor Roth IRA?

I hope all you savvy readers know what a backdoor Roth IRA is? You don’t? It’s really complicated, which is why posts are generally 200000 words or more and have diagrams.. here’s my explanation:If you earn too much to pay into a Roth (per this chart) then you can instead contribute to a Traditional IRA, […]

Why Mutual Funds Suck

The first US based Mutual Fund was created in 1924, called MITTX. The theory was that it allows an investor to buy a broad array of stocks without having to buy 1 piece at a time.. IE it makes diversification affordable. Great idea. Both active and passive funds hold stocks which are traded by the fund’s […]

Making sense of changes to Social Security

The recent Bipartisan Budget act included provisions to close what were deemed ‘loopholes’ within Social Security strategies. Here’s a quick breakdown of what changed: Section 831 (a) – anyone who files for any benefit is deemed to have filed for all benefits. Section 831 (b) any benefits for an auxiliary (spousal payments) must be stopped when […]

Where my assets are located

What a great post idea, tell the world where I buried the loot! I read a few posts from around the web recently from these ‘personal finance bloggers’. For those of you who don’t know yet, a personal finance blogger is more likely a person who wants to earn an affiliate check from a finance […]

$100 a day

I remember back in my traveling days how we’d be so happy to earn $100 per day. It was our goal, and if we hit it, all was well in the world. It might not sound like a lot to many of you, but it really was an incredible amount of money for us, and here’s […]