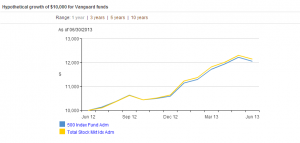

Investors in Index funds are typically following a low cost, long term strategy that is tax efficient by nature. Index funds are funds that track one of the Major Indices such the DJIA, S&P 500 etc… (the etc part is important, and will be the crux of this post). Index Fund investors who follow a […]

The Rules for Offsetting Casino Winnings for Tax Purposes for Non Professional Gamblers

Every now and then we pop down to Atlantic City for a weekend away, as we get access to a great range of comped rooms, dining and entertainment. This trip we were lucky enough to be staying in the Borgata’s Opus Suite, which at 1000 sqft is bigger than my Apartment in Brooklyn, and has […]

Lessons from John Bogle’s First Principle of Investing: Reversion towards the Mean

John Bogle’s First Principle of Investing Reversion towards the Mean is a Mathematical concept dictating that as the frequency of an event increases; its Actual Outcome is more likely to match its Theoretical outcome.Example: Toss a Coin one time, it is random whether it could be Heads or Tails, toss it 5 times and you could […]

What is truly unique about about Passive Investing? Can we refine it and apply its principles better?

I’ve been harping on about Passive Investing for some time now, for those of you who are interested below are several posts on the subject:As you might also know, my passion, both within Finance and Travel is to find the intrinsic value in things, and the more that people tell me something is right, the […]

Monetization of 0% Balance Transfers for an Interest Free Loan and Profit

This concept was rife several years ago, with many people getting massive profits and earnings from taking out debt from 0% APR Credit Cards and using that money to earn profit by investing it in some form of guaranteed product, such as Certificate of Deposit (CD) that would mature prior to the expiration of the […]

Time to get into Debt Again?

Hanging out with people who have emerged from the shadow of Debt and are now ‘Debt Free’ is worse than going to a bar with a reformed smoker, born again Christian. All you get to hear is how awesome it is to be free from the burden of debt and how empowered they now feel; I […]

Compound Interest – the most misunderstood financial concept – Exposing the Myth of How Teens Can Become Millionaires by Dave Ramsey

I just read a post from Dave Ramsey, well known Personal Finance expert and was surprised at the lack of thought in the theory displayed. I think one of the biggest problems we face in taking charge of our Personal Finances is being able to see through the soundbites and marketing gimmicks and get to […]

Taking a Fresh Look at Citi – Citigroup Inc (C)

I just walked past a large gathering of folk from Citigroup Inc. (C) in TriBeCa New York, all donning the company colors as they went about what was apparently a fun run for a ‘Healthy Heart’ and gathering in the square of their building here for a pep talk prior to dashing off to save themselves. […]

Target Date Retirement Funds -An Introduction

Target Date Retirement Funds are an interesting beast indeed. There is a lot of buzz about them in the financial community currently; despite them being around for some 20 years now, first introduced by Barclay’s Global Investors (BGI) in 1993. They are growing in popularity, and could make an interesting part of your Investment Portfolio […]

The Fear of Being Wrong – Understanding your Irrational Behavior

The fear of being wrong, or more accurately, the fear of being called wrong is one of the most debilitating emotional drivers that we all face as we seek to address change in our lives, it is evident across all decision making choices and is enforced by peer groups in order to control social structure. Understanding […]