Converting your Traditional IRA into a ROTH IRA is a very attractive concept for many people, it can save you thousands during your retirement, however, even more importantly is doing it the right way can save you thousands today.When you convert you will be faced with an immediate tax bill for whatever you pulled out […]

Lessons from John Bogle’s Third Principle of Passive Investing – Buy right and hold tight

In part three of the series investigating the underlying message of Vanguard Founder and Passive Investment idol John Bogle we will take a look at the principle of Buy Right and Hold Tight.I think that this finally is reaching a place where we could see a strong difference emerging between the Active Investing habits of […]

Turning off the Tap on your Dividend ReInvestment Program

Dividend Reinvestment Programs, known as DRIP ‘s have long been lauded as an excellent way to accumulate wealth. And they are something that I have been a fan of for a long time. However I am wondering if it is coming to the time to turn the tap off, and stop the DRIPing…As an overview, […]

Drifting the Target Date Retirement Fund

Target Date Retirement funds are ‘set it and forget it’ funds available from all of the top Investment Management Companies. If you want a primer on them I suggest checking out this post first: Target Date Retirement Funds -An Introduction – in a nutshell they are a single fund you purchase, from someone like Vanguard that is […]

$5000 Free Brokerage Account Challenge Part 2 – Asset Allocation

I set up an Account with Fidelity in April 2013 with the mission of building a Brokerage Account with a value of $5,000 funded from Cash Back from Credit Card spending, I also kicked things off with a $250 that I had saved by cutting cable early this year. Today I made my first Asset […]

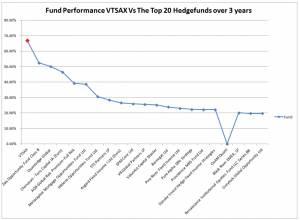

SEC Lifts Ban on HedgeFund Advertising -Here is an advert for you, the top 20 firms under-perform the market.

Breaking news today was that the Securities and Exchange Commission (SEC) has announced Hedgefunds would be now allowed to Advertise Publicly for the first time. There is outrage as people are fearful of how these evil Funds will start manipulating more and more investors and we will have another crisis where the 1% get richer […]

Could Separate Finances be Better?

Since day one of my relationship with my wife our finances have been mixed, in so much as I paid for everything for a good while, and then one day she paid for something, and then it was a bit of a blur. I still remember the day when I allowed her to pay for […]

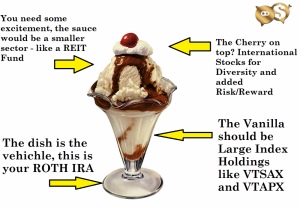

What funds are best for my Vanguard ROTH IRA?

I am often asked the question ‘what funds are best for my Vanguard ROTH IRA?’ by all types of people, at all stages in their lives. As you might be able to guess, each answer is different. The primary driving factor when deciding your fund allocation is: ‘how many more years until retirement?’These days retirement […]

Lessons from John Bogle’s Second Principle of Investing: Time is your Friend, Impulse is your Enemy

Time is your Friend, Impulse is your EnemyHere Bogle states that developing and maintaining an Investment Strategy over time will be much more beneficial for your portfolio development. And those impulsive decisions will cause harm to your wealth. Personally I feel that there is some truth to this sentiment, as often times impulsiveness regarding investment […]

Being Frugal is so uncool

It’s just not cool to be Frugal, everyone want to ‘live for the moment’ and have a great life. Saving is boring, not having the coolest products, flashiest car and biggest house is a sign of weakness in today’s society. Frugal people are boring, and what’s worse they probably have some sort of disease that […]